StakeStone, the newly announced omnichain liquid staking protocol supported by Binance Labs, has caught the attention of the community. The influence of StakeStone has been on the increase, with the build-up it holds within both uniqueness and competitive edges teased in the market.

What is StakeStone?

StakeStone is an omnichain protocol designed for liquidity in staking to support STONE holding by bonding SEP-20 assets into STONE. The STONE token allows users to be exposed to APY profit rates automatically with no problem, using the designing of a mechanism called Optimizing Portfolio and Allocation Proposal (OPAP).

In addition to staking, StakeStone has deployed infrastructure for restaking on protocols to ensure the community restakes its STONE tokens continuously to optimize its capital.

Main Feature

Stake

Users deposit ETH to receive STONE and earn an APY profit margin of approximately 3-4%. There is no minimum staking requirement, but small stakes may be less efficient due to gas prices.

Afterward, STONE is applicable in several DeFi uses for capital efficiency, as well as the STONE-Fi model. The DEX of the STONE-Fi model comprises of the following STONE usage: Lending Protocols, Derivatives STONE provides only one of its usage – QuickSwap pool/ wherein STONE and WETH pairs get locked in the pool to receive G-NFT. G-NFT’s usage should be announced later on

For unstake, the user has two means:

- Request: Unstake the request.

- Instant: Unstake instantly, which may incur slippage and gas fees if the amount the user wants to withdraw is higher than the available balance in the instant pool.

Portfolio & Allocation

Based on OPAP, this feature optimizes capital usage and allows users to exercise more control over their assets. It consists of two tiers:

Portfolio & Allocation: It enables a person to track one’s portfolio and allocation rates. Currently, StakeStone has its portfolio composition with 0.1% in dish and EigenLayer Native Restaking 99.9%, and.

OPAP: The user places a vote in proposals and decides on project portfolios and allocation rates.

Bridge

Bridge allows users to make seamless & frictionless cross-network transfers of STONE without any enforcement of wrapping. Some of its integrated networks are Linea, Mantle, BNB Chain, and Base.

All these features combined make STONE a rich token for functionalities and usabilities, making StakeStone a versatile platform for staking and capital optimization in the DeFi space.

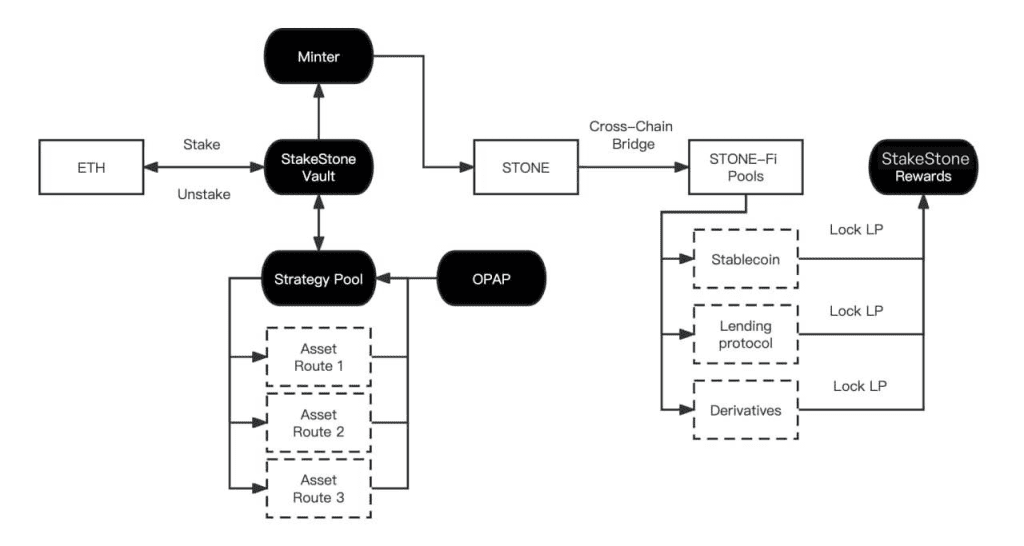

Operating Model

StakeStone has four operational factors or components: StakeStone Vault, Minter, Strategy Pool, and OPAP.

StakeStone Vault

The location where the user’s ETH is temporarily held before it gets allocated to the different strategy pools.

Minter

The Minter conducts the mint and burn procedures regarding the STONE tokens. The process disassociates the minting of the STONE token from the underlying, which means the ETH amount on deposit in the STONE Protocol to mint STONE.

Strategy Pool

Strategy Pool distributes the ETH from the users to various staking and all over the compound restaking protocols to earn profits.

OPAP (Optimizing Portfolio and Allocation Proposal)

An on-chain proposal system, OPAP introduces new profit-generating strategies while optimizing asset allocation. These components work together to guarantee the effective and profitable operation of the StakeStone protocol to end-users as an agile and robust staking solution.

Tokenomics

For now, there is no information on this part of the project.

Team, Investors and Partner

Team

No information regarding the project team has been published.

Investors and Partner

The project took investment in StakeStone on March 25, 2024, from Binance Labs for project development. There is no information released about the capital amount acquired or invested.

StakeStone has engaged with market projects such as Hook Protocol, Merlin Chain, and the Polyhedra project.

StakeStone User Guide: Step By Step

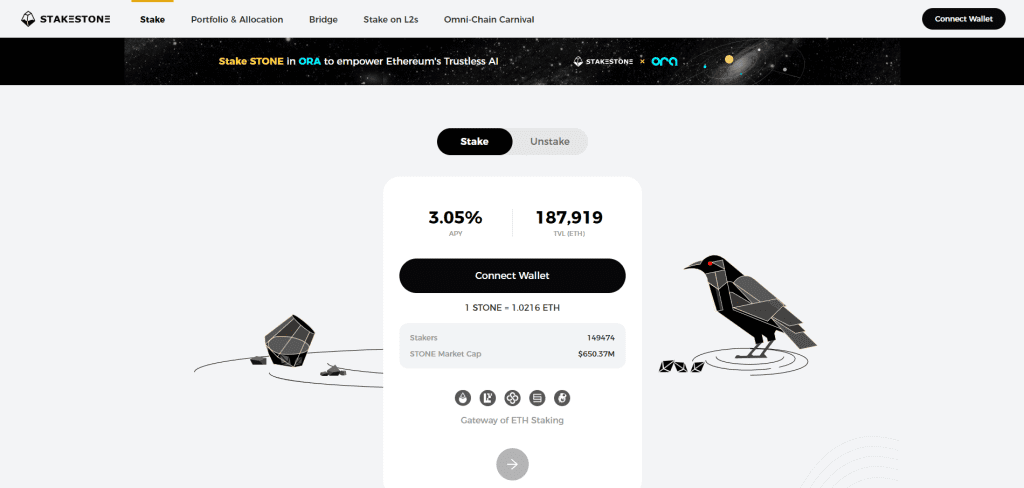

Step 1: Log in to the Platform: Visit the StakeStone platform

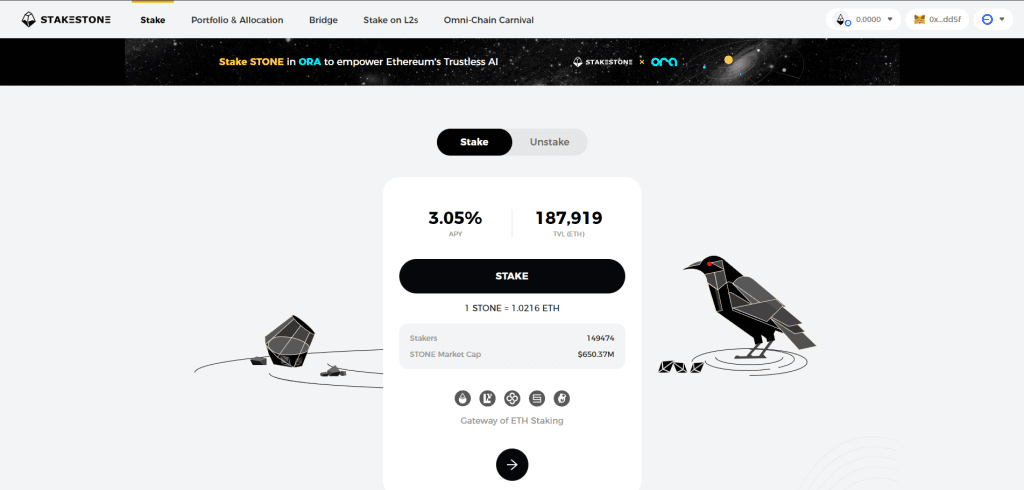

Step 2: Connect Your Wallet: Press “Connect Wallet” to connect your digital wallet with the platform.

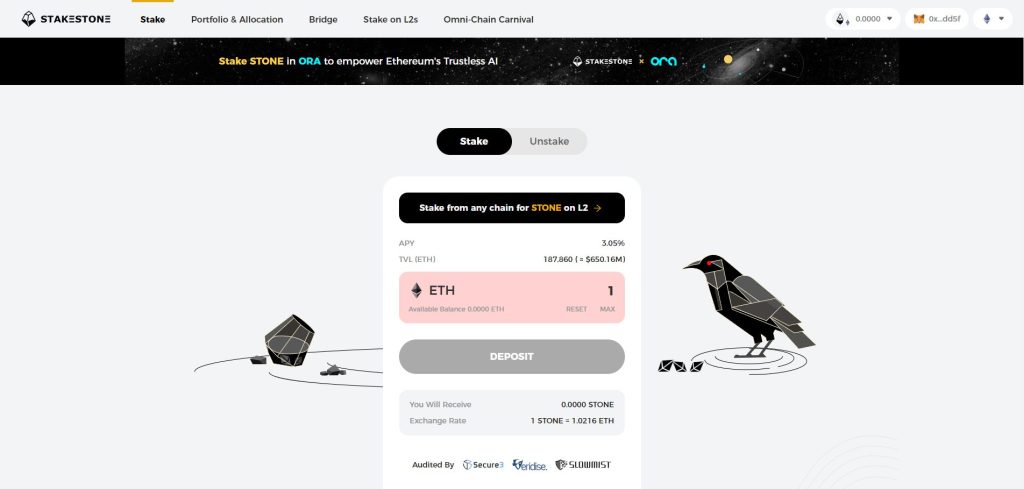

Step 3: Start Staking: Click the “Stake” tab.

Step 4: Specify Staking Amount: Enter the amount of ETH you would like to stake.

Step 5: Finish the Deposit: Click on ‘Deposit’ and sign the transaction in your wallet to execute the payment.

Conclusion

StakeStone is a liquid staking platform initiated in part by the Binance Labs fund; it bases its liquid staking token, STONE, on the LayerZero OFT solution, enabling the flow of this token seamlessly across diversified blockchain networks.

CoinCu looks up to StakeStone as a very promising project with innovative concepts. There is still at its testnet stage, so not a complete evaluation can be given. You can experience the project’s testnet and probably take part in an airdrop.

FAQs

1. What is the use of the STONE token?

It will encourage STONE token holders to take part in DeFi activities across different chains, all in a simple and automated fashion, where they can accrue profits using the OPAP mechanism with ease.

2. What does the StakeStone Vault do?

The StakeStone Vault is a structure that holds the user’s ETH, waiting for the deployment to different strategy pools for staking and re-staking.

3. How does the Minter component work?

The Minter conducts the minting and burning processes of STONE tokens, separating the minting from the underlying assets, which are the ETH deposits used in minting STONE.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |