Key Points:

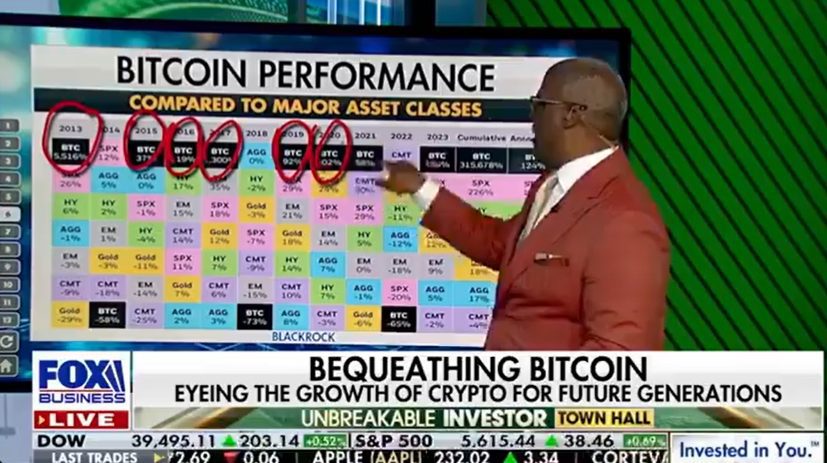

- Fox Business reports Bitcoin’s astonishing surge of 315,678% since 2013, solidifying its status as a top-performing asset.

- Bitcoin’s deflationary model and global acceptance make it a preferred hedge against inflation and economic uncertainty.

Fox Business recently revealed that the Bitcoin price surge has made it the peerless star performer among assets, with a most far-out climb of 315,678% since 2013.

This dramatic growth underscores Bitcoin’s resiliency factor and its unrivalled position in today’s financial markets—far ahead of traditional-style investments over the past decade.

Once just a decentralized digital currency, the Bitcoin price surge has evolved into an entire phenomenon that attracts immense interest from mainstream and institutional investors. It rose from obscurity to prominence, leaving all pessimists and sceptics in its wake, further underpinning its reputation as a force of disruption in finance.

Fox Business Reveals 315,678% Growth Since 2013

According to a Fox Business report, Bitcoin’s exceptional performance proved its inherent qualities: scarcity, utility, and global accessibility. Unlike fiat money, which is subject to higher inflationary pressures, Bitcoin has a deflationary model and will have a maximum of 21 million coins. That is what drove its price higher over time.

Investors, particularly retail and institutional investors, have moved to Bitcoin price surges to hedge against economic uncertainty and inflation. Its decentralized and cryptographically secured nature makes it a hedge against geopolitical risks and currency devaluation. It has somewhat crept onto the radar of different diversified stakeholders in various alternative investing means.

Read more: Top 10 Crypto Casino UK & Bitcoin Sites Reviewed

Bitcoin Price Surge to Prominence in Financial Markets

The tremendous growth that Fox Business has accorded Bitcoin serves to drive home the reality concerning its staying power and further upside potential. Regarding prospects, Bitcoin is bound to continue its charted journey as a premier asset class, propagated by ongoing regulatory clarity and institutional adoption developments, ultimately reshaping global finance and investment strategies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |