Hyperliquid Review: Derivative DEX operating on Self-Developed Layer 1

Hyperliquid is a derivatives DEX that allows users to long or short various assets with up to 50x leverage. The platform operates on its proprietary Layer 1 blockchain, HyperLiquid L1, designed to offer optimum derivatives trading experiences.

What is Hyperliquid?

A DEX for derivatives enables users to go long/short on many assets with a maximum leverage of x50. Hyperliquid operates on layer 1 of the same name developed by the project itself to provide the best user experience for derivatives trading.

Currently, this project is among the top Perp DEX exchanges that support derivative trading of the most assets in the market, with more than 130 different tokens from tokens belonging to non-EVM ecosystems such as Solana, Starknet… to EVM like Ethereum, BNB Chain…

Read More: BracketX Review: Derivatives Platform Friendly To Web3 Users

Product

Hyperliquid L1

It has developed its own Layer 1 blockchain, known as Hyperliquid L1, based on Cosmos’ Tendermint toolkit, and it runs on the Proof of Stake consensus mechanism. this L1 is going to introduce an on-chain fully operational order-book mechanism of Hyperliquid for the elimination of dependencies on other centralized entities. The project emphasizes decentralization when realizing that some other derivatives DEXs use off-chain order book mechanisms to process transactions that will manipulate order results, hence a lack of transparency for users.

By default, this L1 is highly customized to run efficient derivatives DEX rather than general-purpose smart contracts. This will enable Hyperliquid to squeeze out performance and throughput into a formidable derivatives DEX battling CEXs.

For example, Hyperliquid L1 works similarly to the dYdX chain for the most optimized version of dYdX derivatives DEX. For Layer 1s supporting general smart contract functionality, like token swaps, minting NFTs, and trading in-game items, there are Ethereum, BNB Chain, Solana, etc.

Furthermore, it is highly customizable in terms of architecture, processing 20,000 TPS within placing orders, canceling, and liquidation with an average network latency of 0.2 seconds. This means that Hyperliquid L1 has a 20x time better throughput than Tendermint, handling just a bit over 1,000 TPS.

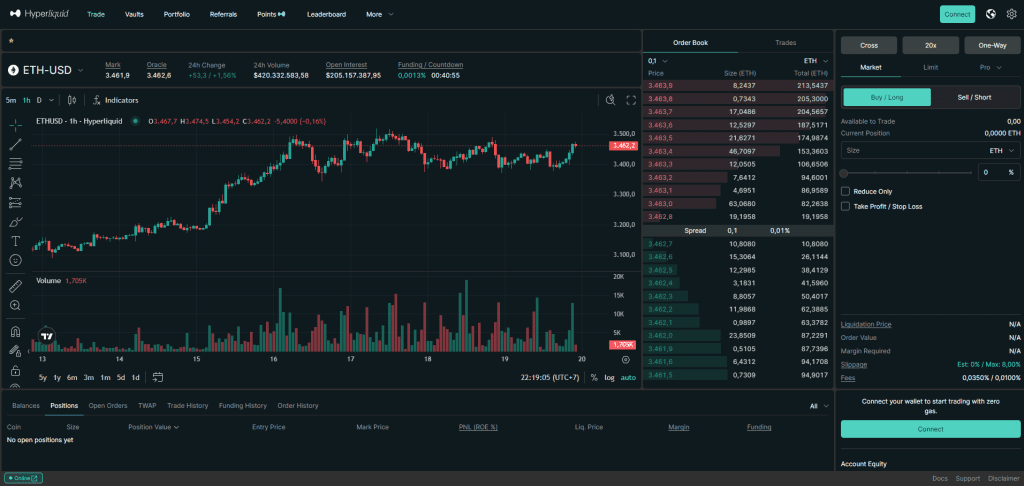

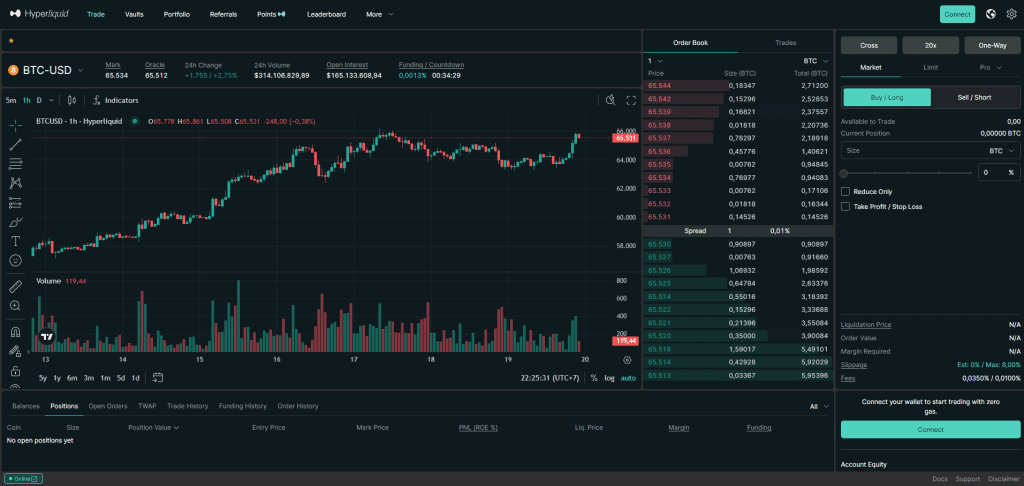

Perpetual DEX

It provides, like CEX and DEX exchanges, long or short different types of assets with various order types as follows:

- Market Order: Immediate execution at the best available price.

- Limit Order: When the price reaches the level set by a user, it’s executed at this price.

- Stop Market Order: It executes a market order when the stop price is reached.

- Stop Limit Order: Execute a limit order within a certain price range.

- Scale Orders: Several orders within a price range

- TWAP Orders: Splitting a large order and executing it during time intervals of 5 minutes up to 24 hours with a maximum slippage of 3%.

It represents tokens in categories such as AI, Layer 1, and DeFi. A special Pre-launch section designates tokens that do not have any listings yet, neither on any CEX nor DEX. Views: Trading ZRO tokens— Hyperliquid believes they are from the LayerZero project.

Spot Trading

A user can buy or sell assets with immediate execution in Limit, Market, and Scale orders. For now, the project supports PURR tokens for spot trading with the token standard HIP-1.

Native spot trading is driven by two permissionless token standards:

- HIP-1: Native token standard for trading in the spot order book, which allows for asset movements between Hyperliquid L1 and other chains.

- HIP-2: A token standard that provides permanent liquidity, serving as a source for the HIP-1 spot order book.

For example, the PURR Token, listed for spot trading, has 50% of its total supply allocated to point holders, while the remaining 50% is permanently committed as liquidity for the PURR/USDC pair, hence classifying itself under the HIP-2 token standard. Users on the platform are airdropped the PURR tokens by earning points through trading or depositing into the Vault.

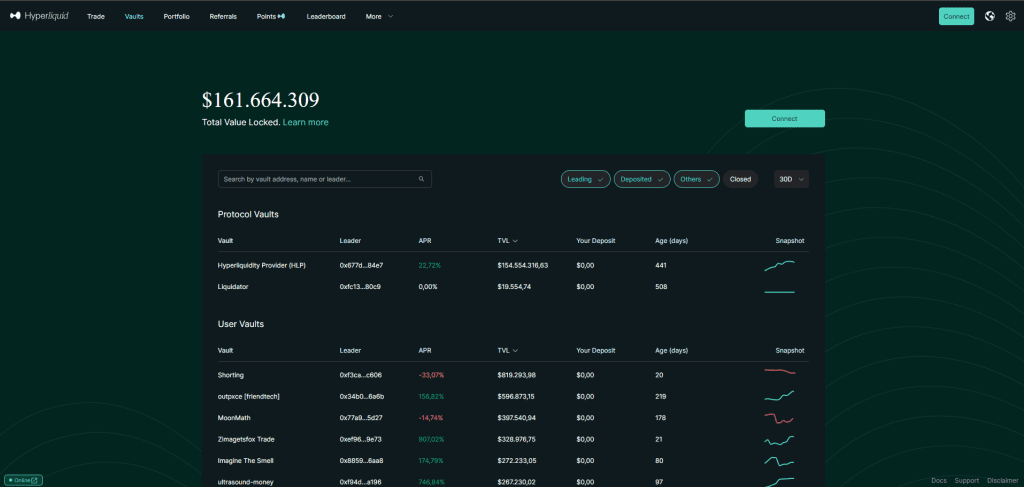

Vault

In Hyperliquid, the Vault works like a liquidity pool in which funds by users can be automatically traded on set orders, very much like Copy Trading on CEX exchanges. Depending on the performance on the long/short orders in the Vault, users earn part of the profits or bear losses. The users can follow specific traders by just depositing funds into their Vaults and getting exposure to their trading strategies.

For example, if you deposit 100 USDC into a Vault containing 1,000 USDC, you would own 10% of the Vault. If the Vault value increases to 2,000 USDC from very successful trading, you can now withdraw 200 USDC, less a 10% fee shared with the creator of the Vault—so your profit would be 190 USDC (less slippage and fees).

The Hyperliquidity Provider is a Vault that Hyperliquid has created to MMing and trade on the platform. Users can either directly deposit their funds into the HLP Vault for safety, or join individually created Vaults by traders.

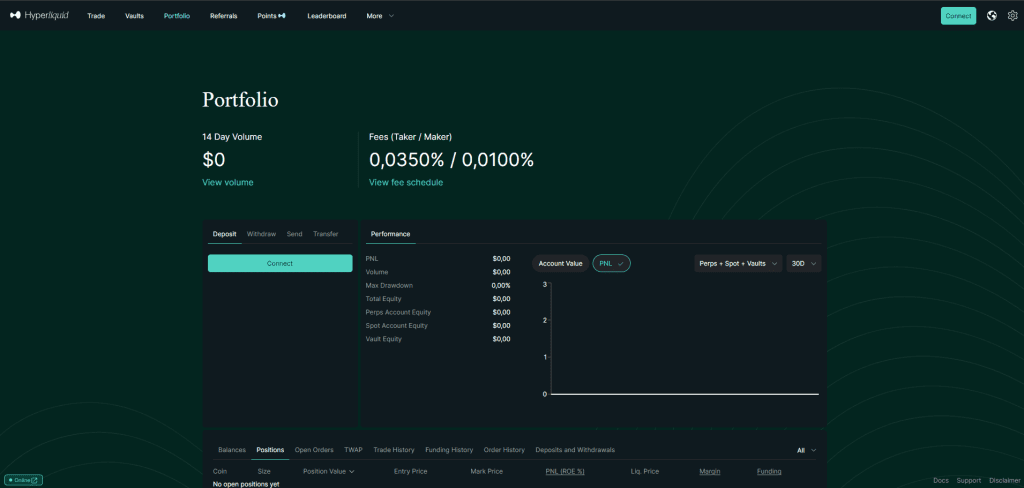

Portfolio

This section contains information about the user’s long/short orders, PnL, trading volume, leverage, etc.

Referrals

Users can invite others by sharing referral links or an invitation code to the platform and receive a commission whenever they trade on Hyperliquid. In case users open long/short orders for 10,000 USD or above in trading volume, an invitation code shall be created.

Points

Users who trade or deposit into the Vault will earn points. These points will be distributed every Thursday and shall run from November 1, 2023, to May 1, 2024. Point holders will also participate in the airdrop of PURR tokens, which is the first token supporting spot trading on Hyperliquid.

Read More: Liquid Staking Derivatives: The Rise of a Dominant DeFi Niche

Opportunities from the HyperLiquid platform

On November 1, 2023, a point award program started with a duration of 6 months, concluding on May 1, 2024. These points shall be acquired by participating in the platform and be tracked directly in the toolbar under the feature “Points”. These wallet addresses are then allotted points based on the amount of long/short trading or liquidity provision they have performed. Every Thursday, 1,000,000 points will be given to users by Hyperliquid.

Tokenomics

Hyperliquid has not yet provided information on a token launch. CoinCu will update once information is made available.

Team, Investors and Partner

Team

The development team behind Hyperliquid is Hyperliquid Labs, led by Jeff and Iliensinc, classmates at Harvard University. The team comes with rich experience from tech and finance companies including Airtable, Citadel, Hudson River Trading, and Nuro.

Investors

Information about investors in the fundraising rounds is not available at this moment. CoinCu will update the information once it’s available.

Partner

Currently, partners are projects like Rage Trade, Mizar, Hummingbot, and Okto.

Roadmap

Currently, Hyperliquid has not announced information about the future development roadmap. CoinCu will update as soon as there is the latest information from the project.

Conclusion

It is a DEX of derivatives where users can long or short various assets with a maximum leverage of 50x. The team has developed its own Layer 1 blockchain, Hyperliquid L1, to increase the UX in trading derivatives.

CoinCu reviews that Hyperliquid is user-friendly with advantages of time, cost, and high-profit allowance. It invites users to join the platform in search of new tools and compete for a chance to get retroactive rewards offered by the exchange.

FAQs

1. What does Hyperliquid seek to solve?

Hyperliquid is a decentralized exchange that seeks to solve the liquidity fragmentation problem, providing seamless trading with low fees and fast execution times.

2. The native token for Hyperliquid is.

The native token of Hyperliquid is HYPL

3. What are the staking options at Hyperliquid?

Yes, Hyperliquid does have staking options for users to receive extra rewards.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |