Key Points:

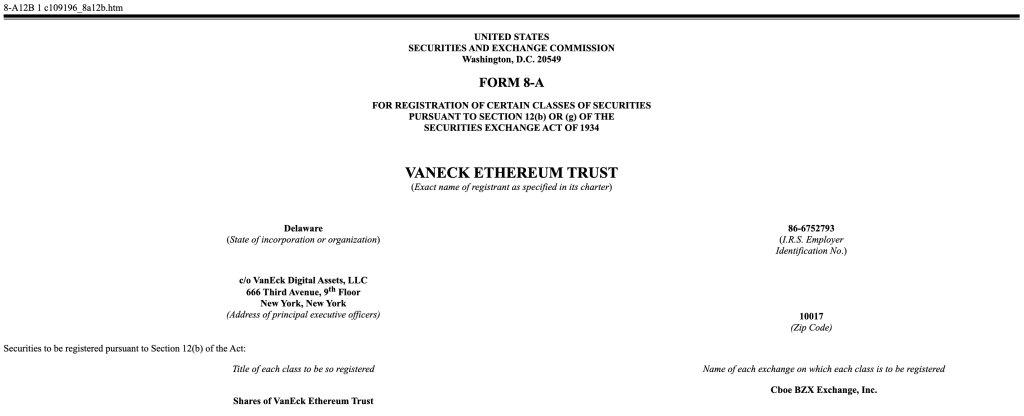

- VanEck files an 8-A form for Ethereum ETF after Bitcoin ETF.

- Ether’s limited institutional interest reduces ETF appeal.

VanEck has filed an 8-A form for spot ETH ETF, following its recent Bitcoin ETF filings, with more filings expected soon, says Analyst Eric Balchunas.

VanEck’s New Filing for an Ethereum ETF

According to Bloomberg ETF Analyst Eric Balchunas, VanEck has filed for an Ethereum ETF. This follows a week after the firm filed for a Form 8-A for a Bitcoin ETF with its launch, suggesting a similar approach it could be taking for Ethereum.

Balchunas, one of the more noted voices in the space, believes additional filings from VanEck are due shortly.

In May, the Securities and Exchange Commission (SEC) reportedly approved the 19b-4 forms for ETFs from a range of institutions, including BlackRock, Fidelity, Grayscale, Bitwise, VanEck, Ark, Invesco Galaxy, and Franklin Templeton.

Readmore: New ARB Staking Mechanism Will Reward Holders With 50% Surplus Fees

Analysis on the Limited Attraction of Spot ETH ETF

Although Ether had recorded over $4,000 in value in March as Bitcoin hit a new all-time high, Kang – founder and partner at crypto-focused venture capital firm Mechanism Capital, remained dismissive in a June 23 post.

On the reason behind it, he said Ether does not have an institutional interest like Bitcoin, which gives little reason for conversion into ETF form.

Kang further highlights that the spot Ether ETFs would likely only attract 15% of the flows that their equivalent spot Bitcoin ETF peers have seen, and from that, the estimates extend from a best-and-worst range of around 10-20%.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |