Key Points:

- Fed Chair Powell suggested possible rate cuts in September to support the economy.

- Traders are anticipating a rate cut, with some expecting a quarter-point reduction and others speculating a possible half-point cut.

- Following Powell’s dovish comments, Bitcoin prices surged by more than 1.2% to $62,300.

In the year’s most closely watched speech, Federal Reserve Chair Jerome H. Powell signalled Friday that the central bank is ready to cut interest rates at its upcoming September meeting.

Read more: Fed Interest Rate Steady At 5.25%-5.50%, High Odds For September Reduction

Fed Chair Powell Signals Possible Rate Cuts in September

Speaking at the Kansas City Fed’s annual conference in Jackson Hole, Wyoming, Fed Chair Powell said the size of the rate cut is still up for debate; the central bank was prepared to adjust its policy in defence of the labour market and the steady path of the economy.

In a broad move of the Fed’s stance, Powell said, “The time has come for policy to adjust.” He stated any decision regarding the appropriate timing and magnitude of rate cuts would be dependent on the incoming economic data, the evolving economic outlook, and the balance of risks.

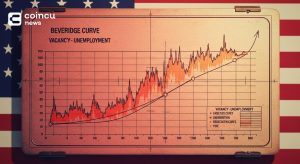

Powell said the Federal Reserve would support the strong labour market and continue to monitor price stability. His comments come after interest rates have been kept near 5.3% for more than a year, the highest in two decades.

Market expectations of a possible rate cut at the Fed’s Sept. 17-18 meeting have risen, as inflation appears to be slowing, and there are signs that the job market may be cooling. Traders have started pricing in a one-in-three chance of a larger half-point rate cut from earlier expectations of a quarter-point cut.

Bitcoin Surges Following Fed Chair’s Dovish Comments

The Fed started aggressively hiking in early 2022 in response to rapid inflation. With supply constraints finally easing and inflation now moderating, Fed Chair Powell indicated that the Fed could shift focus to holding up employment levels.

The financial markets reacted very quickly to Powell’s remarks. Shortly after his speech, Bitcoin prices were up more than 1.2 per cent to $62,300, which means enhanced optimism about the relief of monetary policies and their implications for asset prices.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |