Justin Sun Liquidation Rumors Debunked Amid The Sudden Fall Of ETH Price

Key Points:

- Justin Sun denies rumors of liquidation and emphasizes minimal use of leveraged trading.

- Despite rumors, Sun’s losses were due to Ether’s price drop, not liquidation, and he announced a $1 billion fund to combat FUD.

Justin Sun liquidation rumors have been denied, as he rarely uses leverage. Data showed he lost $280M due to ETH’s drop, not liquidation.

Justin Sun is out to debunk recent rumors swirling around the liquidation of his positions, saying they are not true.

Justin Sun Liquidation Rumors Addressed

According to the founder of TRON and Huobi HTX Global Advisory Committee member, he seldom uses leveraged trading strategies, which offer minimal benefits to the industry from his perspective.

Instead, we prefer to engage in activities that provide greater support to the industry and entrepreneurs, such as staking, running nodes, working on projects, and helping project teams provide liquidity, said Justin Sun.

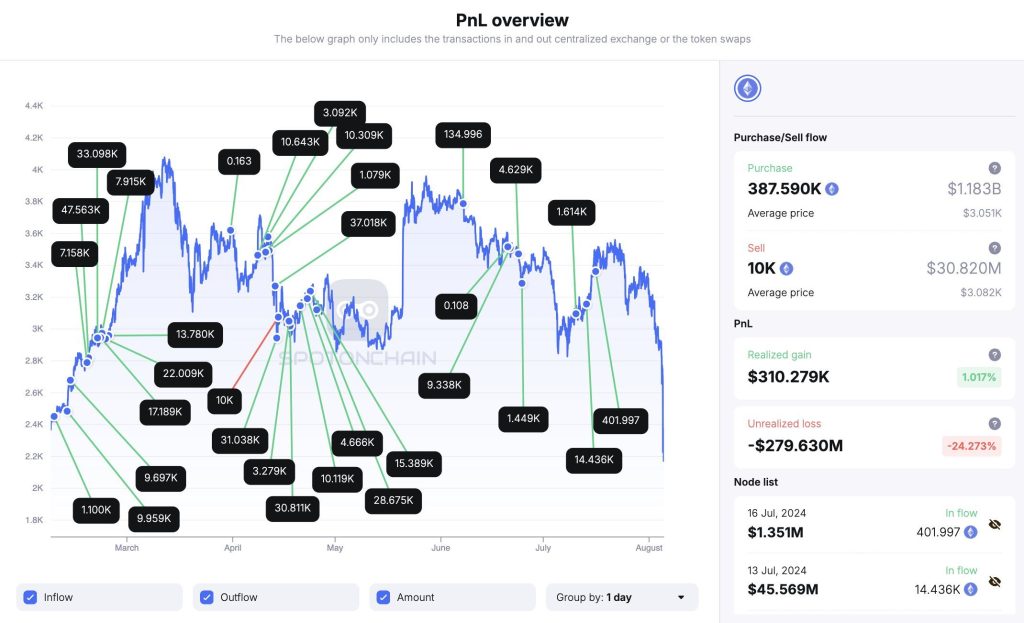

According to data from Spot On Chain, Justin Sun just lost nearly $280 million as Ether’s price sank by 20% instead of being liquidated, as rumors said. Reports indicate that since February 8, 2024, using three wallets, Sun has amassed 377,590 ETH at an estimated cost of $1.15 billion, while ETH is trading far below his average purchase price of $3,051.

In a recent post, Justin Sun outlined some of the developments the crypto industry has gone through in the past year, noting that ups and downs in the market were not a result of negative news.

He also called on the community to shun FUD and move on to the building. To this end, he has announced a $1 billion fund to increase investment and provide liquidity against FUD.

Read more: ETH Price Drop Triggers Massive Liquidations And Market Turbulence

Massive Losses Amid Ether Price Drop

Additionally, Lookonchain reported that 25 addresses were liquidated in the ETH crash for a total of 63,732 ETH, equivalent to $150 million. Among them, address 0x99e8…ddc3 was liquidated for 9,834 ETH, valued at $23.16 million.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |