Key Points:

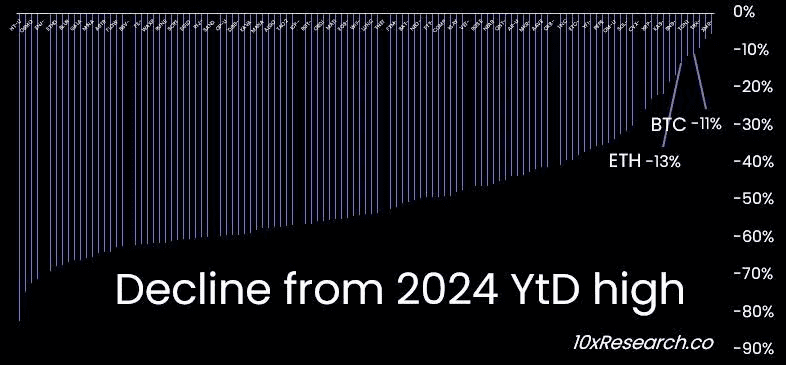

- 10x Research CEO Markus Thielen reports a 50% average price drop in the top 115 tokens from 2024 highs.

- Despite the downturn, Bitcoin (-11%) and Ethereum (-13%) show relative stability, attributed to strategic trader movements.

- Thielen identifies token unlocking and liquidity issues as major contributors to altcoin price declines, emphasizing the need for effective risk management.

10x Research CEO Markus Thielen released a report saying altcoin bear market that by analyzing the top 115 tokens, the average price of cryptocurrencies has fallen 50% from its 2024 high.

Thielen’s latest report attributes this decline primarily to issues surrounding cryptocurrency liquidity.

At the lows, bitcoin and Ethereum were off about 11% and 13%, respectively, from the highs. Thielen says this relative resilience may be due to some traders allocating funds from altcoins to the two stalwarts, which is what happened when the market cycled downward in the past.

Read more: Top 5 Bridge Projects On LayerZero

Market Analysis Reveals Significant Declines in Top 115 Cryptocurrency Tokens

“In an altcoin bear market, proper risk management is the key to survival.” Thielen points out that token unlocking and poor liquidity indicators further drive this downturn. These factors explain why 73% of the analyzed tokens peaked in March 2024 before seeing significant declines.

The Thielen report underlines the broad situation the altcoins are facing, definitively placed within a bear market. As warned, further losses would likely intensify if liquidity did not see notable improvements in cryptocurrency markets. According to the emerging trend, an investor must make strategic decisions and have risk management practices in such volatile market conditions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |