Key Points:

- 21Shares and VanEck file for Spot Solana ETFs.

- GSR reports hint at Solana as next investment product.

- Solana’s market potential backed by GSR metrics.

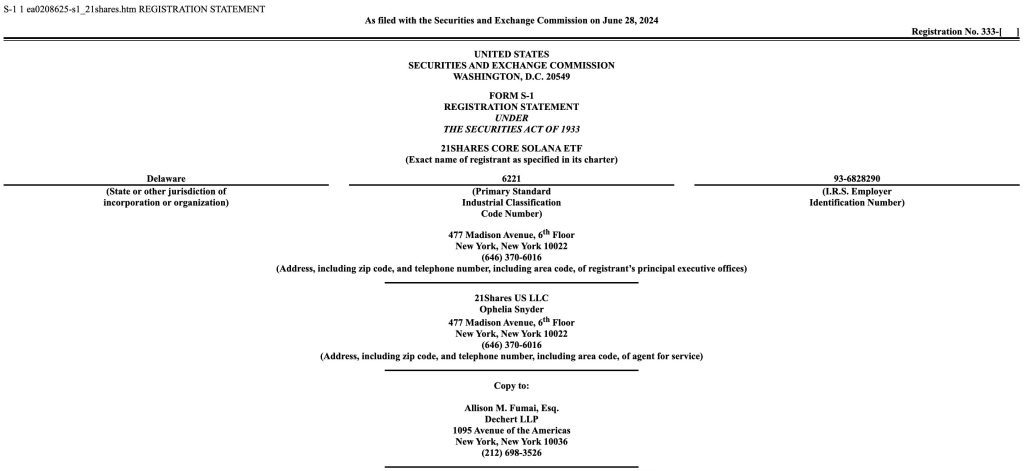

21Shares and VanEck have filed for a Spot Solana ETF with the SEC. If approved, it will offer exposure to SOL without direct investment.

The Spot Bitcoin ETF issuer, 21Shares, has filed with the US Securities and Exchange Commission for a Spot Solana ETF. This is the second SOL ETF application this week, following a similar request by VanEck. Everyone’s been on tenterhooks as to the next cryptocurrency to see an exchange-traded product approval, and Solana seems well-placed.

21Shares Files for Spot Solana ETF with SEC

In one of the recent GSR reports, Solana is the likeliest candidate for the next investment product after granting permission to Bitcoin and Ethereum earlier in 2021. The 21Shares’ Spot Solana ETF will, upon approval, allow investors to get an inexpensive deal in the form of exposure to SOL without directly investing in the token.

Previously, CoinCu reported that VanEck filed a similar application. Matt Sigel, Head of Digital Assets Research at VanEck, believes now is a good time to start the approval process as the regulatory environments have changed.

Readmore: VanEck Spot Solana ETF Proposed, New Boost for Crypto Industry

GSR Data Indicates Strong Demand for SOL-Based Investment

According to GSR data, SOL is one of the important assets in the Market besides Bitcoin and Ethereum, supporting the growing demand for an SOL-based investment product. Based on GSR’s decentralization and demand assessment, it will follow the previously approved ETFs.

Additionally, Solana will be far ahead of the next digital asset if the graph is analysed. Besides Ethereum, SOL is the only other asset that has scored positively in GSR metrics on decentralization and demand.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |