Key Points:

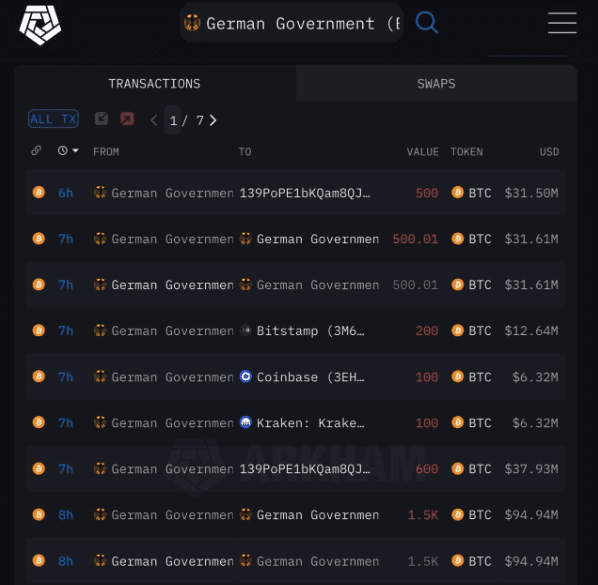

- 1,500 BTC worth ~$94 million USD was transferred to major exchanges, including Kraken and Coinbase.

- Circle’s USDC is now compliant with MiCA laws, becoming the first major stablecoin legalized in the European Economic Area.

- The Polkadot community is concerned about the treasury running dry in under two years due to overspending, with $87 million USD spent since 2024.

USDC complied with MiCA laws, Mt. Gox Bitcoin repayments began, and macroeconomic updates included Fed Chairman Powell’s inflation concerns and rising U.S. unemployment.

Last week’s highlights big news (July 1 – July 7)

Another 1,500 BTC (~$94 million USD) was transferred to Kraken, Bitstamp, and Coinbase exchanges.

Circle has also announced that the USDC has been issued in compliance with the MiCA laws, thus becoming the first major stablecoin to be legalized in the European Economic Area.

The U.S. Marshals Service has chosen Coinbase Prime to provide a storage and trading solution for certain crypto assets the Department of Justice seized. That makes sense because on whose behalf do you think the wallet service is selling crypto when needed?

Matthew Sigel, the head of crypto at VanEck, just confirmed on the record that one of the main reasons VanEck filed for a Solana ETF is that they think Trump is going to win: if Biden wins, the chances of the Solana ETF are close to 0.

The Polkadot community has raised concerns that the treasury will run dry in under two years due to overspending. Currently, the Polkadot treasury has $245 million USD in total assets, of which $188 million USD are liquid assets. Since the start of 2024, Polkadot has spent $87 million USD, of which $37 million USD has been used in advertising.

Justin Sun (Tron) offered to buy all of Germany’s Bitcoin from the German government. At present, the German government holds $2.3 billion USD in Bitcoin.

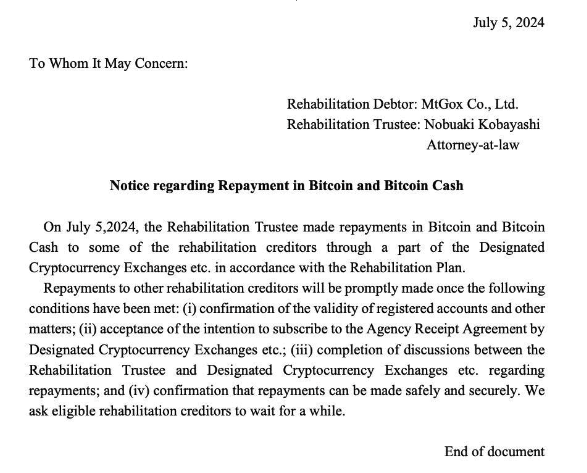

Mt. Gox confirmed repayments have started in BTC and BCH. Depending on whether creditors have filed complete documents, they will pay in order. Finally, repayments started, and this case will finally be resolved this year and will not affect the market anymore.

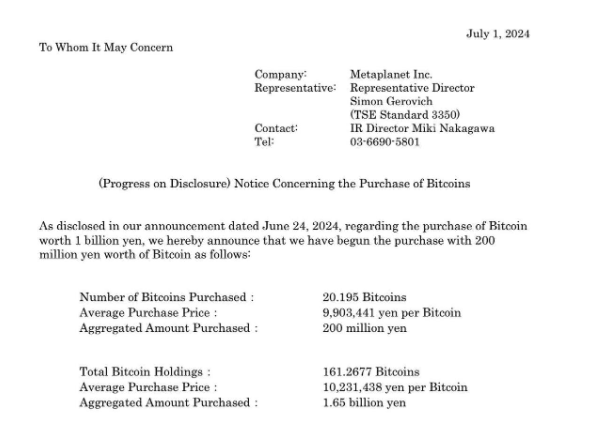

Metaplanet bought an additional 200 million Yen ($1.2 million USD) in Bitcoin.

The Sony subsidiary in Japan, Amber Japan, will officially change its identity to S.BLOX on July 1, 2024. S.BLOX would collaborate with other companies within the Sony group to expand crypto trading activities, serving opportunities growing from the market.

The Philippines’ SSS (Social Security System) can now receive USDT payments. It is a state-managed social insurance program that serves employees in the formal, informal, and private sectors.

Macroeconomics (July 1 – July 7)

The Fed Chairman, Jerome Powell, told Congress he was pleased with the progress on the inflation front thus far. However, he indicated he wants to see more progress before he is confident enough to start the interest rate cuts.

However, Chairman Powell continued to express concern about cutting too soon, risking the progress made in reducing the inflation rate.

Powell spoke at a forum attended by European Central Bank President Christine Lagarde and Central Bank of Brazil Governor Roberto Campos Neto.

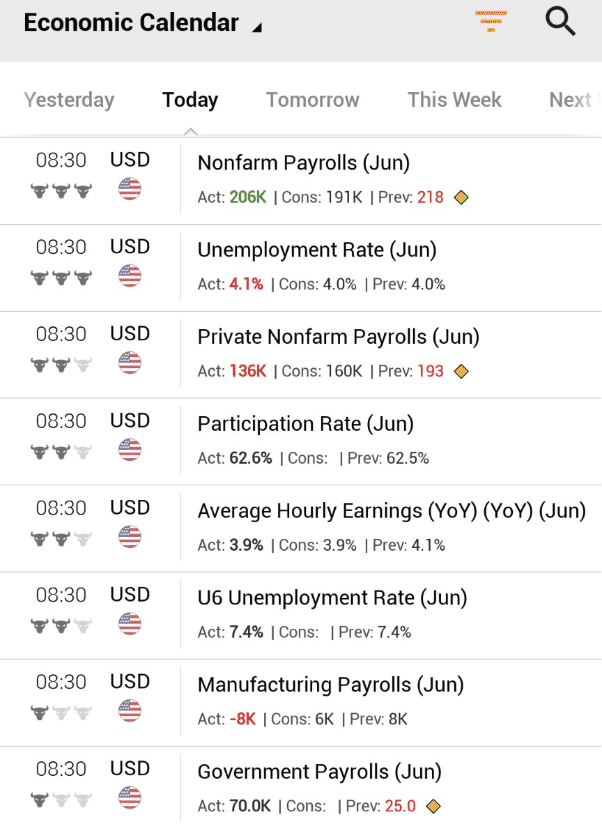

Unemployment in the U.S. unexpectedly rose to 4.1%.

Non-farm payrolls increased by 206K in the month, higher than Dow Jones’ forecast of 200K but lower than the 218K in May.

The fact that the unemployment rate is headed higher despite the uptick in non-farm payrolls suggests that many people are taking on a second or third job to fight inflation.

Key Economic Events This Week

TUESDAY, JULY 9

- Fed Chairman Powell testifies before the Senate

- A vote in the House on overriding a Presidential veto on repealing SAB121

WEDNESDAY, JULY 10

- Fed Chairman Powell testifies in the House

- Representative Ro Khanna will lead a roundtable with billionaire Mark Cuban and Democratic officials about crypto.

THURSDAY, JULY 11

- CPI inflation data: Estimate 3.1% | Last month: 3.3%

- Core CPI inflation data: Estimate 3.4% | Last month: 3.4%

- St. Louis Fed President Alberto Musalem speaks

- Senate hearing to confirm SEC Commissioner Caroline Crenshaw for the next term

FRIDAY, JULY 12

- PPI inflation data (wholesale inflation)

Prediction Market Crypto

BTC price actions over the last 24 hours:

- BTC closed out the week officially at $55,800, breaking below the 16-week sideways range of $60k—$73k.

- BTC is trending back down to retest the most recent low to around $53k and is currently trading at $55k.

- Yesterday’s altcoin pump had a slight bounce. Many altcoins are reversing and moving sideways at the newly formed bottom range.

- Over $31 million USD of stablecoin net outflows were drawn off exchanges over the last 24 hours.

Coins that have shown great value storage compared to $BTC, $ETH, and $SOL since the beginning of the year.

- Layer 1: $TON

- Meme: $SHIB $PEPE $WIF $FLOKI $BONK

- DeFi: $MKR, $PENDLE

- AI dePIN: $FET $RNDR $AR

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |