Key Points:

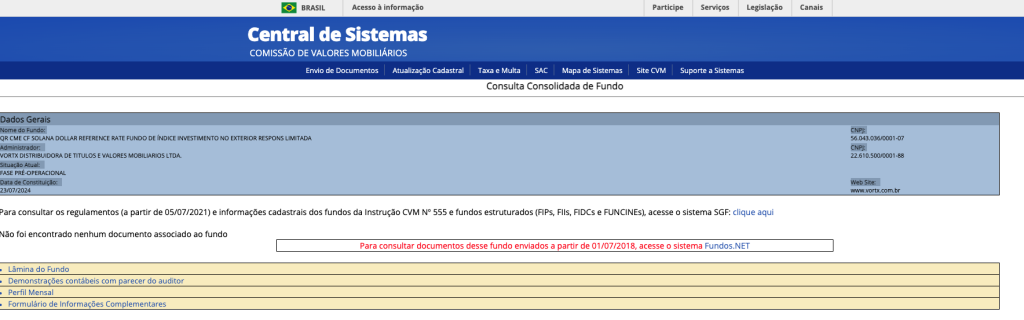

- Brazil approves the first spot Solana ETF, managed by QR and Vortx.

- The ETF uses CME CF Solana Dollar Reference Rate F for pricing.

The Brazilian Securities and Exchange Commission approved the first spot Solana ETF, managed by QR and Vortx, with a launch expected within 90 days.

The Brazilian Securities and Exchange Commission has greenlighted the first spot Solana ETF. According to Cointelegraph, QR, a Bitcoin and Ethereum ETF management company, will manage the ETF, which will be managed by Vortx.

Brazilian Securities and Exchange Commission Approves Spot Solana ETF

Although the investment product is still in its very early days of operation, pending further regulatory approval from B3, a launch within the next 90 days is expected.

Currently, Solana ETPs trade on the SIX Swiss Exchange, the 21Shares Solana ETP with the ticker ASO, and on Deutsche Börse Xetra in Germany, the CoinShares Physical Solana and the ETC Group Physical Solana. The newly approved Solana ETF will use the CME CF Solana Dollar Reference Rate F as its reference price, ensuring a reliable and transparent measure of Solana’s value in US dollars.

Read more: Solana ETF’s Explosive Potential and Its Future If Approval Takes Place in 2025

Comparison with Solana ETPs and Benchmark Rate

The benchmark rate, developed by the Chicago Mercantile Exchange (CME) and Crypto Facilities (CF), aggregates data from several trusted exchanges to provide an accurate quote for Solana.

Additionally, the information is further filtered for noise and market anomalies, capturing the weighted average price of Solana over time.

QR, which led the charge in the rollout of spot ETFs in Brazil, became the first to roll out a 100% Bitcoin and Ethereum ETF in the South American nation. In contrast with Brazil, it’s highly unlikely that the application for a spot Solana ETF by VanEck in the US will be green-lighted anytime soon based on the current policies of the SEC.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |