Key Points:

- Grayscale files for Solana ETF on NYSE, following Bitcoin ETF options approval.

- Grayscale Solana Trust manages $134.2M in assets globally.

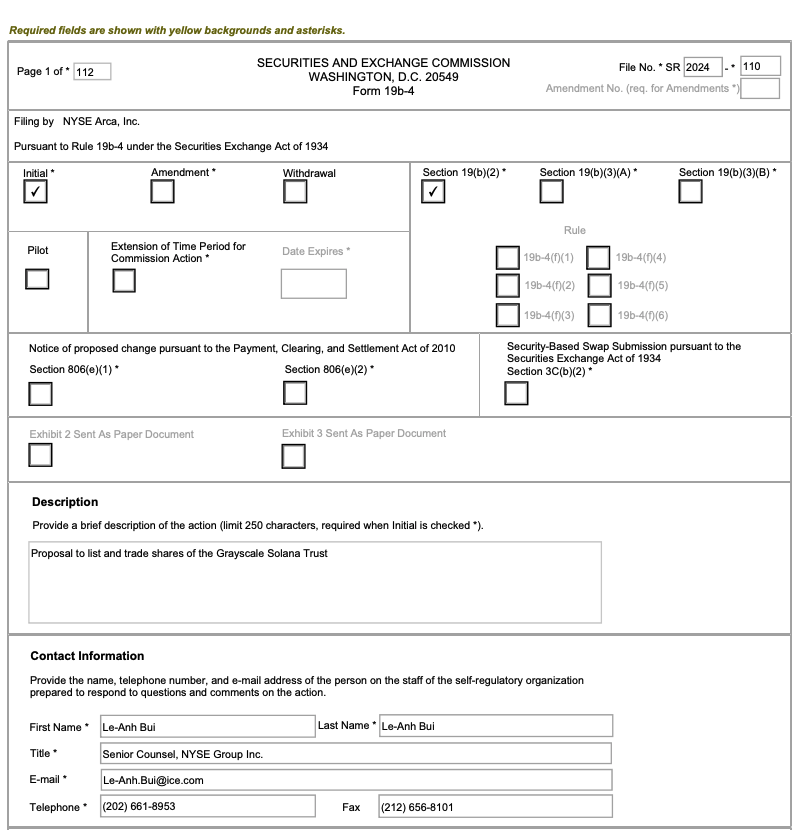

Grayscale files for Solana ETF on NYSE, following successful Bitcoin and Ethereum ETF launches in 2024. Currently managing $134.2M in assets via Solana Trust, the firm aims for faster approval under new SEC guidelines.

Grayscale Investments has submitted an official filing for a Solana (SOL) exchange-traded fund with the New York Stock Exchange. The thereof follows the NYSE’s recent approval to launch Bitcoin ETF options trading.

Crypto ETFs Transform Markets

In 2024, cryptocurrency ETFs have significantly impacted the market. The year started with the SEC approving 11 spot Bitcoin ETFs, leading to BTC reaching a new all-time high in March. Following Bitcoin, Ethereum ETFs were launched, and now Solana appears positioned as the next potential candidate.

Grayscale’s Bitcoin Trust has emerged as one of the leading BTC ETFs since January 2024. The Grayscale Solana Trust, currently the largest globally, manages approximately $134.2 million in assets, representing 0.1% of SOL’s total circulation.

Read more: Highly Anticipated Spot Solana ETFs Will Be Approved in 2025

Grayscale Files for Solana ETF

The filing indicates Grayscale’s intention to convert the Trust to a spot SOL ETP, aiming to provide investors with regulated access to SOL investments through a national securities exchange. With recent SEC changes, Solana ETFs could potentially receive faster approval compared to previous cryptocurrency ETFs.

However, because the Trust is not currently listed as an exchange-traded product (“ETP”), the value of the Shares has not been able to closely track the value of the Trust’s underlying SOL. The Sponsor thus believes that allowing Shares of the Trust to list and trade on the Exchange as an ETP (i.e., converting the Trust to a spot SOL ETP) would provide other investors with a safe and secure way to invest in SOL on a regulated national securities exchange.

Wrote in the Filling.

Looking ahead to 2025, the cryptocurrency investment could expand further, with XRP ETFs potentially joining the approved products.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |