ETH Futures Skyrocket to 3.1M, Hinting at Ethereum ETF Approval!

Key Points:

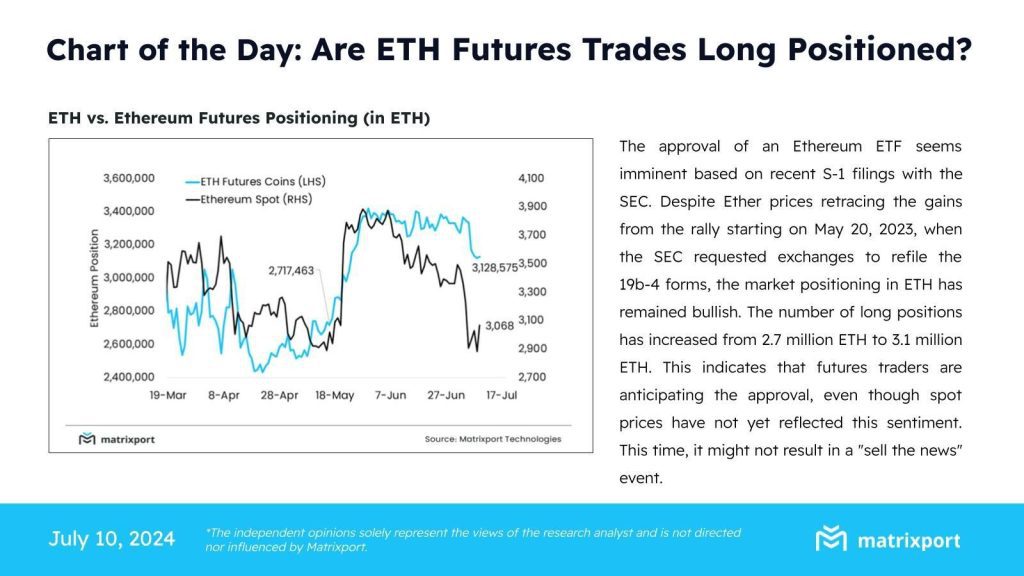

- Ethereum futures long positions grew from 2.7M to 3.1M ETH since May 20.

- Traders anticipate Ethereum ETF approval, which is reflected in the surge of future positions and signal confidence in regulatory developments.

Matrixport published an earlier today highlighting an unprecedented bull trend in ETH futures positions.

Despite the recent price correction, ETH futures long positioning surged from 2.7 million ETH to 3.1 million ETH after the market recovered since May 20. This means that futures traders have become very optimistic about a potential Ethereum ETF approval in the near future.

The surge in ETH futures longs shows an extremely confirmed belief among traders that regulatory approval for an ETF centred on Ethereum is looming despite the spot price of ETH, which has yet to reflect the same degree of optimism. Analysts say this could be a delayed spot market reaction or further bullishness until the ETF approval expectation materializes.

Read more: Spot Ethereum ETF Approval Likely to Happen on July 4

Ethereum Futures Surge Amid ETF Optimism

Some experts have proposed that an already bullish positioning on the ETH futures would not immediately draw a “sell the news” event. ETF approval would likely keep traders maintaining or increasing their positions, considering further price increases post-approval.

Further analysis by Matrixport indicates that institutional and retail investors are looking to position appropriately to take advantage of possible ETF-related developments in the Ethereum market. This would then be a part of the greater trend whereby market participants look beyond immediate price action and into accused future regulatory strides and institutional adoption that might be fueled by these developments.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |