Tokenomics is an important factor for investors to consider the project’s token allocation policy. Let’s refer to Coincu‘s article Tokenomics Explained to learn more about this important component.

Tokenomics Explained Overview

Tokenomics is a combination of two terms: “token” and “economics”. It could be perceived as the “economy of cryptocurrencies” and how they are built and applied to the operating model of that project. The term tokenomics is a lot used in crypto investing.

Tokenomics is everything about tokens in crypto projects. Understanding and studying tokenomics will make investors assess precisely the efficiency of the token and its potential to grow or not.

Tokenomics is the study of a project’s whole economic structure, not just the allocation of tokens. There are five essential factors to take into account while assessing tokenomics:

- Allocation and Distribution

- Supply Dynamics

- Token Model

- Incentive Structures

- Consensus Mechanism

Allocation and Distribution

This is the element which outlines who will receive the tokens and the process for bringing them to market.

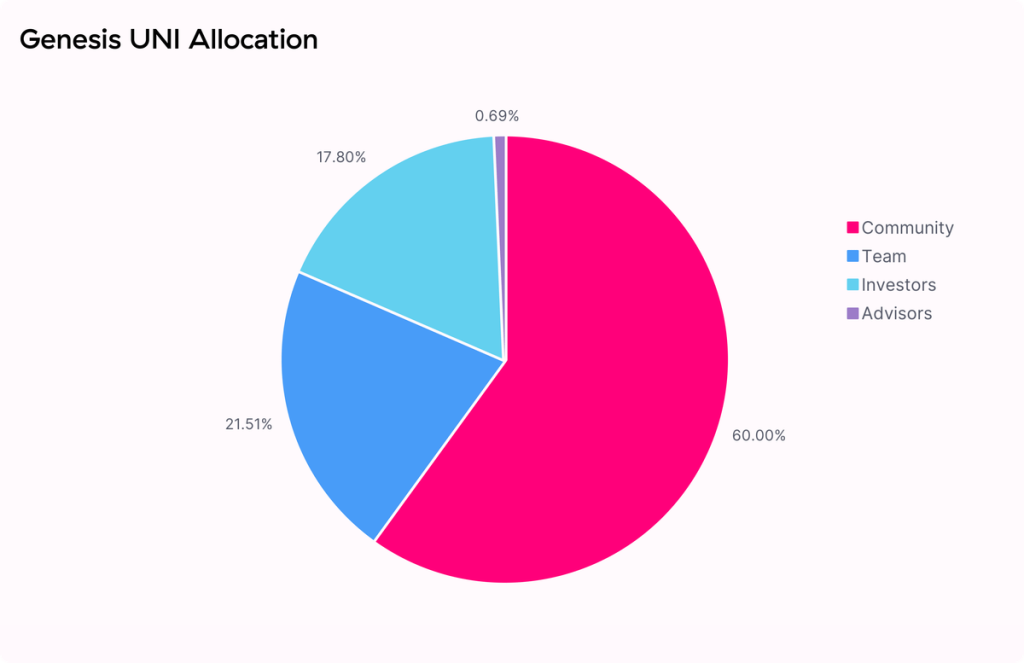

The $UNI tokenomics is often seen as a prime example, with the majority of tokens allocated to the community and the full supply distributed over a 4-year period.

➣ Projects typically distribute tokens via either a fair launch or a pre-mine.

- Fair launch: tokens are mined and controlled by the community from the start.

- Pre-mine: tokens are created and allocated prior to the public launch, often to raise capital. Most crypto projects opt for pre-mined tokens.

Read more: Filecoin Tokenomics: The Force Behind The Strong Pull In The Storage Sector

Token supply

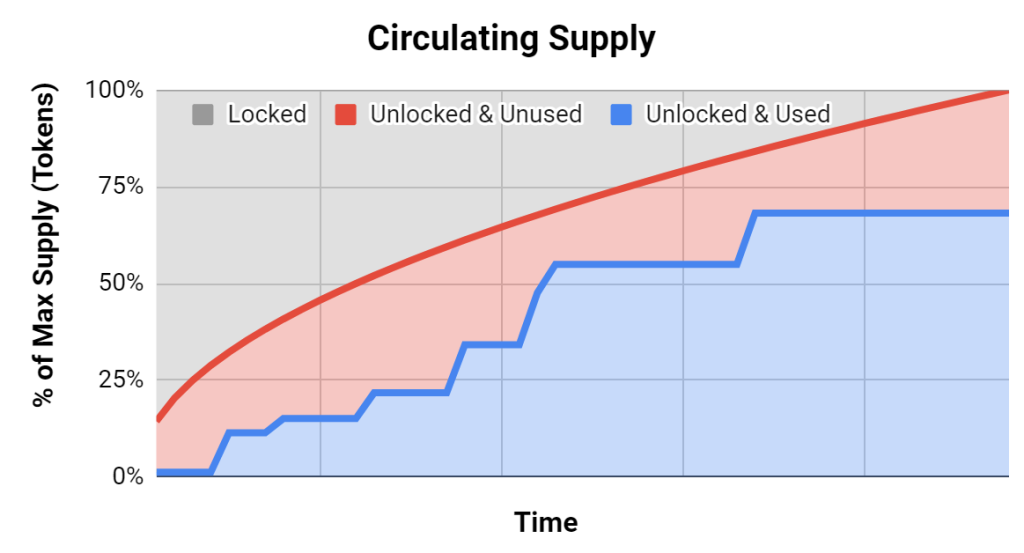

Token supply represents the total number of tokens in a project and how that number might change over time.

- Circulating supply is the number of tokens currently available in the market.

- Total supply includes all tokens, whether circulating or locked in smart contracts for future release.

- Maximum supply is the total number of tokens that will ever exist once the cap is reached.

➣ A significant gap between market cap and total supply creates the issue of “low float, high FDV” – a common problem recently.

The concept is straightforward: starting with a high valuation can hinder the project’s growth due to ongoing selling pressure from token unlocks.

Token Model

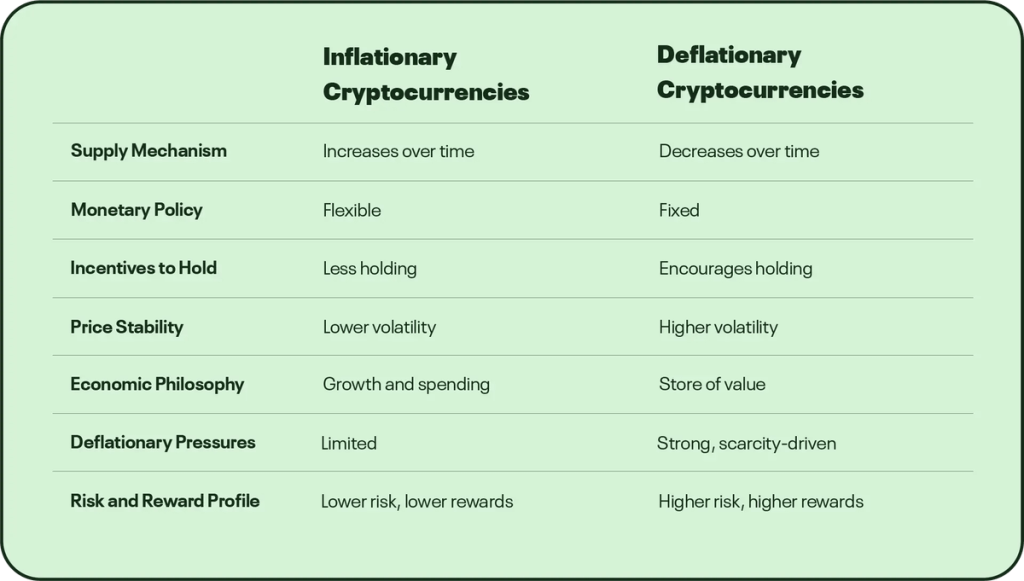

This part refers to one main question – Is the coin inflationary or deflationary? Let’s analyze every part:

➣ The Inflationary Model

An inflationary token model does not have a fixed maximum supply, meaning the number of tokens can increase indefinitely over time. This model is often used to incentivize network participation and growth, as new tokens are continuously minted and distributed to users, validators, or stakers as rewards.

Pros:

- Encourages Participation: By continually minting new tokens, the network can provide ongoing rewards, motivating users to stay engaged and actively participate in the ecosystem.

- Supports Growth: This model allows for flexible token distribution, ensuring that the network can continue to expand without hitting a cap on supply.

Cons:

- Inflationary Pressure: The constant increase in supply leads to inflation, which can erode the value of individual tokens over time.

- Devaluation: As more tokens are minted, the dilution effect reduces the value of tokens held by early participants, potentially discouraging long-term holding and investment.

➣ The Deflationary Model

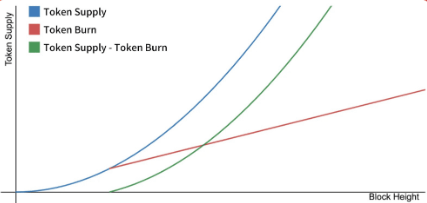

A deflationary token model places a fixed cap on the total supply, meaning no additional tokens will be created once the maximum supply is reached. This model may also involve token burns, where a portion of the existing tokens is permanently removed from circulation, effectively reducing the total supply over time.

Pros:

- Creates Scarcity: By limiting supply and burning tokens, a natural scarcity is created, which can increase demand and potentially drive up the value of the remaining tokens.

- Prevents Inflation: Since no new tokens are minted beyond the cap, there is no inflationary pressure to dilute the value of the existing tokens, helping to maintain or increase their worth over time.

Cons:

- Encourages Hoarding: The anticipation of higher future value due to token scarcity may encourage users to hoard tokens instead of using them within the ecosystem, reducing liquidity and slowing down network activity.

- Hinders New Investors: As tokens become scarcer and potentially more expensive, it may be difficult for new investors to enter the market, limiting broader adoption.

- Reduced Token Utility: In some cases, the focus on scarcity can reduce the actual utility of the token, as fewer people may want to spend or use tokens if they expect future price increases.

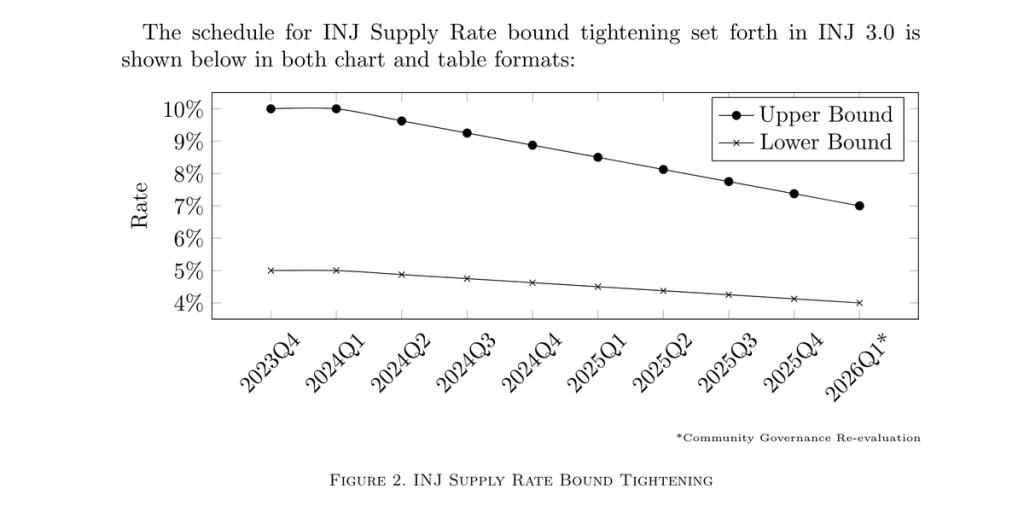

An example of a project utilizing a deflationary model is $INJ (Injective), which incorporates periodic token burns to reduce supply and boost scarcity.

Read more: The Huge Impact Of Tokenomics And Its Two Core Principles

Token Incentives

Users should have the motivation not only to join the project but to buy a few tokens early, stay there, and continue to invest their money and time in it. It could be done through: Profit sharing and Staking pools.

➣ Profit Sharing Model

The profit sharing model is designed to reward token holders by distributing a portion of the project’s revenue or profits back to them. This distribution can take various forms, such as airdrops, fee reflections, staking rewards, or other token distribution mechanisms. The goal is to incentivize holding and long-term participation in the ecosystem by providing tangible benefits to those who support the project.

➣ Staking Pools

Token holders have the opportunity to stake their tokens, contributing to network security and functionality while earning rewards. This process, often referred to as “staking,” allows participants to act as validators or delegate their tokens to validators who perform critical tasks in maintaining the network. The staking mechanism serves several purposes and offers multiple benefits, including:

- Holding Tokens: By staking their tokens, holders can participate in the network’s consensus process and help validate transactions, ensuring the network remains secure and decentralized. In return, stakers receive rewards, often in the form of additional tokens.

- Activity Levels: The rewards that stakers earn may depend on their level of activity. Higher participation, such as consistent staking over time or participation in governance, can lead to greater rewards.

- Platform Features: Some platforms offer additional features or benefits to stakers. These can include governance rights, exclusive access to certain platform functionalities, or early participation in new projects or products.

- Participant Status: Staking can also elevate a participant’s status within the ecosystem. Long-term stakers or those with larger amounts of staked tokens may gain access to special privileges, premium services, or higher-tier membership levels.

Consensus Mechanism

A consensus mechanism or protocol allows distributed systems to work together and stay secure. These mechanisms conceal a great deal of the logic utilized behind a blockchain. There are 2 main consensus mechanisms: Proof-of-Work and Proof-of-Stake.

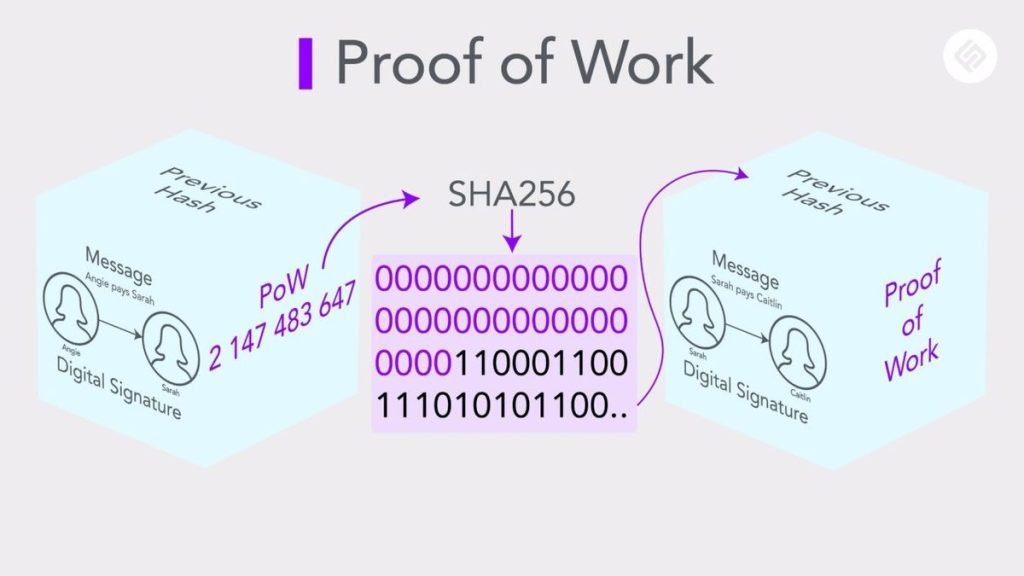

➣ Proof-of-Work

Proof-of-Work (PoW) is one of the earliest and most well-known consensus mechanisms used in blockchain technology. In this protocol, miners—participants with powerful computers—compete to solve complex mathematical puzzles. The goal of each miner is to be the first to solve the puzzle and add a new block of transactions to the blockchain. This process is called “mining.”

- Puzzle Solving

- Block Creation and Reward

- Transaction Validation

- Energy Consumption

- Miner Power and Centralization

Miners must perform computationally intensive tasks to find the correct solution, which requires significant processing power. The difficulty of the puzzle is adjusted over time to ensure that blocks are created at a consistent rate, regardless of the total number of miners or the processing power available.

The miner who solves the puzzle first earns the right to create a new block. In return, they receive a reward, typically in the form of newly minted tokens (such as Bitcoin). This reward incentivizes miners to continue participating in the network and securing it.

Once a miner creates a new block, it is added to the blockchain and shared across the entire network. This block contains a list of transactions or smart contract executions that are validated by the network. Other miners verify the correctness of the block, and if it passes the validation process, it becomes an immutable part of the blockchain.

One of the significant drawbacks of PoW is its high energy consumption. The computational work required to solve these puzzles consumes vast amounts of electricity, leading to concerns about the environmental impact of PoW networks, especially large ones like Bitcoin.

In a Proof-of-Work system, miners wield considerable decision-making power. Those with more computing resources (often large mining farms) can dominate the network, raising concerns about potential centralization in what is intended to be a decentralized system.

Read more: Proof-of-Work Vs. Proof-of-Stake: The Obvious Difference Between 2 Mechanisms

➣ Proof-of-Stake

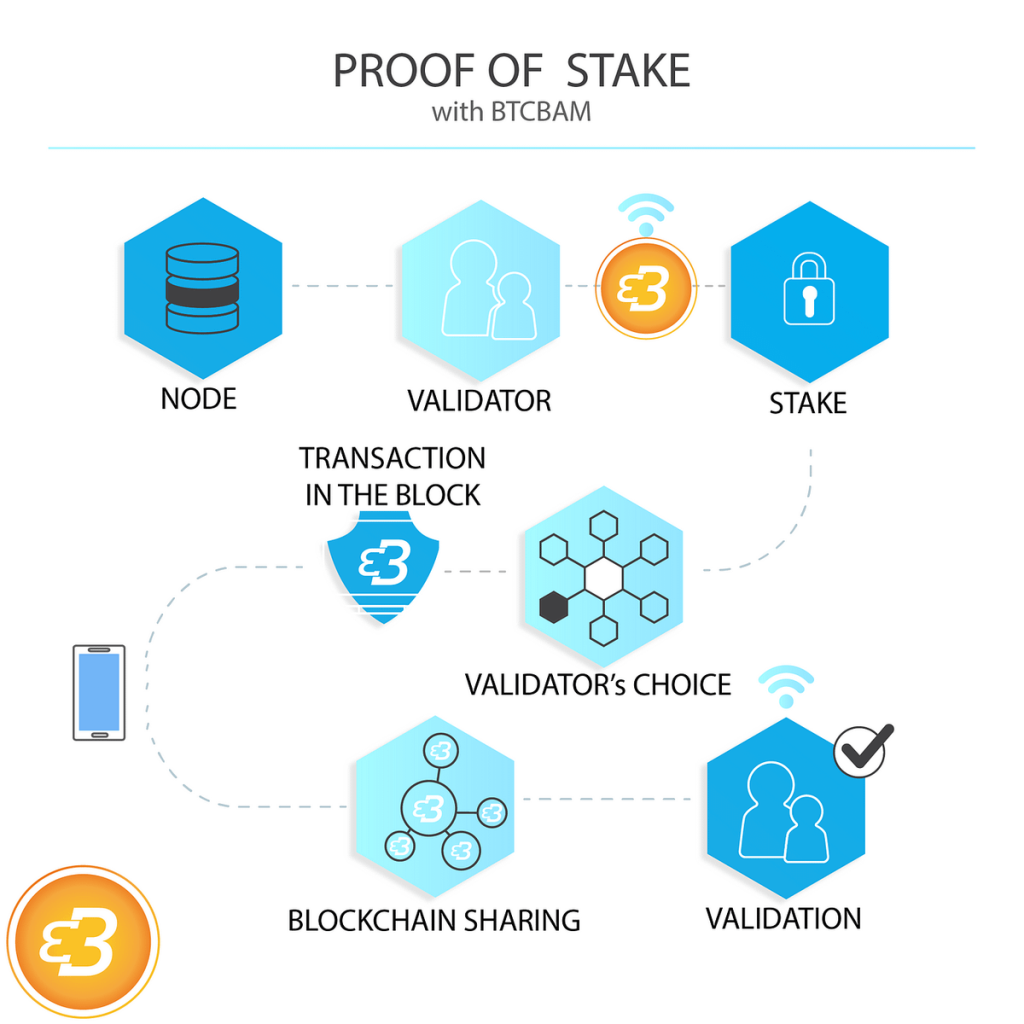

Proof-of-Stake (PoS) is an alternative consensus mechanism to Proof-of-Work (PoW), designed to offer a more energy-efficient and scalable approach to maintaining blockchain integrity. In PoS, the process of validating transactions and securing the network is carried out by validators (also called nodes) who are selected based on the number of tokens they hold and are willing to “stake” in the network.

- Staking Tokens for Validation

- Energy Efficiency

- Rewards and Incentives

- Slashing Mechanism

- Encouraging Long-Term Token Holding

- Decentralization and Power Distribution

In PoS, validators are not required to perform computational work like in PoW. Instead, they secure the network by locking up a certain amount of their tokens in the blockchain. The amount staked directly influences the validator’s chances of being chosen to create a new block. Generally, the more tokens a validator holds and stakes, the higher their likelihood of being selected to validate transactions and create new blocks.

One of the most significant advantages of PoS over PoW is its reduced energy consumption. Since PoS does not rely on energy-intensive computational tasks to secure the network, it is far more environmentally friendly. This makes PoS a more sustainable option for long-term blockchain development, especially in response to growing concerns about the environmental impact of PoW-based systems.

Validators in PoS are rewarded for their participation, typically receiving transaction fees or newly created tokens as compensation for securing the network. In return, they help validate transactions, secure consensus, and maintain the overall integrity of the blockchain.

PoS systems often include a penalty mechanism called “slashing” to ensure honest behaviour among validators. If a validator is found to be acting maliciously or failing to properly validate transactions, they can lose part of their staked tokens.

Unlike PoW, where computing power determines influence, PoS is built around token ownership. Validators with more staked tokens have more influence and a higher chance of validating transactions.

While PoS provides a more efficient alternative to PoW, concerns about centralization remain. Wealthier participants or entities with large token holdings may have disproportionate influence over the network. However, many PoS systems mitigate this risk by introducing mechanisms such as delegation, allowing smaller holders to combine their stakes and participate collectively in the validation process.

Conclusion

Understanding tokenomics is important when investing because a project with smartly designed token buying and holding incentives will have a better chance of surviving and growing than a project that does not build an ecosystem around its token. Hopefully, our article has helped you gain more useful knowledge about investing in crypto.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |