Market Overview (Nov 4 – Nov 10): Trump Victory and FED Policy Propel Bitcoin to New Heights

Bitcoin hit a new all-time high after Trump victory. BlackRock’s Bitcoin ETF surpassed its Gold ETF at $33B. Chainlink, Swift, and UBS advanced tokenized fund withdrawals in Project Guardian.

Last week’s Highlights Big News (November 4 – November 10)

Bitcoin Reaches New All-Time High Following Trump’s Election Win.

BlackRock’s Bitcoin ETF Market Cap Surpasses $33 Billion, edging past its Gold ETF ($32 Billion) in under a year.

Chainlink, Swift, and UBS successfully conducted a trial for cash withdrawals from a tokenized investment fund. The trial is part of the Monetary Authority of Singapore’s Project Guardian, which aims to test the applicability of blockchain technology in traditional finance.

Avalanche Foundation Purchases 1.97 Million AVAX Tokens from Luna Foundation Guard for $53 Million. LFG initially bought these tokens for $100 million in 2022 to support TerraUSD (UST), but the Terra ecosystem collapsed in May 2022 when UST devalued.

Ethereum Foundation’s 2024 Report Discloses $970 Million in Reserves. With 81% held in crypto (primarily ETH, representing 0.26% of ETH’s supply), the rest consists of non-crypto assets and investments.

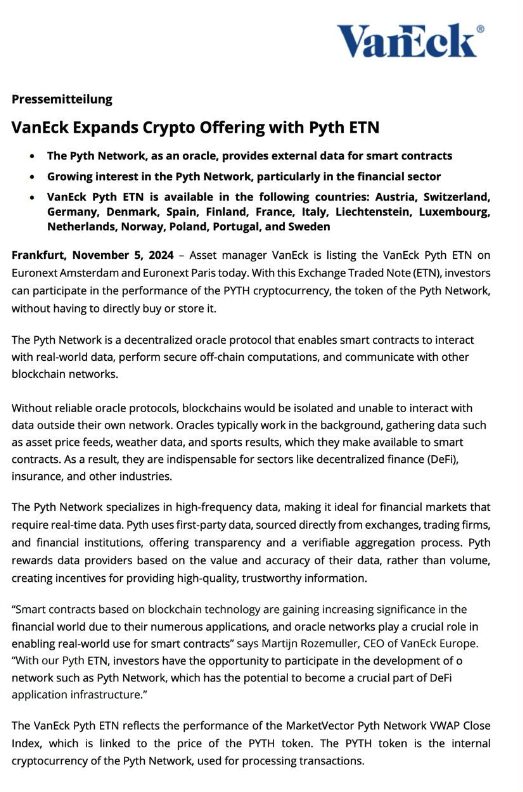

VanEck Introduced PYTH ETN in Europe, which functions like an ETF but is legally a debt instrument rather than shares.

Crypto Firms, Including Robinhood, Kraken, and Paxos, Unveil Global Dollar (USDG) on Ethereum

Deutsche Telekom and Bankhaus Metzler Explore Bitcoin Mining Using Excess Energy. Europe’s largest telecom group aims to utilize surplus energy for sustainable Bitcoin mining.

Monetary Authority of Singapore (MAS) Initiates Tokenization Support Measures. Plans include developing trade networks, building market infrastructure, and supporting shared settlement for tokenized assets.

Read more: Market Overview (Oct 28 – Nov 3): Big Token Unlocks and $42B Plans After October’s End

Macroeconomic News

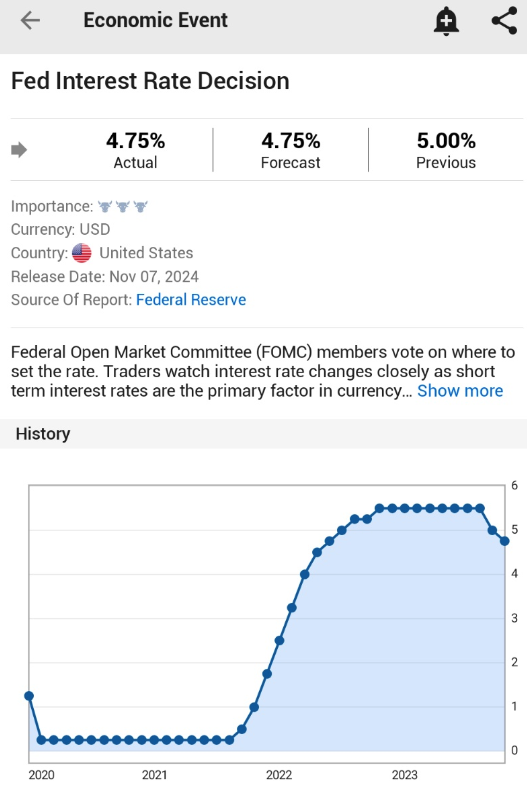

FED Cuts Interest Rate by 0.25%

The Federal Reserve reduced interest rates by 0.25%, emphasizing current economic stability despite some slowdown. Labour markets and inflation remain under control. The FED’s stance remains dovish, although there have been no changes to previous forecasts. The FED Chairman also noted the potential impacts of Trump administration policies on economic conditions.

The Chairman avoided commenting on political questions or potential presidential influence over FED policy. He highlighted that the FED is not relying on specific forecast models due to anticipated policy changes related to future tax and spending plans.

Maintaining a cautious and flexible approach, the FED has refrained from specific commitments for December or next year, emphasizing responsiveness to actual economic indicators over predictive modelling.

The pace of monetary easing is likened to a plane landing; adjustments are made continuously to ensure a safe landing.

Key Economic Events This Week

Monday, November 11: Veterans Day, the bond market closed

Tuesday, November 12:

- Speech by Fed Governor Christopher Waller

- Speech by Richmond Fed President Tom Barkin

- Speech by Philadelphia Fed President Patrick Harker

Wednesday, November 13:

- CPI Inflation: Forecast 2.5% | Last Month 2.4%

- Core CPI Inflation: Forecast 3.3% | Last Month 3.3%

- Opening remarks by New York Fed President John Williams

- Speeches by Dallas Fed President Lorie Logan, St. Louis Fed President Alberto Musalem, and Kansas City Fed President Jeff Schmid

Thursday, November 14:

- Speech by Fed Governor Adriana Kugler

- PPI and Core PPI (Wholesale Inflation)

- Speech by Fed Chairman Jerome Powell

- Speech by New York Fed President John Williams

Friday, November 15:

- Empire State Manufacturing Survey

- U.S. Retail Sales Data

- Speech by New York Fed President John Williams

Market Overview

Currently, TOTAL3 is near its peak, within 5% of the T3 peak and 42% below the previous cycle high.

Bitcoin Reaches New All-Time High at $81.7k, in which BTC continues its climb, setting record highs as bullish momentum dominates.

The Market Maintains a Strong Uptrend for BTC and Altcoins, with over $30 million in stablecoins entering exchanges in the past 24 hours, and the market outlook remains optimistic.

We’re now watching for BTC to stabilize and dominance to decrease, signalling an ideal profit-taking moment.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |