JPMorgan Crypto Prediction Shows A Strong Market Rebound In August

Key Points:

- JPMorgan forecasts a crypto market rebound in August.

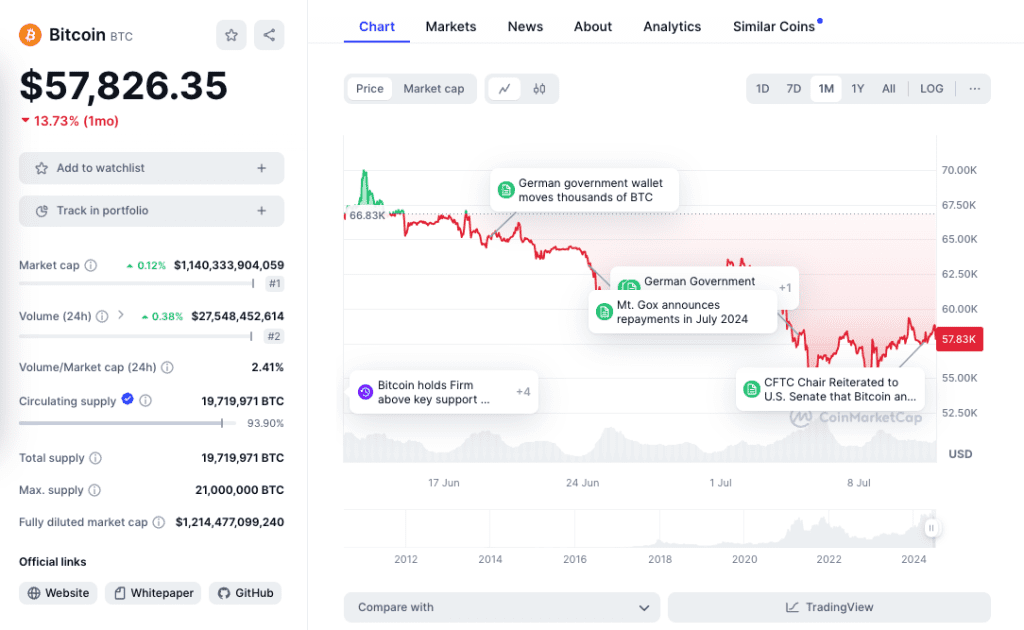

- Net flow estimate cut to $8 million due to German Bitcoin sales.

- Bitcoin’s price dropped to $57,800, down 14% in 30 days.

JPMorgan crypto prediction shows the cryptocurrency market to rebound in August despite current pressures from German government sales.

Recently, investment banking giant JPMorgan predicted a full-scale comeback for Bitcoin and the wider cryptocurrency market in August. The bank said the ongoing liquidations in the market are projected to prevail until the end of July.

JPMorgan Crypto Prediction for Bitcoin and Market

In an updated projection, JPMorgan cut its year-to-date net flow estimation. The firm now sees $8 million in flows, down substantially from the prior $12 billion call. The market has been under increased pressure over the recent week or so, partly driven by ongoing selling from the German government.

Above all, JPMorgan underlined this in a recent research report that noted liquidation likely stopped in July. Analysts at the bank have contributed to this change in net flow prognosis, coming with new data pointing out that the liquidation is likely due to a decline in Bitcoin reserves across the cryptocurrency exchanges over the last month.

For Nikolaos Panigirtzoglous at JPMorgan, the $12 billion mark was highly likely considering Bitcoin’s price relative to the cost of production and other competitive assets like gold.

Readmore: German Bitcoin Sell-Off Sees 10,853 BTC Transferred In 12 Hours

Key Factor Influencing Bitcoin Price Decline

One of the prevailing factors in the market has been the continued sale of Bitcoin by the German government. More than $2 billion worth of the cryptocurrency was confiscated, and its massive sale in the past several weeks has hit directly on the asset’s price.

Bitcoin changes hands at $57,800, far from the record peak in March when it exchanged for $73,000. Moreover, it fell nearly 14% in the past 30 days, according to CoinMarketCap. At the same time, today’s positive US inflation data put slight reversals into its price.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |