Key Points:

- The SEC is moving towards approving an Ethereum ETF.

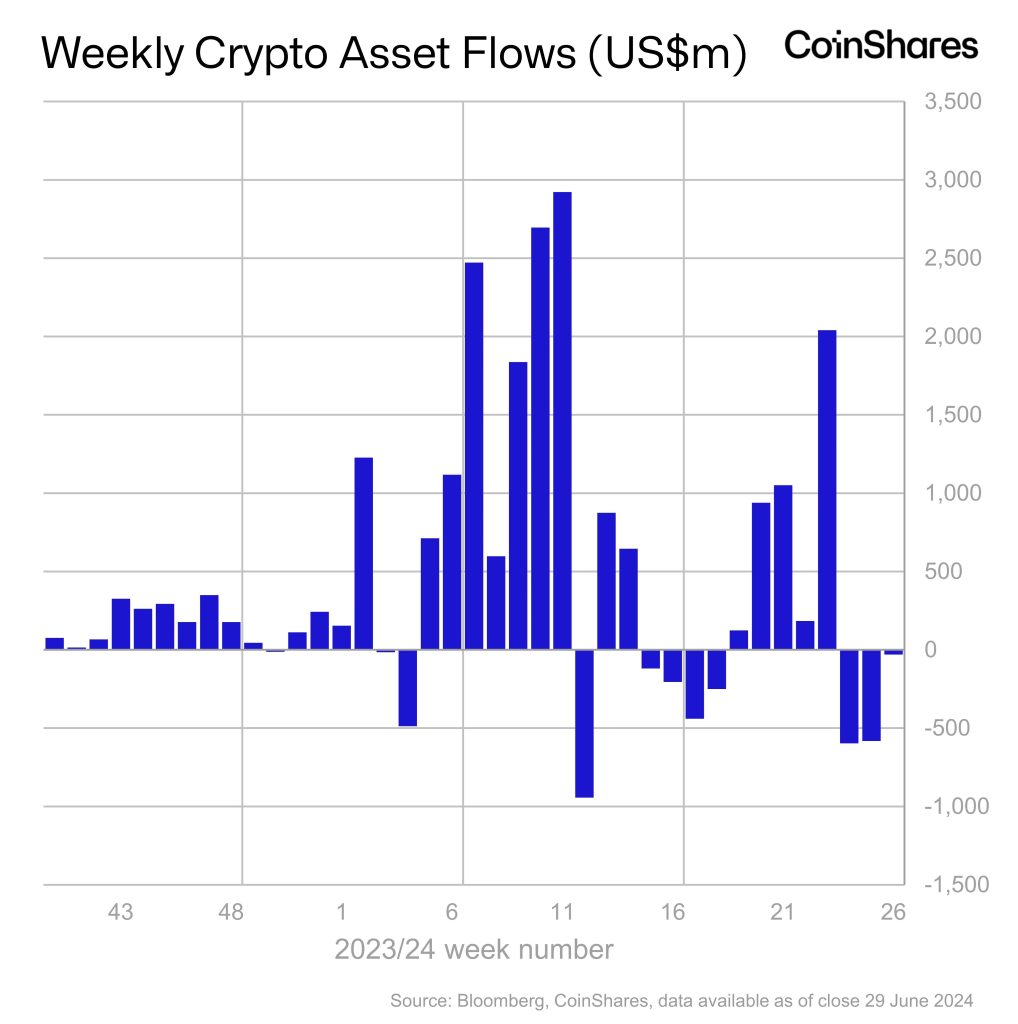

- Despite Bitcoin ETF outflows, other ETFs like IBIT, ARKB, and BITB saw net inflows.

- Ethereum-based ETPs saw their largest net outflows since August 2022.

The SEC is moving towards approving an Ethereum ETF, with no set timeline. While Bitcoin ETFs saw outflows, others experienced inflows. Ethereum ETF approval timeline remains uncertain.

Last week, the SEC incrementally moved towards greenlighting an Ethereum ETF for the first time, returning the S-1 form to the prospective issuer for a look-through. This form is the second part of the two-step process for listing an ETF. The first step is to approve the 19b-4 form on May 23.

Ethereum ETF Approval Timeline and Process

However, The Block reported that there wasn’t any recognized timeframe for the S-1 form’s approval, and its processing depends on the pace at which the SEC completes its work.

While US-based Bitcoin ETFs saw huge outflows for the third week running, $37.3 million in aggregate, net inflows occurred in other ETFs. To be specific, BlackRock’s IBIT sucked in $82.4 million, all on Friday.

Ark Invest’s ARKB and Bitwise’s BITB were not far behind, taking up a further $26.3 million and $15 million in net weekly inflows. The net inflows into all these ETFs from January stand at $14.5 billion.

Readmore: Roaring Kitty Buys Chewy Shares (6.6%): The Next GameStop Saga?

Investment Flows in Bitcoin and Other ETFs

Last week also marked an all-time high in the outflow streak of spot Bitcoin ETFs, $1.16 billion, the highest since a four-week run beginning April 8 till May 6. But things are taking a different turn. These ETFs accumulated daily net inflows from Tuesday to Friday, totalling $137.2 million.

Digital asset investment products globally saw $30 million in net outflows last week. According to James Butterfill, Head of Research at CoinShares, there seems to be somewhat of a change in sentiment around Bitcoin.

However, as the listing date for the spot Ethereum ETFs in the US nears, Ethereum-based ETPs recorded their largest net outflows since August 2022, at $61 million.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |