Market Overview (August 5 – August 11): The Week Of Ripple and Binance, Economic Shifts Looming

Weekly highlights: Ripple wins SEC case, Binance lists Toncoin, Capula’s Bitcoin ETF holdings, Xapo Bank’s new product, macroeconomic updates, and market overview.

Last week’s highlights big news (August 5 – August 11)

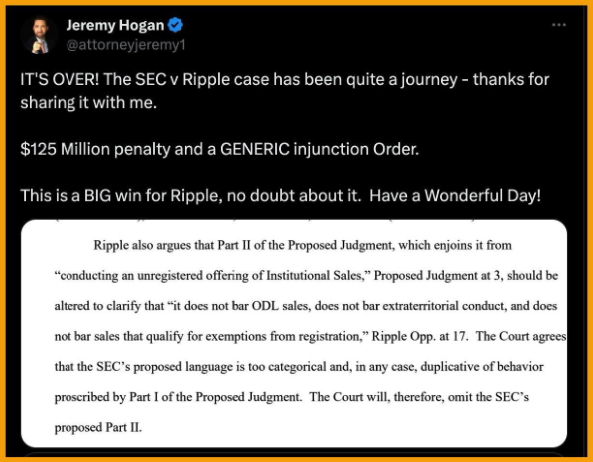

3-Year SEC vs Ripple Legal Saga Comes to an End – Ripple Wins Against All Odds: The 3-year-long lawsuit pitched by SEC against Ripple has finally ended, yet generating another major victory for Ripple. The judge authorized a fine on Ripple of $125 million rather than the $2 billion sought by the SEC.

Binance Lists Toncoin (TON): Binance listed Toncoin (TON) on August 8 at 10:00 UTC.

Capula Management Bitcoin ETF Holdings: Capula Management, the fourth-biggest investment management company in Europe, has just disclosed its Spot Bitcoin ETF holdings to be around $500 million.

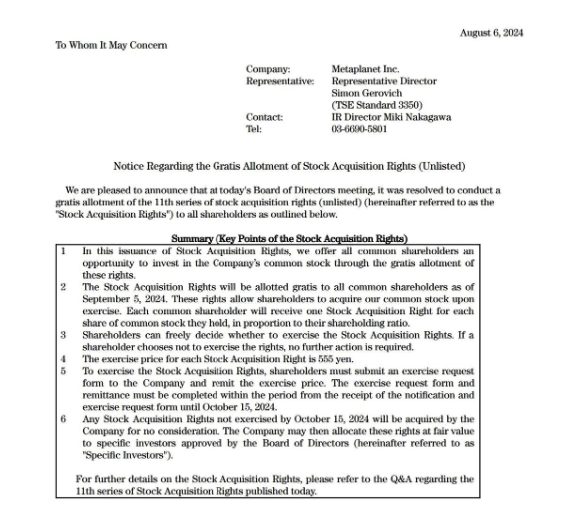

Metaplanet Stock Purchase Rights Offering: Metaplanet’s stock purchase rights offering of 10 billion yen (~$69 million) to buy more BTC.

DappRadar Report: A DappRadar report from July 2024 stated that AI-based DApps represented 28% of daily activity, outperforming blockchain gambling at 26%.

New Offer from Xapo Bank: Xapo Bank launched the first-ever product by a UK bank—an interest-bearing Bitcoin and fiat account, with a 1% return paid in Bitcoin, without having to stake it.

Grayscale Bittensor Trust and Grayscale Sui Trust: Grayscale has launched two new products: Grayscale Bittensor Trust and Grayscale Sui Trust.

Ripple’s New Stablecoin: Ripple’s new stablecoin has been tested on Ethereum and the XRP Ledger, but it is not yet trading. RLUSD requires some regulatory approvals.

Read more: Market Overview (July 29 – August 4): MicroStrategy’s BTC Purchase And SEC Lawsuit Revised

Macroeconomics (August 5 – August 11)

Federal Reserve’s Response to Economic Weakness: The Chicago Fed President said that the Federal Reserve will respond to signs of economic weakness. “Interest rates are currently very high, and we don’t need to be at this level if necessary. The data I have received tells me we don’t need to. Again, that is my opinion; I am just one person and cannot speak for other officials.”

Jeremy Siegel Rate Cut Urging: Jeremy Siegel, Wharton School, urges the Fed to make an emergency 0.75% rate cut and another 0.75% cut in September.

Major U.S. Economic Events This Week

- Tuesday, August 13:

- PPI (wholesale) inflation data

- Wednesday, August 14:

- CPI inflation data: Estimate 3.0% | Previous 3.0%

- Core CPI Inflation Data: Forecast 3.2% | Prior 3.3%

- Thursday, August 15:

- Initial Jobless Claims

- Empire State Manufacturing Survey

- Philadelphia Fed Manufacturing Survey

- US Retail Sales Data

Market Overview

Rumours and Investigations: They are supposedly bankrupt and being investigated by the CFTC. But they have only 21,394 wstETH ($63.6 million) left.

BTC Weekly Close: BTC closed the week over $60k with a good-looking volume candle, having swept $10B in liquidations on Binance. However, the rebound momentum was weakening as BTC dropped the $60k watermark.

CPI Data Impact: CPI data this week can potentially cause temporary price volatility; the last one certainly did.

Stablecoin Net Flow: Stablecoins continue to be withdrawn from exchanges in large amounts: the past 24 hours have seen more than $198 million of net flow.

Jump Trading’s Ethereum Activity: In these two weeks, Jump Trading has not ceased transferring more Ethereum over to exchanges. For withdrawal and redemption requests, they asked to withdraw about 11,501 ETH ($29.11 million) from Lido and asked for redemption of an additional 19,049 ETH ($48.22 million).The figure is not significant enough to cause a move in the market.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |