Bitcoin Spot ETFs See $168M Outflow on August 5 Amid Market Volatility!

Key Points:

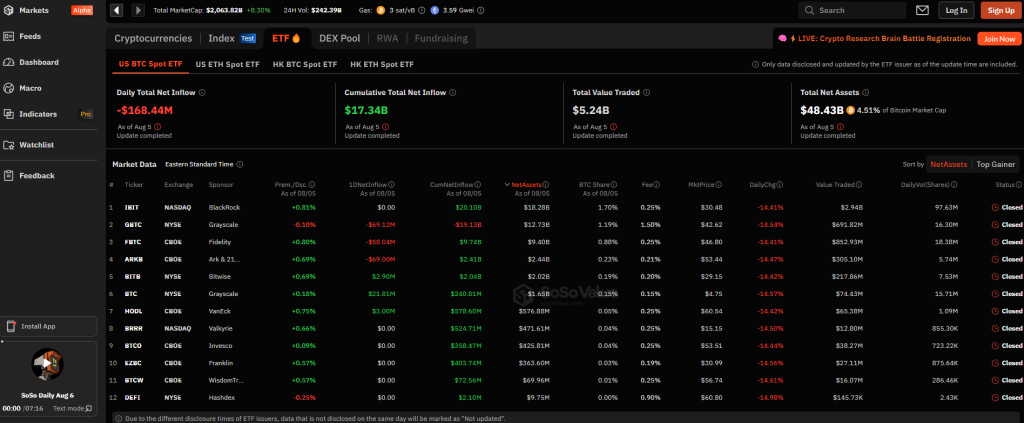

- On August 5, Bitcoin spot ETFs faced a significant net outflow totalling $168 million.

- Grayscale GBTC outflowed $69.115M, Fidelity FBTC outflowed $58.04M, and ARK 21shares ARKB outflowed $69M.

- Grayscale mini ETF BTC saw an inflow of $21.8114M, indicating strategic reallocation amidst market volatility.

On August 5, significant activity in Bitcoin spot ETFs netted a total outflow of $168 million.

The data has something else to reveal: net flows into the world of different ETFs are changing and moving wildly, further reflecting the market volatility and uninterrupted shifts in investor sentiment.

Bitcoin Spot ETFs Face Significant $168M Outflow

Grayscale Bitcoin Trust, one of the larger crypto investment vehicles, notched outflows of $69.115 million. A withdrawal of this magnitude will likely mean that something has changed about investor confidence, no doubt pegged to recent ups and downs in Bitcoin prices and regulatory uncertainty across the board on digital assets.

Read more: Spot Crypto ETFs Face Record Outflows Amid Global Market Crisis

Detailed Breakdown of Fund Movements

Grayscale‘s mini ETF BTC saw an inflow of $21.8114 million. The inflow may indicate that while investors are backing out of more significant, established funds, others have begun looking toward the smaller, more flexible investment vehicle. Viewed in another light, the inflow into the mini ETF could have represented some strategic rebalancing or even a bet that smaller Bitcoin investments would be resilient.

The most famous is Fidelity’s Bitcoin spot ETFs (FBTC), which has had the most significant outflows, $58.04 million. Fidelity, a sizeable traditional finance firm dipping its toes into crypto, signals to a greater extent the market sentiment, where traditional investors are very cautious about the current state of the market.

On the other hand, the ARK 21Shares Bitcoin ETF (ARKB) lost $69 million. While Cathie Wood’s ARK Investment has been among the most vocal proponents of cryptocurrencies, the outflow seems to suggest that even the most optimistic are reviewing their positions in light of market dynamics.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |