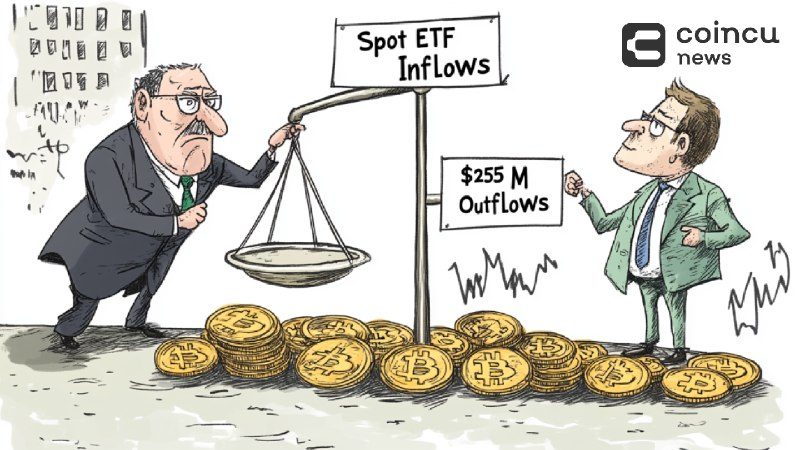

Key Points:

- Bitcoin Spot ETF inflows hit $255M, driven by BlackRock and Fidelity.

- Ethereum Spot ETF outflows reached $39M, reflecting market divergence.

Bitcoin Spot ETF inflows hit $255M on November 18, led by BlackRock’s $89.3M and Fidelity’s $59.9M, while Ethereum Spot ETF saw $39M in net outflows.

Bitcoin Spot ETF Inflows Reach $255M in Single Day

Bitcoin Spot ETF inflows reached $255 million on November 18, led by BlackRock’s IBIT with $89.3 million and Fidelity’s FBTC with $59.9 million. These numbers indicate an extreme investor interest in Bitcoin-backed ETFs, especially from large institutional players such as BlackRock and Fidelity.

This surge further underlines growing confidence in Bitcoin as an asset class. According to Sosovalue, bitcoin spot ETFs have increasingly been viewed as a reliable way to get exposure to Bitcoin without directly holding the cryptocurrency, bolstering adoption among traditional investors.

Read more: Bitcoin ETF Options Makes Important Progress After New CFTC Rules

Ethereum Spot ETF Outflows Highlight Market Trends

Meanwhile, while Bitcoin Spot ETFs witnessed heavy inflows, Ethereum Spot ETFs registered a net outflow of $39.08 million on the same day, demonstrating a striking divergence in the changing market dynamics between the two leading cryptocurrencies. The outflows arguably suggest cautious sentiment among Ethereum investors or a flight to focus on Bitcoin, given its perceived resilience.

However, Ethereum’s outflows do not necessarily mean declining interest in the asset; rather, they realign the investment approach. These trends mirrored the complexity of the crypto ETF market, which continued to develop as investors explored diverse opportunities across different digital assets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |