ETH Price Drop Triggers Massive Liquidations And Market Turbulence

Key Points:

- Ethereum hit $2,111, causing $370M in liquidations.

- DeFi liquidations reached $320M in 24 hours.

- Market corrections were driven by Japan’s rate hike and U.S. Fed’s caution.

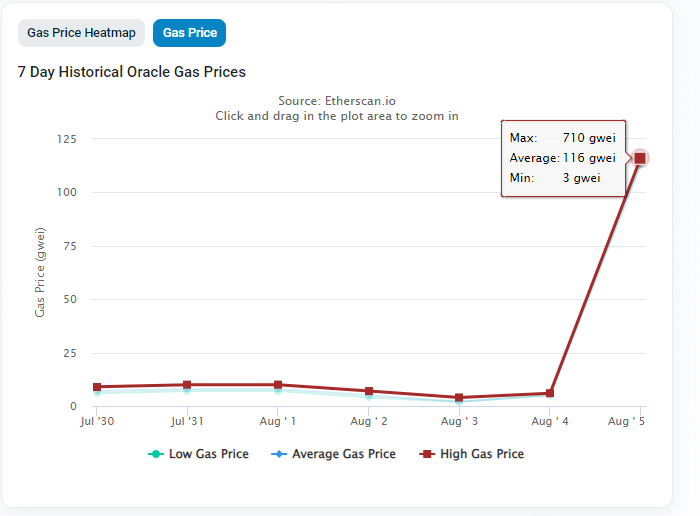

ETH price drop to $2,111 led to $370M liquidated in an hour. Gas fees peaked at 710 gwei. Further drops could liquidate up to $271M. BTC and ETH are down significantly.

According to CoinMarketCap, Ethereum dropped as low as $2,111 before recovering. During this period of volatility, $370 million was liquidated within an hour.

Significant Volatility and ETH Price Drop Observed

Wu also reported that at $2,100, the highest Ethereum gas fee reached 710 gwei, while the current average is approximately 350 gwei. Should Ethereum drop to $1,950, around $92.2 million in crypto assets within DeFi protocols would be liquidated. At $1,790, the liquidation volume would increase to $271 million.

As per Parsec data, lending liquidations on DeFi platforms have just crossed $320 million in the last 24 hours, a new high for the year. In detail, ETH collateral liquidations stood at $187 million, wstETH at $77.9 million, and wBTC at $32.5 million.

Bitcoin is not immune, down 12% in the past 24 hours and 20% over the past week. Ethereum has been down 21% over the past 24 hours and 30% over the past week, erasing the year-to-date gains and has kept it down by some 3% since January 1.

Read more: Bitcoin Price Crashes By 22% Amid Market Turmoil and Seized Assets

Impact of Global Financial Policies on Market Volatility

According to CoinDesk, the Bank of Japan’s move to raise its benchmark interest rate might have furthered the recent market correction, sending the yen higher and the Nikkei stock index down 6% early Monday.

The sell-off in Japan spilt into the U.S. markets, with the Nasdaq falling more than 5% in the last two sessions of the previous week. Nasdaq futures tumbled 2.5% Sunday evening. Additionally, the cautious stance of the U.S. Federal Reserve on rate cuts in September also contributed to market uncertainty.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |