Market Overview (Sept 23 – Sept 29): FTX Repayment Rumors Pump Bankrupt Coins

FTX repayment rumors impact altcoins. PayPal expands crypto services for US businesses. SEC charges stablecoin companies. Kraken acquires Dutch firm. Visa plans Ethereum-based platform for tokenized assets.

Last week’s highlights big news (September 23 – September 29)

Visa plans to launch a platform allowing banks to issue fiat-backed tokens on Ethereum, facilitating the tokenization of real-world assets (RWAs) such as commodities and bonds.

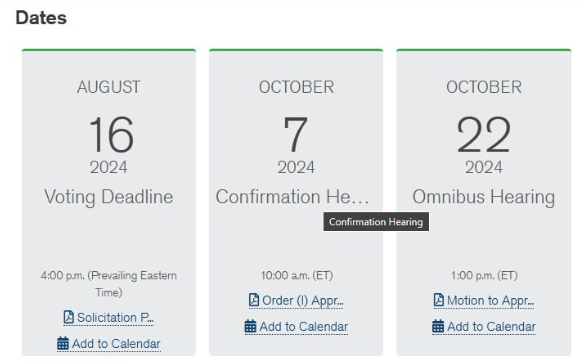

Rumors of FTX repaying $16 billion in debt next Monday caused $FTT to pump 100%, with bankruptcy-related coins $USTC and $LUNC also rising. However, this news is false. A hearing on October 7 will decide how the repayment occurs (cash, stablecoins, crypto). FTX will have 60 days to repay a portion, not the full amount, starting in Q1-Q2 2025.

In other news, PayPal now allows US businesses to buy, sell, and hold crypto.

SEC has charged TrustToken and TrueCoin for defrauding investors in their stablecoin investment program. Both companies agreed to fines of $163,766 each. Additionally, TrueCoin will pay $340,930 and $31,538 in interest.

Kraken has completed its acquisition of Coin Meester BV (BCM), one of the longest-registered crypto brokerage firms in the Netherlands, to expand its operations as a registered Virtual Asset Service Provider (VASP) in the Netherlands, France, and Poland.

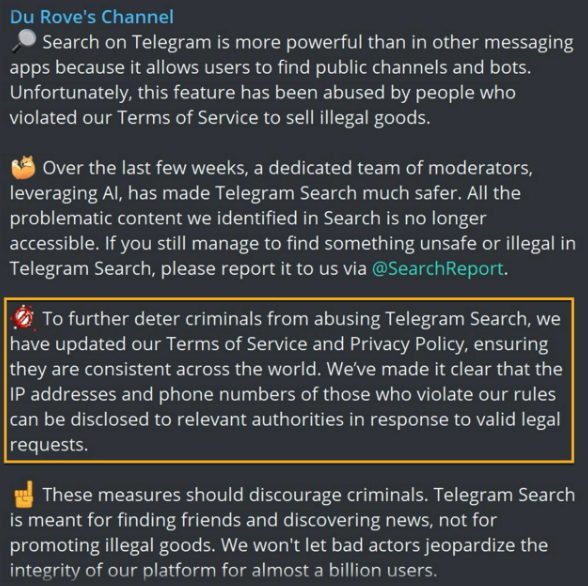

Telegram announced that it will provide users’ IP addresses, phone numbers, and other details to authorities upon legal request.

Travala.com, a crypto-friendly travel platform, has integrated the Solana network, allowing users to earn SOL rewards through its loyalty program. The AVA token will be deployed on Solana, following Ethereum and BNB Chain.

Solana Labs has partnered with Google Cloud to launch Gameshift, an API designed to connect Web2 experiences with Web3, targeting traditional game developers for NFT and blockchain integration.

Visa plans to launch a platform allowing banks to issue fiat-backed tokens on Ethereum, facilitating the tokenization of real-world assets (RWAs) such as commodities and bonds.

Read more: Market Overview (September 16 – September 22): Binance CEO CZ Returns, Tech Cryptos Poised for Surge

Macroeconomics

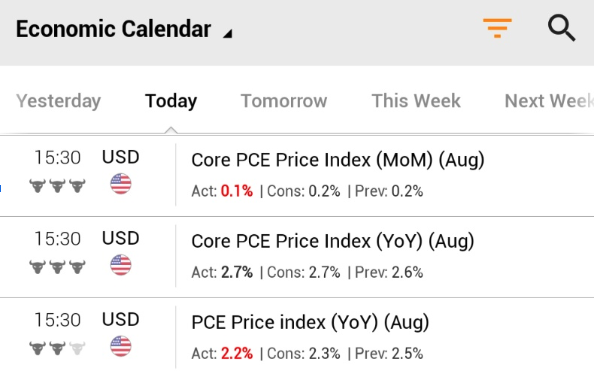

- PCE: 2.2% (Estimated 2.3%, Previous 2.5%)

- Core PCE: 2.7% (Estimated 2.7%, Previous 2.6%)

Upcoming Economic Events:

Monday, September 30:

- Fed Governor Michelle Bowman and Fed Chair Jerome Powell speak

Tuesday, October 1:

- ISM Manufacturing Index, Job Openings Report, Fed Governor Lisa Cook speaks

Wednesday, October 2:

- ADP Employment Report, various Fed officials speak

Thursday, October 3:

- Initial Jobless Claims, ISM Services Index, Fed officials’ discussions

Friday, October 4:

Market Overview

In the last 24 hours, BTC has closed its third consecutive green weekly candle but is now correcting after hitting the $66k resistance. Several altcoins, which experienced rallies in recent days, are also undergoing corrections.

Memecoins that led previous market surges are seeing deeper pullbacks. The market remains in a “tug-of-war” phase as it awaits the outcome of the US presidential election. For now, the best strategy is to hold firm and ride out the current volatility.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |