Key Points:

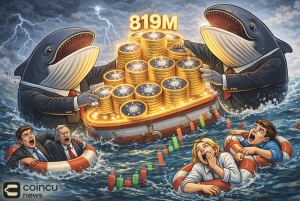

- USDT and USDC supply have increased by nearly $3 billion in the past week, indicating heightened investor activity after the market crash.

- Tether’s market cap has reached an all-time high of over $115 billion, while Circle’s USDC market cap has risen to $34.5 billion, the highest since March 2023.

According to CoinDesk, USDT and USDC supply surged by almost $3 billion in a little over the past week, indicating renewed investor activity following a market crash on August 5.

Read more: Tether USDT Redemptions Will Be Stopped on Multiple Blockchains in 2025

USDT and USDC Supply Rises $3 Billion in a Week

On-chain data showed Tether has moved $1.3 billion in USDT to exchanges and market makers since the crash. This influx pushed USDT’s market capitalization to a new record high above $115 billion.

The activity at Circle has also been heavy, with some 3.9 billion USDC issued and 2.3 billion redeemed over the past week. This meant a net increase of around 1.6 billion USDC to bring the total USDC in circulation to $34.5 billion, and the reserve is now at $34.6 billion, of which $4.5 billion sits in cash and $30.1 billion in the Circle Reserve Fund.

CoinDesk reports that the USDC market capitalization has surged by about $1.6 billion this week alone to $34.5 billion, the highest since March 2023. In the meantime, deposits of Binance’s USDT and USDC made more than $1.5 billion and $820 million, respectively, in the four days after the crash.

Tether and Circle Grow Strong Thanks to Bull Market

The USDT and USDC supply increased dramatically from November to March on the back of a cryptocurrency price rally that sent Bitcoin’s price to a record above $73,800. That growth came to something of a standstill, but it has lately picked up again.

In related news, Tether Holdings will increase its headcount to 200 by mid-2025. It is going to add talent mainly in compliance and finance. Its CEO, Paolo Ardoino, said that it looks forward to maintaining a lean structure while attaining flexibility.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |