Key Points:

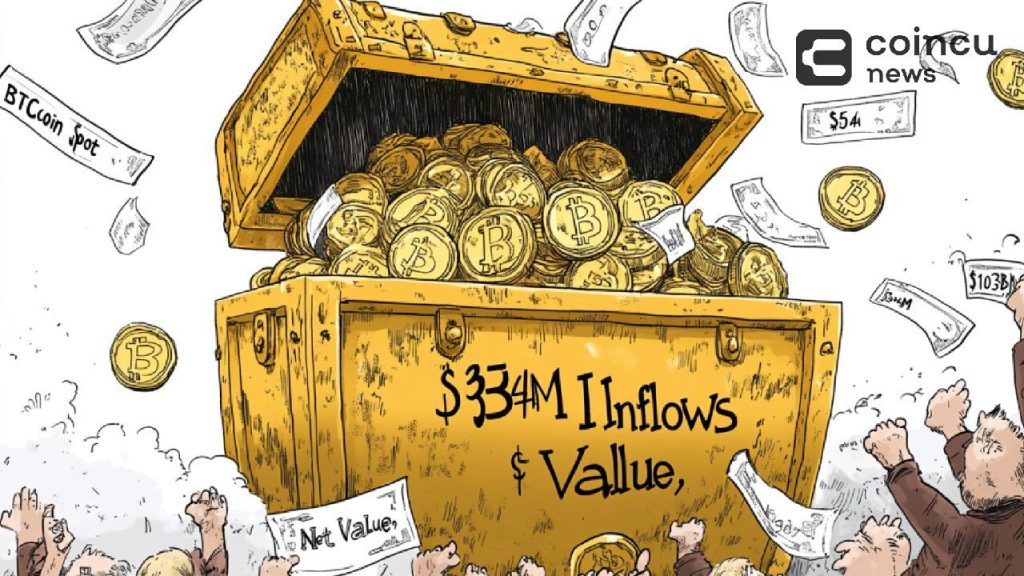

- Bitcoin Spot ETF Inflows reached $354M on December 2, with BlackRock IBIT contributing $338M.

- Ethereum Spot ETF saw $24M in inflows, extending its streak of positive net inflows to six consecutive days.

Bitcoin Spot ETF Inflows hit $354M on December 2, with $338M from BlackRock IBIT. Ethereum Spot ETF net inflows reached $24M, continuing a 6-day streak.

Bitcoin Spot ETF Inflows Reach $354 Million in One Day

On December 2, Bitcoin Spot ETFs experienced significant inflows totaling $354 million, showcasing the growing investor interest in Bitcoin-based ETFs. BlackRock’s IBIT contributed $338 million in single-day net inflows, underlining its strong market presence. The total net asset value of Bitcoin Spot ETFs now stands at $103.909 billion, reflecting continued institutional confidence.

This influx highlights the pivotal role of BlackRock in driving Bitcoin ETF adoption. The substantial inflows also emphasize Bitcoin’s resilience as an investment asset amid fluctuating market dynamics, further cementing its status in institutional portfolios, according to Sosovalue.

Read more: Bitcoin Spot ETF Outflows Reach $138M After 7-Week Inflows

Ethereum Spot ETFs Maintain Strong Inflow Momentum

Ethereum Spot ETFs saw a total net inflow of $24.23 million on December 2, marking the sixth consecutive day of positive inflows. BlackRock’s ETHA led with $55.92 million in single-day inflows, followed by Fidelity’s FETH contributing $19.89 million. The total net asset value of Ethereum Spot ETFs is now $11.133 billion.

These consistent inflows underline Ethereum’s rising prominence in the ETF market. Its role in DeFi and scalability advancements, like Ethereum 2.0, continues to attract institutional investors. This trend contrasts Bitcoin’s dominance, reflecting diversifying preferences within the crypto ETF landscape.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |