Key Points:

- BTC and ETH volatility dropped sharply by 10 vols, reflecting a significant market shift.

- Risk reversals for ETH and BTC volatility fell further, indicating a growing bearish outlook among traders.

- Lower-than-expected CPI numbers led to immediate reactions in equities and crypto, with the market bracing for more downside.

According to QCP, BTC and ETH volatility were sold off post-CPI, resulting in a sharp decline of around 10 vols.

BTC and ETH Volatility Plummets Post-CPI Release

BTC and ETH volatility sold off sharply, dropping by approximately 10 vols. This substantial decline reflects a marked shift in market sentiment, significantly as risk reversals dipped further, registering at -8 vols for ETH and -6 vols for BTC. The options market is now anticipating more downside due to the fresh supply.

The crypto rally did not last long, as the market sold off sharply. The downturn followed news of the U.S. transferring 10,000 BTC to Coinbase Prime and Jump trading offloading 17,000 ETH, events that have triggered increased selling pressure and dampened bullish momentum. These negative numbers suggest that traders are increasingly interested in hedging and not betting further on the upside in this trend.

Read more: US Core CPI Rises 0.2% in July As Bitcoin Holds at $61,000

Softer CPI Triggers Sharp Market Reaction

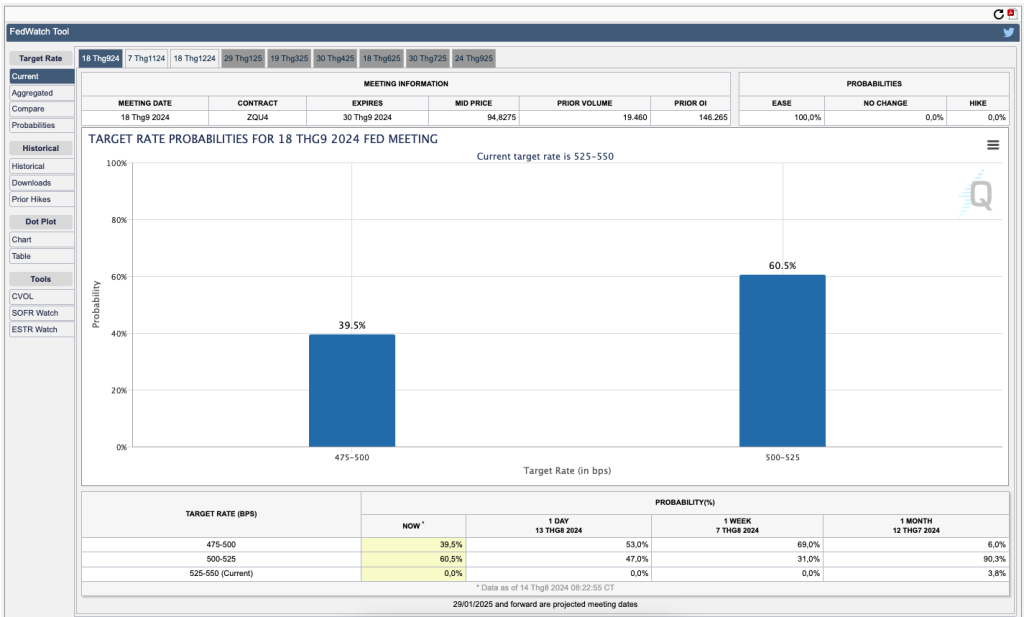

The report on the CPI, which is usually an indicator of inflation, was very much in between the lines. Before the CPI release, the market priced in a 62.5% probability for a 25 basis points rate cut from 47.5%, indicating a shift in investor sentiment following softer-than-anticipated CPI numbers.

As market participants adjust their expectations, further volatility from these sectors could be anticipated.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |