Key Points:

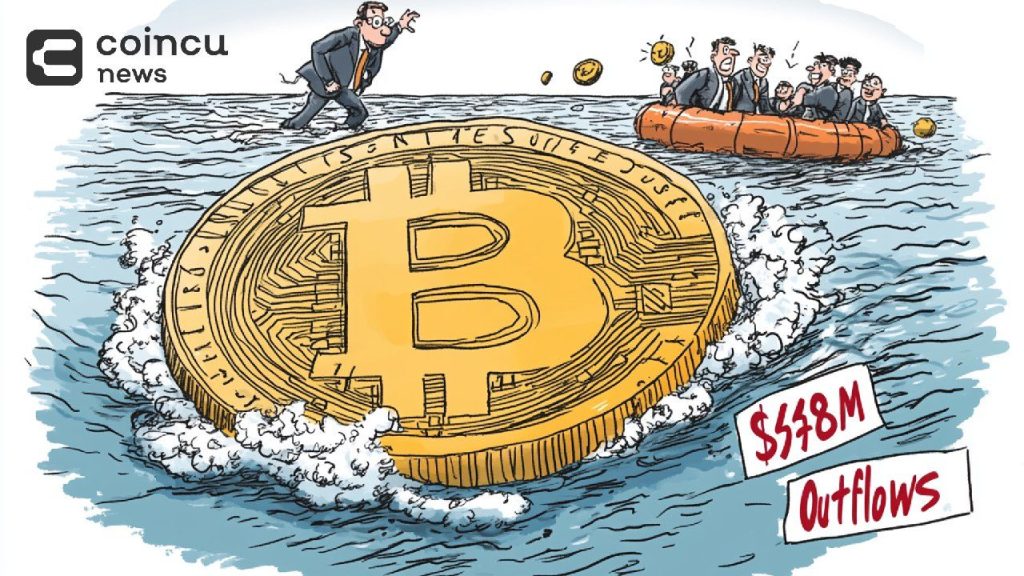

- Bitcoin Spot ETF Outflows totaled $438M after 5 days of net inflows.

- Despite outflows, BlackRock ETF IBIT had a $268M single-day inflow.

Bitcoin Spot ETF Outflows reached $438M on November 25, marking the first outflow in 5 days, while BlackRock ETF IBIT saw a $268M inflow the same day.

Bitcoin Spot ETF Outflows After Five Consecutive Inflow Days

Bitcoin Spot ETF saw its first net outflow in five days on November 25, totaling $438 million. Despite that, BlackRock ETF IBIT still recorded a net inflow of $268 million, indicating sustained interest from institutions. The total net asset value of Bitcoin Spot ETFs remains gigantic at $102.23 billion, speaking to their dominance in the crypto ETF market.

These outflows follow a very strong inflow streak and reflect the short-term change in investor behavior. In these changing markets, BlackRock’s continued inflows serve to highlight resilience and its strategic role in driving investment momentum in Bitcoin, according to Sosovalue.

Read more: Bitcoin Spot ETF Inflows Hit $3.38 Billion Setting Record

Ethereum Spot ETF Inflows Amid Bitcoin Outflows

On the contrary, while Bitcoin Spot ETF saw outflows, Ethereum Spot ETFs reported a net inflow of $2.834 million on November 25. The total net asset value for Ethereum Spot ETFs is now at $10.277 billion, marking Ethereum’s solid position in crypto investments.

Ethereum inflows may simply show that investors are moving to diversified blockchain assets. While Bitcoin remains dominant, the steady inflows into Ethereum Spot ETFs have underlined the growing appeal and adoption of the blockchain in institutional markets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |