Key Points:

- Altcoin market capitalization has fallen by 30% since March.

- Token unlocks led to a price slump as digital assets were sold.

- New tokens on Binance in 2024 dropped drastically from their all-time highs.

Altcoin season is seeing a slump, with the market cap dropping nearly 30% since Bitcoin’s peak. This is due to token unlocks causing major price drops.

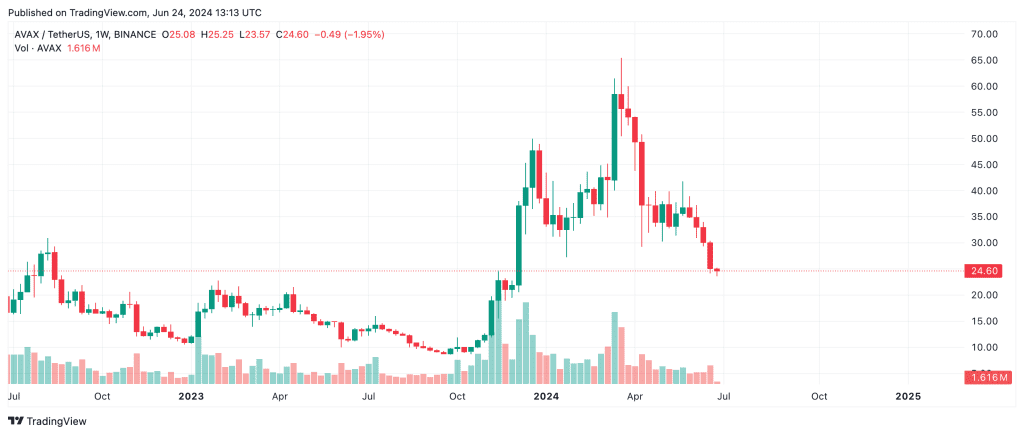

The altcoin market, including Avalanche, DYDX, PYTH, and others, is deep in Red Sea territory, and some presume it might become an early “crypto winter.” CoinMarketCap showed that the market capitalization for altcoins, excluding Ether and stablecoins, has fallen by nearly 30% since Bitcoin’s price peak in March.

Altcoin Season Fades: Market Capitalization Drops By 30%

According to Bloomberg, this is largely due to the unlocking of many tokens of various projects, which allows venture capitalists and creators to sell their digital assets received years ago in return for investment or work on a project.

Since these unlock dates are public, anticipated selling options from unlocking venture capitalists could mean a huge price slump. The tokens of DYDX, Avalanche, and PYTH, which have had significant unlocks this May, have dramatically reduced.

According to CoinMarketCap, tokens of DYDX and Avalanche slumped by as much as 50% since mid-March, and PYTH’s value plunged to one-third.

Venture capitalists and the general public are now more aware of token unlocks and supply-side data, so most market players would prefer short-term gains instead of holding for long-term benefits.

Readmore: Mt Gox Payout Date Revealed, Potential Bitcoin Selling Pressure In July 2024

Market Oddities: High Prices but No Regular Buyers

Only twelve of the top 90 non-stablecoin assets available on centralized exchanges posted positive returns since March 14th, when Bitcoin reached its all-time high.

Data researcher CCData pointed out that since it almost touched $74,000, Bitcoin has dropped around 12%, with more than half of the top 100 tokens down over 25%.

Additionally, Wu reported that all new tokens listed on Binance in 2024 have plunged far from their all-time highs, some by over 80%. The market has been acting strangely, where many infrastructure projects release their tokens, but no regular buyers show up at high prices.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |