Bitcoin Inflows Surge to $543 Million After Powell’s Rate Comments

Key Points:

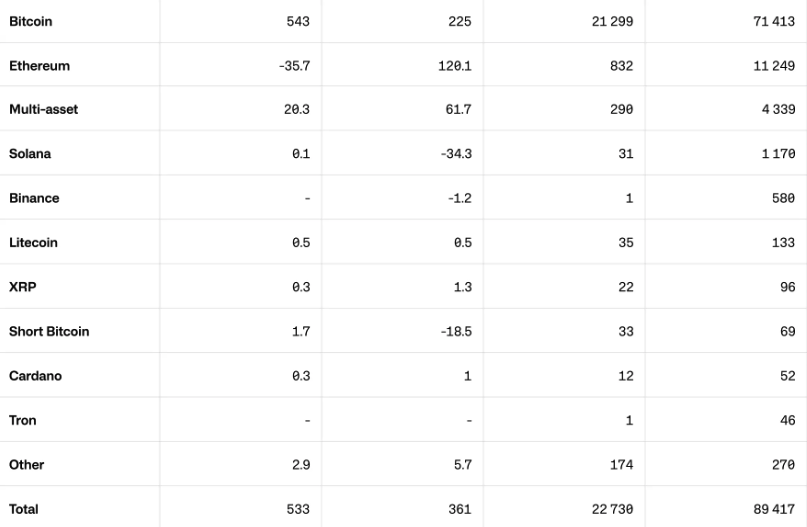

- Digital asset investment products saw a significant inflow of $533 million in one week, with Bitcoin receiving the majority at $543 million.

- Ethereum experienced outflows of $36 million, while blockchain equities saw inflows for the third consecutive week.

Bitcoin inflows surged to $543 million in a week, driven by Powell’s comments on interest rate sensitivity. Total digital asset inflows reached $533 million, with the US leading at $498 million.

According to the recent CoinShares weekly report, inflows into digital asset investment products amounted to about $533 million in one week, marking the biggest inflow in about five weeks.

Record-Breaking Bitcoin Inflows Surge Past $500 Million

Bitcoin saw most of the inflows totaling $543 million, mostly after Federal Reserve Chair Jerome Powell spoke on Friday. The increase in Bitcoin inflows reportedly comes after Federal Reserve Chair Jerome Powell said the cryptocurrency seems sensitive to interest rate expectations.

By comparison, there were outflows from Ethereum equating to $36 million. Blockchain equities exhibited a third consecutive week of inflows, increasing by $4.8 million.

Read more: DOGS Bot Farm Users Banned As Airdrop Claims Face Cleanup

Regional Variations in Digital Asset Investment Flows

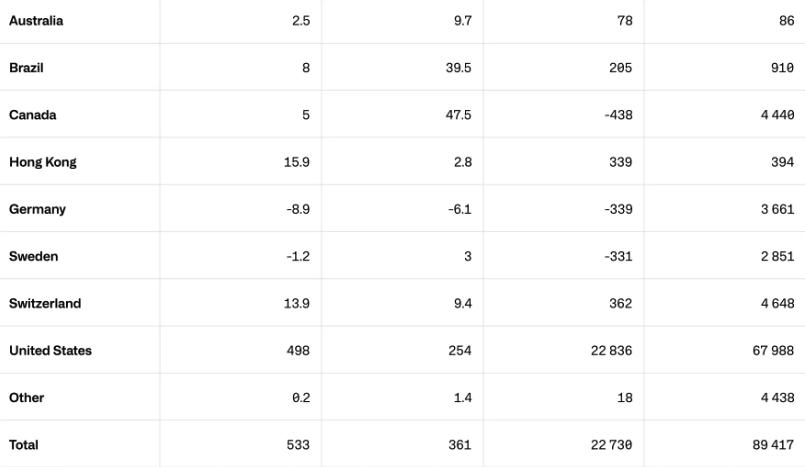

Regarding regions, the United States was at the top with inflows of $498 mln, followed by Hong Kong with inflows of $16 million and Switzerland with inflows of $14 million.

Meanwhile, the previous report indicated that digital asset investment products recorded US$30 million in inflows, with newer providers gaining market share. Trading volumes decreased by 50% to US$7.6 billion.

Bitcoin attracted US$42 million, Ethereum US$4.2 million (the latter number masked its provider shifts), and Solana experienced record outflows of US$39 million due to declining memecoin volumes. Short bitcoin ETFs had US$1 million in outflows.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |