Terraform And Kwon Agree To Pay $4.5 Billion Following Fraud Verdict

Key Points:

- SEC reaches a $4.5 billion settlement with Terraform Labs and Do Hyeong Kwon.

- Defendants face injunction and hefty penalties.

Terraform and Kwon settled with the SEC for $4.5B over crypto asset fraud. The case revealed deceptive claims and resulted in investor losses.

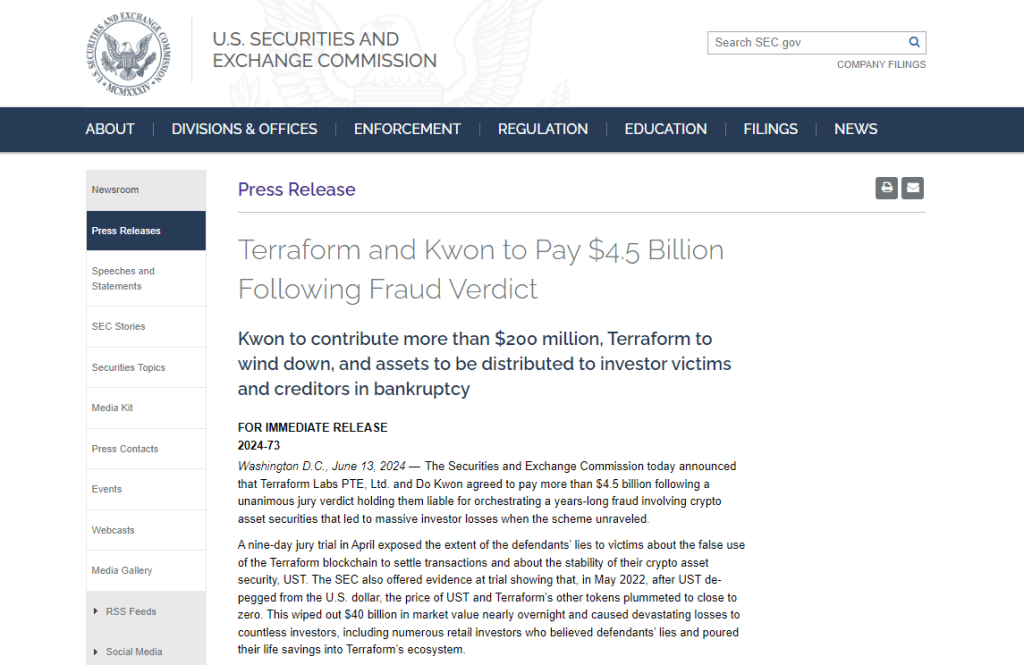

The Securities and Exchange Commission announced that it had reached a settlement with Terraform Labs PTE, Ltd. and Do Hyeong Kwon shortly after an advisory jury read its unanimous verdict. The settlement, which is more than $4.5 billion, concludes the multi-year case of fraud through crypto asset securities.

Terraform and Kwon Reach Multi-Billion Dollar Settlement with SEC

The nine-day trial exposed the defendants’ deceptive practices, revealing inaccurate claims about using the Terraform blockchain for transaction settlement and the stability of their crypto-asset security, UST.

Evidence presented in court showed the plummeting prices of UST and other Terraform tokens after the detachment from the U.S. dollar in May 2022. The dramatic drop caused a $40 billion wipeout in market value, leading to substantial losses for many investors.

According to SEC Chair Gary Gensler, a product’s economic realities will define its status as a security under securities laws, certainly more than the label or hype of that particular product. Gensler showed that investors have had huge losses due to Terraform and Kwon’s fraudulent aspects. He reminded the firms that compliance with the law was very important to avoid investor harm.

Readmore: FTX Settles IRS Tax Claim: $24 Billion For Customers To Be Reimbursed

Enormous Fines and Permanent Injunction Against Future Violations for Terraform and Kwon

According to Gurbir S. Grewal, head of the SEC’s Division of Enforcement, Kwon and Terra’s actions rank among the largest securities frauds in the United States’ history.

Today’s multi-billion dollar settlement not only holds them accountable and prioritizes the return of hundreds of millions of dollars to harmed investors, but also makes clear that, despite the vast resources that crypto asset defendants deploy against us, the dedicated staff of the Division of Enforcement will not stop until they achieve justice for the victims of these breathtaking frauds.

Wrote in the statement

Additionally, Kwon has agreed to pay $110 million in disgorgement, approximately $14 million of prejudgment interest, and an $80 million civil penalty. Added to this, the settlement requires Terraform to pay more than $3.5 billion in disgorgement, approximately $467 million in prejudgment interest, and a $420 million civil penalty.

Both defendants will face an injunction, which permanently forbids them from violating registration and fraud provisions as provided under the federal securities laws.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |