Key Points:

- US inflation report did not significantly affect Bitcoin’s price.

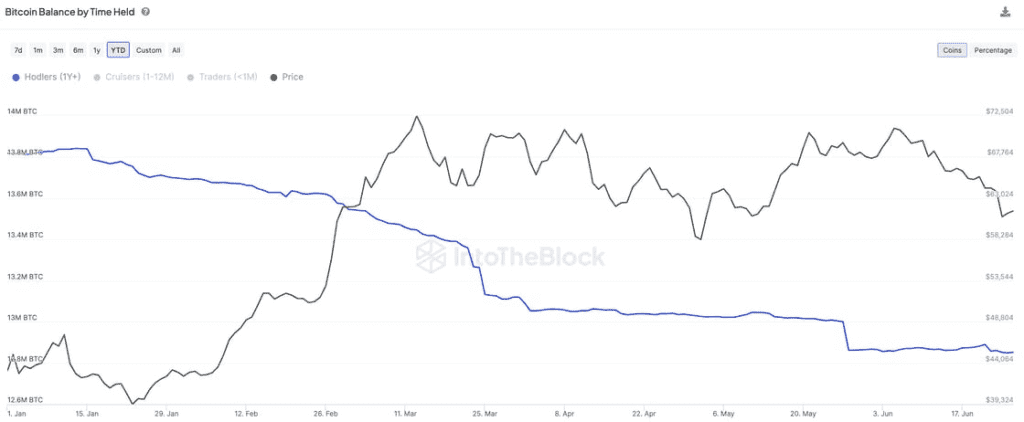

- Active Bitcoin wallets have hit a multi-year low.

- Long-term Bitcoin holders sold $10 billion worth of BTC in May.

Despite equities rallying due to lowered US PCE Inflation, Bitcoin’s price remained steady, with long-term holders selling significant amounts.

Despite equities rallying behind the latest U.S. inflation report, Bitcoin, the world’s largest digital asset by market capitalization, hardly budged in price.

US PCE Inflation Impact on Bitcoin and Stock Futures

The world’s largest cryptocurrency by market capitalization decreased by 0.7% over the past 24 hours and was trading at $61,400 at 12:00 p.m. UTC per CoinMarketCap’s Price Page. Additionally, the GM30 Index of the top 30 cryptocurrencies only increased 0.82% to 128.84, as shown by IntoTheBlock.

The U.S. Bureau of Economic Analysis announced Friday that inflation in the U.S., as measured by the annual change in the Personal Consumption Expenditures Price Index, fell to 2.6% in May.

Stock futures rose following the report, with Dow Jones Industrial Average futures up 0.09% and the NYSE Composite rising 0.085% in pre-market trading, while S&P 500 futures stayed steady.

Readmore: Bitcoin Bull Run Continues Despite Potential Bearish Patterns, Says CryptoQuant CEO

Bitcoin’s Active Address Ratio and Long-term Holder Activities

According to data from IntoTheBlock, this has brought Bitcoin’s weekly active address ratio to 1.22%, a level last seen in November 2010.

Of course, as a result, the total number of active Bitcoin wallets dropped to a multi-year low rating; on May 27, there were only 614,770 active addresses within Bitcoin wallets—the lowest since December 2018.

In May alone, long-term holders sold 160,000 BTC, about $10 billion. Selling pressure somewhat slowed down in June, but still, 40,000 BTC were moved out of the long-term holders’ wallets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |