Key Points:

- U.S. core CPI rose 0.2% in July, annually at 3.2%.

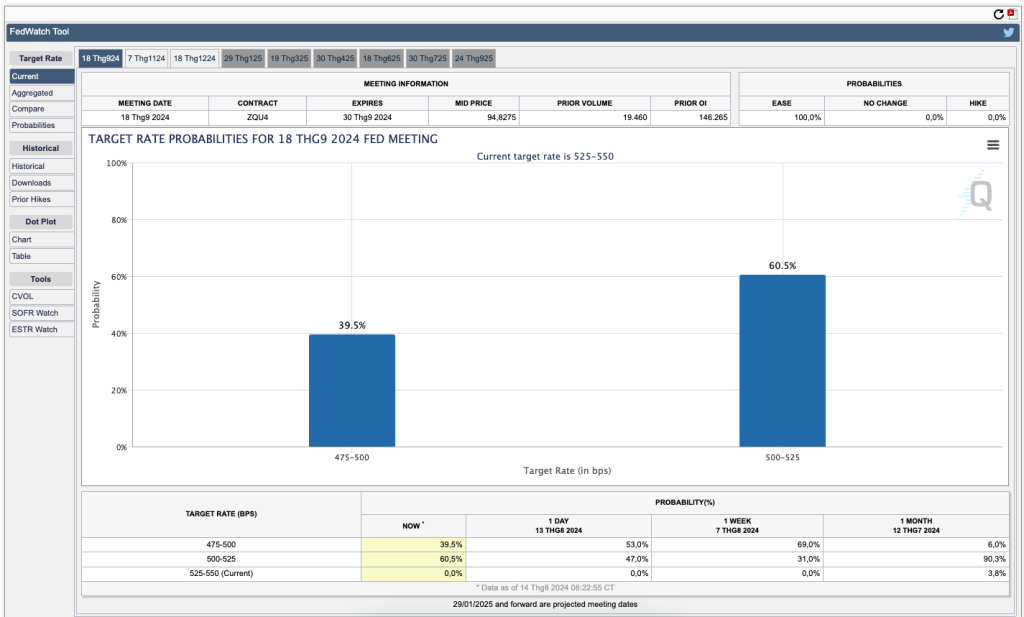

- Fed may cut rates in mid-September, with a 52.5% chance of a 50 bp reduction.

- Bitcoin steadied around $61,000 after the CPI report.

US Core CPI rose 0.2% in July, with a year-over-year increase of 3.2%. The overall CPI also gained 0.2%. These figures influence the Fed’s mid-September meeting, with potential rate cuts expected.

As expected, the U.S. core consumer price index rose 0.2% in July, unchanged from 0.1% in June. Year over year, the core CPI, which strips out changes in the prices of food and energy, came in at 3.2%, also as expected and a tad weaker than June’s 3.3%.

US Core CPI Rose 0.2% in July

The government said the overall CPI also gained 0.2% in July after falling 0.1% in June. The CPI rose 2.9% annually, a tad below the expected 3% and June’s 3%.

These figures are important because they set up the scene for the Federal Reserve’s mid-September meeting, at which a possible rate cut is already expected.

The CME FedWatch tool priced a 52.5% chance of a 50 basis point reduction in the benchmark fed funds rate range from its current 5.25% – 5.50% and a 47.5% chance of a 25 basis point cut.

Read more: Kamala Harris Proposes 28% Crypto Tax Rate For Wealthy Fairness: BBG

Bitcoin’s Reaction to CPI Report

The price of Bitcoin only somewhat reacted to the CPI report, and the king of cryptocurrency is sticking around $61,000 as of this writing. Other key U.S. macroeconomic indicators on the docket include tomorrow’s initial jobless claims and retail sales reports.

Additionally, the Federal Reserve’s annual Jackson Hole gathering, taking place before the end of August, may provide further insights into potential policy changes. Historically, the conference has been used by Fed chairs to announce significant policy shifts.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |