Key Points:

- Goldman Sachs holds $418.65 million in spot BTC ETF shares.

- Goldman also invested in Grayscale, Invesco, Bitwise, WisdomTree, and ARK 21Shares funds.

Goldman Sachs Bitcoin ETF holdings total $418.65M, including $238.6M in BlackRock’s iShares Bitcoin Trust, $79.5M in Fidelity’s FBTC, $35.1M in Grayscale’s fund, and $56.1M in Invesco Galaxy Bitcoin ETF.

Following the launch of 11 spot Bitcoin ETFs in January, investment bank BTC ETF holdings have seen significant inflows over the past seven months.

Goldman Sachs Bitcoin ETF Holdings and Rankings

According to the latest quarterly 13F filing, Goldman Sachs, a Multinational financial services company, has $418.65 million in spot BTC ETF shares.

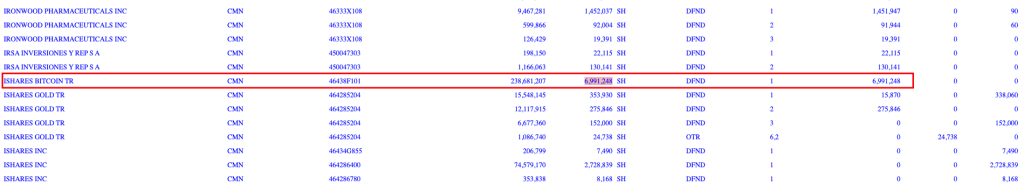

The largest portion belonged to BlackRock’s iShares Bitcoin Trust, which boasts around 6.9 million shares priced at $238.6 million. The figure would make Goldman Sachs the third-largest holder of the IBIT fund after Millennium Management and Capula Management.

Goldman also reportedly disclosed 1.51 million shares in Fidelity’s FBTC, worth $79.5 million, and 660,183 shares in Grayscale’s Bitcoin fund, which was converted and now amounts to $35.1 million.

Read more: Kamala Harris Proposes 28% Crypto Tax Rate For Wealthy Fairness: BBG

Additional Bitcoin Fund Investments by Goldman Sachs

Additionally, Macroscope reported the investment bank held $56.1 million in the Invesco Galaxy Bitcoin ETF and shares in three other funds from Bitwise, WisdomTree, and ARK 21Shares.

Institutional investment managers with over $100 million in equity assets under management must file 13F filings each quarter with the SEC. The filings give a snapshot of the institutional investment manager’s long equity positions and options; however, short positions are not disclosed, which limits the comprehensiveness of a portfolio overview.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |