Key Points:

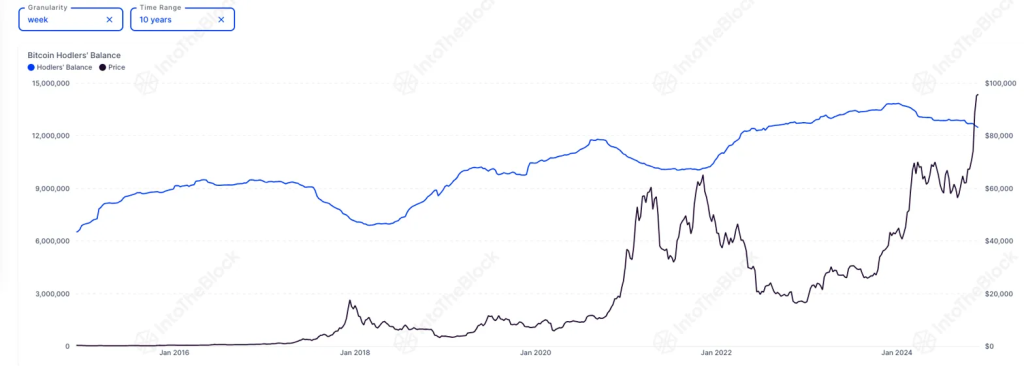

- Long-term Bitcoin holders show a modest 9.8% decrease in holdings this cycle.

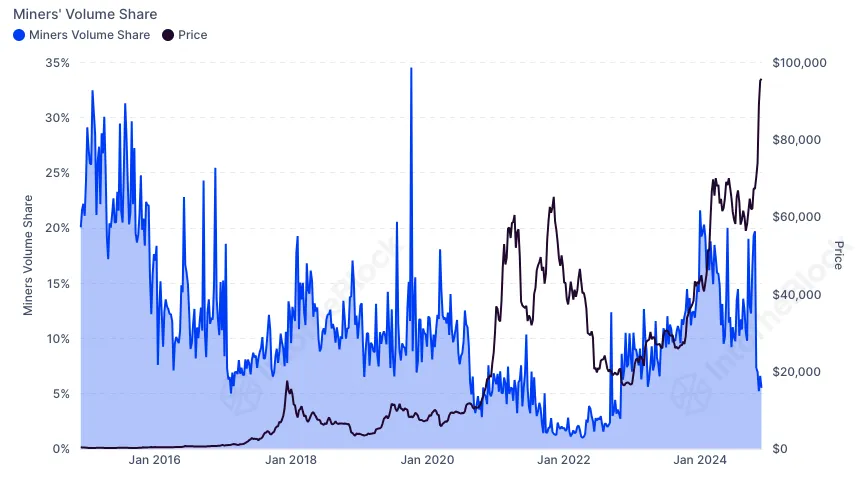

- Bitcoin miners’ trading volume share has dropped to 5% from previous highs.

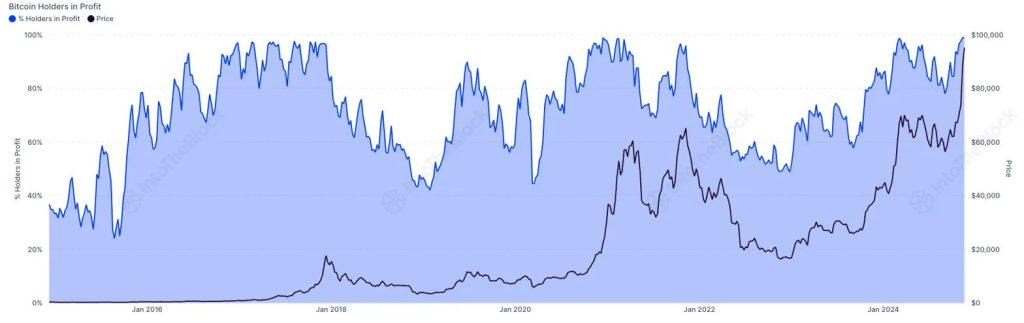

- Currently, 98% of Bitcoin holders are in profit.

Bitcoin long-term holders reduce holdings to 12.45M BTC, showing a moderate 9.8% decline compared to previous cycles. Miner volume at 5%, while 98% of holders remain in profit.

Recent Bitcoin Cycle data from IntoTheBlock reveals a cautious shifting of balances, with long-term holders gradually reducing their holdings, now down to 12.45 million BTC – the lowest level since July 2022.

Bitcoin Long-term Holder Activity Declines

Such a gradual decline in long-term holder balances suggests a more measured approach than past cycles. During the 2021 and 2017 market cycles, long-term holder balances fell by 15% and 26%, respectively. In contrast, the current cycle has seen a more moderate 9.8% decrease in long-term holder balances.

Additionally, the Bitcoin Hodlers’ Balance chart showcases the steady accumulation of Bitcoin by long-term holders, with their balance reaching a peak of 13.8 million BTC in January 2024 before gradually declining to 12.45 million BTC.

Read more: Bitcoin Bull Run Stalls Below $100K as Markets Rebalance

Market Statistics and Performance Data

The Miners’ Volume Share chart shows that miner participation has fluctuated between 5% and 30% of the total Bitcoin trading volume over the past eight years. The peak in miner activity occurred in October 2019, when they accounted for 34.5% of the volume share. As of today, the Miner’s Volume Share is at around 5%.

The percentage of Bitcoin holders in profit has ranged from a low of 20% during the 2018 bear market to a high of over 95% during the 2021 bull run. Currently, around 98% of Bitcoin holders are in profit.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |