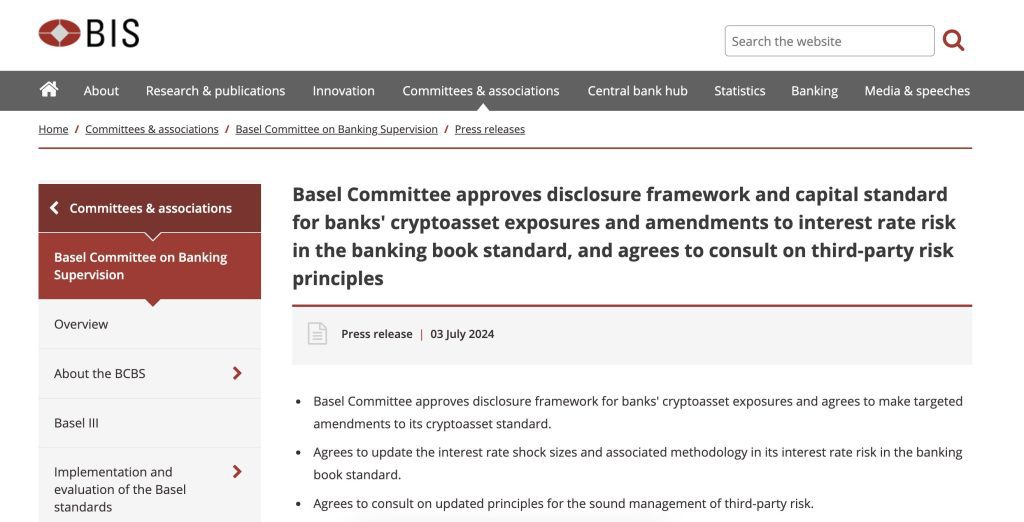

Basel Committee Approves Cryptoasset Standards Update, Effective 1st Jan 2026

Key Points:

- Basel Committee adopted a crypto asset risk disclosure framework, effective 2026.

- Ongoing monitoring of risks related to tokenized deposits and stablecoins.

Basel Committee approves cryptoasset disclosure framework and targeted revisions, enhancing transparency and market discipline.

The Basel Committee on Bank Supervision adopted a bank’s framework for disclosing cryptoasset risks and agreed to make the targeted revisions to its cryptoasset standards.

Basel Committee Approves Cryptoasset Framework

The new framework sets out standardized public forms and templates covering bank cryptoasset risks to improve information availability and support market discipline. It will be published later this month and implemented on 1 January 2026.

The Basel Committee met virtually on 2 and 3 July to discuss various policy and supervisory initiatives. It considered comments received on the following consultations. The finalised disclosure framework will promote access to information and support market discipline.

Additionally, it authorized a set of targeted revisions to the cryptoasset prudential standard, which promotes consistency in understanding the standard, particularly in areas where Stablecoins would be eligible for preferential Group 1b regulatory treatment. The update will be published later this month, effective 1 January 2026.

Readmore: Biden Replacement Memecoins Surge 200% Amidst Election Doubts Rise

Prudential Implications of Tokenized Deposits

According to the statement, Members discussed the prudential implications of banks’ issuing tokenized deposits and stablecoins. The size and intensity of such financial stability-related risks depend on the specific structure, jurisdictional law, and regulation for these products.

So far, developments suggest that such risks are largely captured by the existing Basel Framework. The Committee will, however, continue to monitor this area, among others in the markets for cryptoassets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |