South Korea Crypto Trading Plummets By 83% As US Liquidity Rises

Key Points:

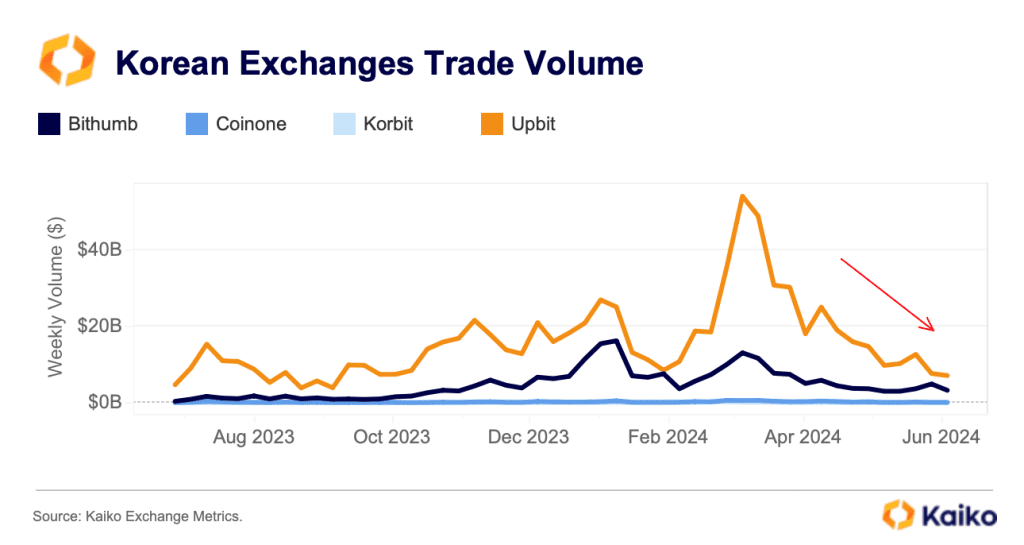

- South Korean crypto exchanges experienced a dramatic drop in trading volume in Q2.

- Upbit and Bithumb offer high-volume trading pairs, mostly small-cap altcoins.

- US exchanges are seeing increased liquidity, with improved conditions for Bitcoin trading.

South Korea crypto trading volume plunged from $35 Billion in Q1 to $6 Billion in Q2. Factors include risk sentiment and US inflation.

As reported by Kaiko, South Korean cryptocurrency exchanges have suffered a dramatic fall in trading volume. From beating USD trade volumes in Q1, KRW trades dropped quite significantly in Q2.

Dramatic Decline in South Korea Crypto Trading Volume in Q2

The weekly trade volume on major Korean exchanges, such as Upbit, Bithumb, Coinone, and Korbit, dropped from an average of $35 billion in Q1 to just $6 billion by early June. The decline hit particularly hard on Upbit, with its market share against its main local competitor, Bithumb, retreating to 67%, the lowest since February.

According to experts, softening risk sentiment could contribute to the decline, considering that higher-than-forecast U.S. inflation had come on top of a repricing in Federal Reserve rate cut expectations.

Unlike other exchanges, Upbit and Bithumb offer a larger number of high-volume trading pairs. However, such popular assets are typically small-cap altcoins driven by swings in speculative interest, which does not always correlate with better liquidity conditions.

Readmore: Circle Expands Workforce By 15% For Further Expansion: Report

Comparing Liquidity Conditions: The Korean Market vs US Exchanges

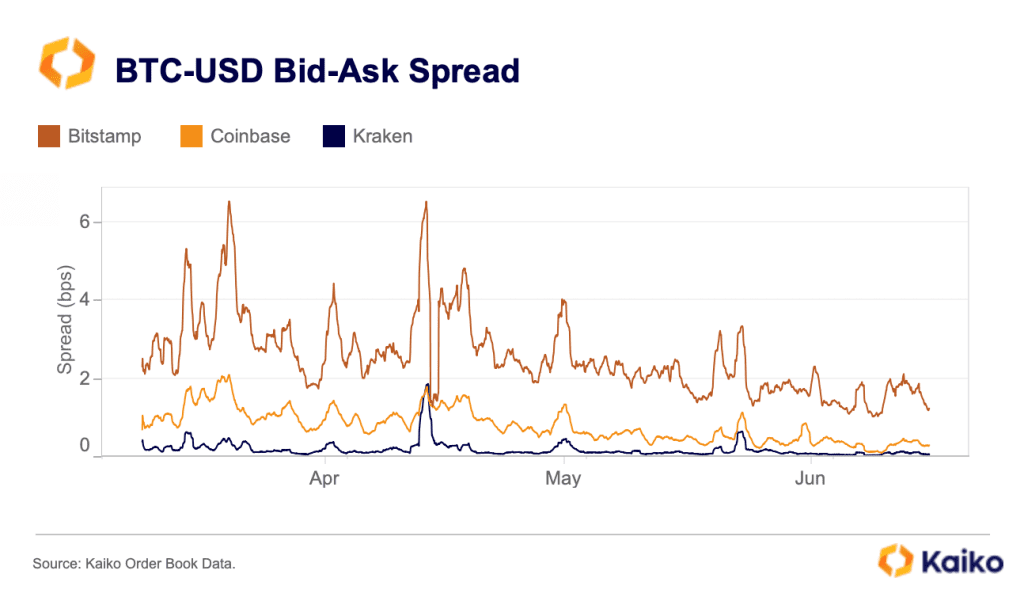

Unlike the Korean market, liquidity is rising on US exchanges. One of the major indicators for market liquidity, the bid-ask spread, has fallen sharply on most US exchanges, pointing to much-improved liquidity for Bitcoin.

The spreads came down from 2.3 to 1.9 basis points on Bitstamp, above 1 to 0.3 basis points on Coinbase, and 0.4 to 0.1 basis points on Kraken.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |