The TON blockchain is growing, and one potential DeFi niche contributing to the network is staking. The opportunity to participate is becoming increasingly attractive for investors who want to earn passive income on TON. In this article, let’s explore the best TON staking protocols with Coincu.

Overview of TON Staking Protocols

Staking for DeFi is of prime importance on every Proof-of-Stake blockchain, and there’s no exception for TON. At present, more than 620 million Toncoin, estimated at about $3.2 billion, is staked on the network.

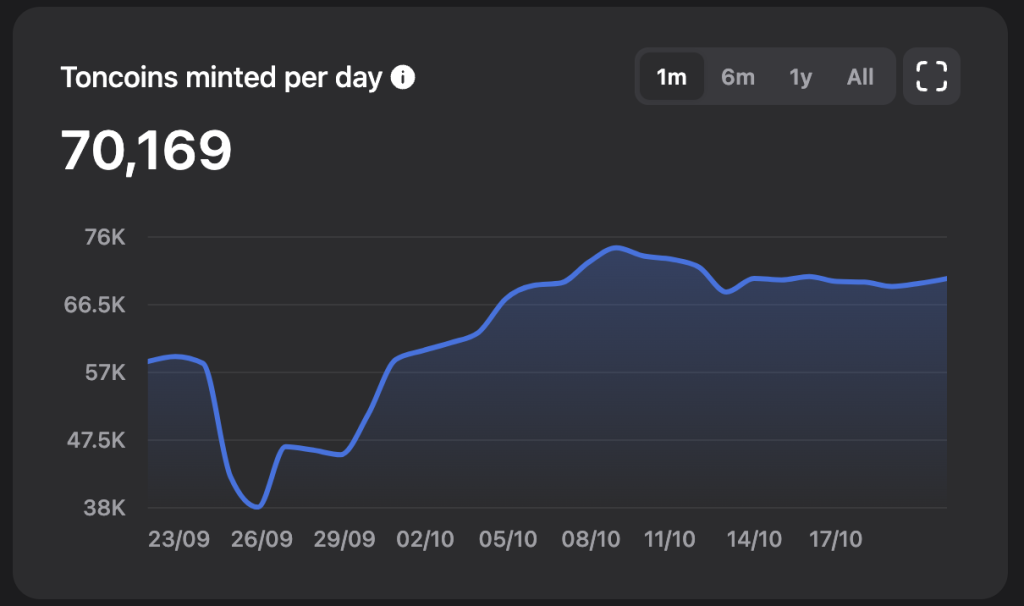

Validators are an important part of the TON network. As a reward, they receive 1.7 TON in staking rewards for each block created, and they also accumulate transaction fees from those blocks. It is estimated that active validators earn around 50,000 TON daily. The total stake of a validator influences his influence within the network: the bigger the stake, the more tasks are given to him, which means he gets higher remuneration.

Liquid staking has become one of the most popular solutions developed based on the TON blockchain, allowing better liquidity and higher return rates for users. It is different from traditional staking, which would require, say, at least 300,000 TON to stake, in that liquid staking lets any regular user delegate a much smaller amount to validators and receive a share of the reward.

With significantly lower TVL and DEX volumes than its more established blockchain counterparts, the DeFi ecosystem in TON is growing very fast. Thus, TVL in the network grew 30x times just within the first six months of 2024, which is a great deal to indicate potential growth. Secondly, the stake involvement factor is relatively lower than that of other top blockchains, showing future avenues for further coverage of staking protocols in TON.

The basis of these liquid staking protocols is pretty simple: smart contracts accept deposits of Toncoin and later distribute these coins among the validators. Thus, users contributing to the liquidity of the staking pool indirectly take part in securing the network and its processes and receive some fraction of the rewards that validators generate.

Read more: Overview of TON Ecosystem: Targeting Web3 Users with Huge Potential

Best TON Staking Protocols

- Tonstakers – Top Liquid Staking Platform on TON

- bemo – Making Staking on TON More Accessible and Rewarding for Everyone

- Stakee – Profitable Staking Platform Helps You Earn TON With Best APY

- JVault – Creating Staking Pools and Reward Holders for Long-term Asset Holding

- Hipo Finance – Staking Platform Prioritizing Security and Ease of Use

- XBANKING – Non-custodial Staking & Liquid Pools Provider

- TonStake – Leading Custodial Staking Service on TON Blockchain

Tonstakers

Tonstakers is the leading liquid staking solution designed for the fast-emerging blockchain of The Open Network. Since TON coins remain fully in the custody of the users, the yield accrues while retaining full ownership of digital assets by participants of a strongly growing and active community.

One of the differentiating aspects of Tonstakers is the work it does with TON Core Developers; that adds weight to its role in the bigger TON ecosystem. Equally, it has positioned strong partnerships with reputed industry players like Tonkeeper, TOP Labs, and OKX that further stamp its status in the blockchain world.

Tonstakers represent a non-custodial staking solution that enables users to be fully in control of their funds throughout the staking process. Security is at the forefront, powered by open-source code deeply audited by Certik, one of the most prominent blockchain security companies. Its liquid staking token, tsTON, opens staking for mass-market access by allowing users to stake with as little as 1 TON.

Read more: Tonstakers Review: Top Unique Staking Platforms On TON Blockchain

bemo

The bemo platform started out in May last year as a DWF Labs funded project but has very quickly established itself among the top players of the TON blockchain. The protocol has been expanding consistently and at the moment holds the leading position in the liquid staking sector of the TON blockchain with $75 million TVL.

Bemo users who deposit TON tokens into the platform are given stTON tokens, which will grow in number over time, depending on the pool performance. Beyond these, users can also earn additional stXP rewards depending on their level of engagement or inactivity on the Bemo platform and other services. The bemo team is preparing for the launch of its native token, BMO, which will see the issuance of up to 20% of the total supply of BMO to stXP holders. In the future, BMO governance tokens will be giving stXP tokens a takeover in the system.

All things taken into account, such as a user-friendly platform, capacity to earn returns in the future, and opportunity to get involved in management, bemo will be the most suitable platform for people who are looking to earn interest on their assets through investing in products on the TON blockchain. In terms of security, bemo has stated that the project was audited by Certik in December 2023, while more audits are ongoing, enhancing the trustworthiness of the protocol.

Stakee

Since its launch in December 2023, Stakee has become one of the most well-known players in the TON ecosystem, gathering $27 million of TVL, according to DefiLlama data. The platform makes the staking process easier for TON users by making this process more user-friendly. Users get STAKED tokens back after depositing TON coins to Stakee and those tokens rise in value over time by accruing staking rewards.

But what makes Stakee special is the flexibility it allows. STAKED tokens can be used just like regular TON coins: send them to others, barter them on DEX, and later use them in other services on top of the TON network.

Importantly, Stakee interacts with official smart contracts provided by the TON Foundation. These heavily audited contracts keep over $200 million of users’ funds under their belt, hence securing a deal for high trust among users.

JVault

JVault is a multifunctional DeFi service that can allow users to perform a wide range of actions, starting with staking, fundraising, and ending with taking part in decentralized governance. This gives a huge deal of freedom to the end-user and the project itself, enabling one to create custom staking pools, stake different jettons, and give an opportunity to generate passive income which goes beyond the frames of traditional staking.

The brightest part of JVault probably is its launchpad, which supports new token sales and further expansion in the TON ecosystem. The token-locking services add a layer of security and trust needed for these budding projects.

Going forward, JVault also will expand its suite of offerings with ambition to add the tools for creating a DAO. Smart contracts are independently audited and open-sourced for trust and transparency on the platform.

Hipo Finance

In July 2023, Hipo emerged as the big player in the liquid staking market, taking a leaf from the book of success of bemo. The project prioritizes security and ease of use in ensuring a seamless staking experience for all platform users. Weeks from its launch, Hipo went through deep audits from two independent auditors, further showing its dedication to security and trust.

The core of the Hipo offering was the hTON token that would be used across various DeFi applications on the TON network, further enhancing liquidity and providing more flexibility to stakers over their assets. The Hipo team launched the new protocol version v2 in March 2024. The improved version was audited by Ender Ting, a freelance auditor and contributor in the TON community. Such an audit means that the changes were compliant with all the requirements set by the highest security and efficiency standards.

Hipo also addresses community involvement by implementing reward programs: a referral program to reward users for bringing more participants onto the network, and bounty rewards for active contributors/participants in return for rewards represented as Hipo NFTs. Holders of NFTs will be qualified for distribution in an airdrop of the governance token of the project, HPO.

Read more: TonUp Review: The First Launchpad Platform On TON

XBANKING

XBANKING is scaling up its crypto staking operation on the blockchain of TON to provide institutional-grade services, while supporting over 140 types of cryptocurrencies along the way. The project has also obtained strategic partnerships with key entities like Bybit and TON Ventures, boosting its credibility in the highly competitive crypto marketplace. Simultaneously, XBANKING cooperates closely with large blockchain infrastructure providers like Google Cloud and Coinbase to solidify operational grounds further.

One of the major innovations of XBANKING will be the introduction of ‘restaking.’ In this regard, users will be allowed to obtain extended yields on top of their staked assets by re-staking their liquid staked tokens, depicting an overwhelmingly attractive option to maximize returns.

Though the core stream of products by XBANKING is targeted at appealing and serving large staking requirements for institutional clients, the full-suite approach ensures that the individual user benefits from its staking and liquidity pooling services.

TonStake

TonStake provides an accessible staking solution tuned for the specific mechanics of the TON ecosystem. With a minimum stake of 1 TON, users can start their participation without extensive funds. The site has a 36-hour rhythm of staking. TonStake perfectly fits TON’s Proof-of-Stake cycle and increases user interaction with the network consensus mechanism.

One of the highlighted features is reward compounding, which happens automatically on the platform. Although TonStake charges a service fee of 10%, the value is delivered to the users in smooth procedures. The automated unstaking and withdrawal features make the exit strategy easy for users to handle when managing their investments.

Read more: Top 10 TON Ecosystem Coins by Market Cap

Benefits of TON Staking Protocols

The TON staking protocol provides secure and rewarding grounds for users to contribute to DeFi. The key benefits it offers are that:

| Stable Rewards in a Liquid Asset | The staker’s rewards will be issued by the protocol in TON with a very substantial market capitalization of $13.3 billion. |

| Lower Risk | Unlike many DeFi protocols that expose users to potential loss through impermanent loss in DEXes or liquidation in lending protocols, staking with TON minimizes these risks. Even more, some staking platforms, such as Tonstakers, are protective against slashing, which is a big risk when it comes to staking. |

| Security Improvement of Network | By participating in staking, participants are contributing to the security of the TON network. This process, therefore, raises the stakes for honest notary validators who contribute to the improvement of the integrity and resilience of the blockchain. |

| Liquid Staking Opportunities | In liquid staking, users can further enhance the rewards by using their liquid staking tokens in several DeFi protocols. This two-tier potentiality for income makes TON staking more and more popular among investors who seek to increase the return on their investment. |

Read more: The Open Network Review: The Most Potential Layer 1 Today

Conclusion

Staking has always been one of the best investment opportunities on the TON blockchain. With the TON staking platforms we provide, we hope you have more options to expand your portfolio.

FAQs

Which TON staking platform has the most TVL?

Tonstakers is currently the leading platform among TON staking protocols, with TVL over $224 million.

Is STAKED listed on any CEX?

Stakee’s token is not listed on any of the top DEX or CEX platforms so its usage conditions are limited.

How long does it take to unstake?

Depending on the amount of TON and the platform you choose, along with the staking options, the unstake time will vary but is usually instant.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |