Bitcoin Hit $100K for The First Time After 16 Years of Invention

Key Points:

- Bitcoin surged to $102,650, gaining 138% this year.

- Trump’s election fueled crypto positiveness, with Bitcoin hitting $100,000 for the first time.

- Ethereum, Solana, and XRP also saw strong gains, with further rallies expected.

Bitcoin hit $100K on Wednesday, climbing to $102,650, up 138% this year, rebounding from FTX’s collapse. Predictions range from $125K by year-end to $500K in the future, though some analysts expect a pullback.

Bitcoin (BTC) topped $100,000 before climbing to $102,650 on the back of Wall Street’s growing recognition of crypto as an asset class and the election of crypto-friendly Donald Trump. The price pierced through the six-figure mark at 2:40 PM UTC after briefly falling to $99,600.

Bitcoin has gained 138% this year, rebounding from the 2022 collapse of FTX and the conviction of founder Sam Bankman-Fried.

Bitcoin Hit $100K for The First Time

Analysts see Bitcoin rising as high as $125,000 before the year ends. However, some have more dramatic predictions: $500,000 from Matt Hougan, $1 million courtesy of Arthur Hayes, as U.S. deficit spending balloons. The bet is for a pullback into $45,000 – $60,000 as other traders try to catch the next rally; below that, support might kick in at $74,000.

Fast Check

Bitcoin’s annual inflation rate is approximately 1.8% and will only continue to decrease over the period, as per Texas Association of Public Employee Retirement Systems

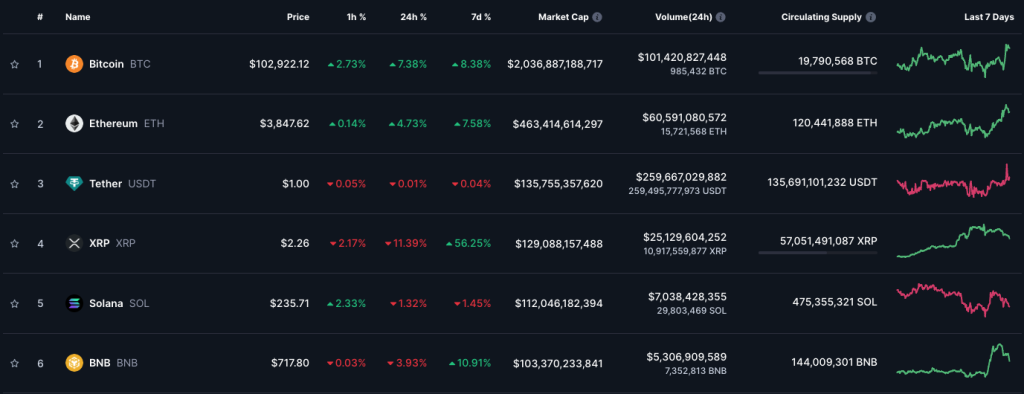

Not just Bitcoin but other cryptocurrencies have gained momentum, as per CoinMarketCap data. Ethereum’s Ether reached $3,800 for the first time since June, up about 35% since the US election.

Solana leapt 40% at $263 on November 23 before trading at $235 as of today, while Ripple’s XRP jumped 360% within 30 days, retail-driven mainly by South Korean investors. Analysts say rallies across the crypto market are set to continue.

Bitcoin Price History: Milestones and Key Events from 2009 to 2024

| Year | Start of Year (USD) | End of Year (USD) | Rate of Return (%) |

|---|---|---|---|

| 2009 | $0.00099 | $0.00099 | 0% |

| 2010 | $0.00099 | $0.39 | 39,900% |

| 2011 | $0.39 | $4.70 | 1,103% |

| 2012 | $4.70 | $13.45 | 185% |

| 2013 | $13.45 | $805.00 | 5,860% |

| 2014 | $805.00 | $320.00 | -60.25% |

| 2015 | $320.00 | $430.00 | 34.38% |

| 2016 | $430.00 | $960.00 | 123.26% |

| 2017 | $960.00 | $13,880.00 | 1,345% |

| 2018 | $13,880.00 | $3,693.00 | -73.39% |

| 2019 | $3,693.00 | $7,160.00 | 94.44% |

| 2020 | $7,160.00 | $29,000.00 | 305.88% |

| 2021 | $29,000.00 | $46,000.00 | 58.62% |

| 2022 | $46,000.00 | $16,500.00 | -64.13% |

| 2023 | $16,500.00 | $43,100.00 | 161.21% |

| 2024 | $43,100.00 | $102,000.00 (YTD) | 136.87% (YTD) |

2009 – Price: $0.00099

Key Events:

- January 3: Bitcoin was created by an unknown person or group under the pseudonym Satoshi Nakamoto, and the first block (Genesis Block) was mined.

- October 5: The first exchange rate for Bitcoin was established when NewLibertyStandard exchanged 5050 BTC for $5.02 (valuing Bitcoin at $0.00099).

- BitcoinTalk Forum was launched as a community hub, fostering early discussions on Bitcoin.

2010 – Price: $0.39

Key Events:

- May 22: The first real-world transaction using Bitcoin, famously involving the purchase of 2 pizzas for 10,000 BTC, by BitcoinTalk user Laszlo Hanyecz.

- July: The Bitcoin exchange Mt. Gox was launched, offering a platform for Bitcoin trading.

- First recorded Bitcoin exchange rate: Bitcoin was traded for around $0.39.

2011 – Price: $4.70

Key Events:

- February: Bitcoin reached parity with the US dollar for the first time, breaking the $1 mark.

- June: Bitcoin’s price surged to $30 before experiencing a crash back to $10. The volatility began attracting both attention and criticism.

- October: Silk Road (a darknet market) began accepting Bitcoin as a payment method, boosting Bitcoin’s legitimacy.

2012 – Price: $13.45

Key Events:

- November: Bitcoin underwent its first halving, reducing the mining reward from 50 BTC to 25 BTC.

- WordPress started accepting Bitcoin as payment for services, marking a significant milestone for adoption.

- Bitcoin Foundation was formed to promote the cryptocurrency.

- December: Bitcoin hit its annual high of $13.45.

2013 – Price: $805

Key Events:

- April: Bitcoin reached a price of $266, and experienced its first major price correction.

- November: Bitcoin surged to an all-time high of $1,100, driven by increasing mainstream attention and global events like the Cyprus banking crisis.

- Bitcoin’s first billion-dollar market cap: Bitcoin’s market cap surpassed $1 billion for the first time.

2014 – Price: $320

Key Events:

- January: Bitcoin reached over $1,000, but soon started a significant downward trend.

- February: Mt. Gox, one of the largest exchanges at the time, declared bankruptcy after losing 744,000 BTC.

- Bitcoin adoption: Companies like Overstock.com and Microsoft began accepting Bitcoin for transactions.

2015 – Price: $430

Key Events:

- January: Bitcoin dipped to around $150 before starting its recovery.

- November: Unicode Consortium added the Bitcoin symbol (₿) to the official character set.

- Regulation: The New York Department of Financial Services began an investigation into Bitcoin, leading to the development of the BitLicense.

2016 – Price: $960

Key Events:

- Bitcoin’s hash rate reached 1 exahash per second, indicating strong network growth.

- July: Bitcoin’s second halving took place, reducing the block reward from 25 BTC to 12.5 BTC.

- Bitcoin’s price steadily increased, peaking close to $1,000 by the end of the year.

2017 – Price: $13,880

Key Events:

- January: Bitcoin broke $1,000 and never returned to lower levels for the rest of the year.

- November: Bitcoin’s price surged to nearly $20,000, fueled by growing interest from retail investors.

- SegWit Activation: Bitcoin underwent a soft fork in August, allowing the activation of Segregated Witness (SegWit).

- December: The Chicago Board Options Exchange (CBOE) and CME Group launched Bitcoin futures trading, marking Bitcoin’s entry into traditional financial markets.

2018 – Price: $3,693

Key Events:

- January: Bitcoin reached an all-time high of $19,000 before entering a bear market.

- February: Regulatory scrutiny increased, with countries like China imposing restrictions on crypto exchanges.

- June: The Bitcoin Cash hard fork occurred, creating Bitcoin Cash (BCH) from Bitcoin, amidst growing debates on scaling solutions.

- Bitcoin’s price crashed to as low as $3,122 by December, ending the year at $3,693.

2019 – Price: $7,160

Key Events:

- March: Bitcoin surged to $4,000, setting the stage for further price increases.

- May–June: Bitcoin reached a mid-year high of $13,880 before retracing in the second half of the year.

- Regulation: The U.S. SEC continued to investigate Initial Coin Offerings (ICOs) and the classification of Bitcoin and other cryptos as securities.

- Halving speculation: Markets began to speculate on the 2020 halving.

2020 – Price: $29,000

Key Events:

- March: Bitcoin crashed to $3,850 due to the COVID-19 pandemic before quickly recovering.

- May: Bitcoin underwent its third halving, reducing the block reward to 6.25 BTC.

- Institutional Investment: Companies like MicroStrategy and Tesla made significant Bitcoin purchases, sending Bitcoin prices higher.

- End of the year: Bitcoin closed at $29,000, starting its rapid ascent toward $40,000.

2021 – Price: $46,000

Key Events:

- January: Bitcoin broke $40,000 for the first time.

- April: Bitcoin reached a new all-time high of $64,000.

- May: China intensified its crackdown on Bitcoin miners, leading to a price dip.

- November: Bitcoin again reached new highs near $68,000, fueled by institutional adoption.

- End of year: Bitcoin closed near $46,000, after a volatile year.

2022 – Price: $16,500

Key Events:

- January: Bitcoin struggled with a sharp decline, beginning the year above $40,000.

- May: Bitcoin fell to $30,000 and continued to struggle in the second half of the year, reaching lows near $17,000.

- FTX Collapse: The FTX exchange collapse in November caused significant market turmoil, pushing Bitcoin down further.

- End of year: Bitcoin closed around $16,500, marking a significant drawdown.

2023 – Price: $35,500

Key Events:

- January–June: Bitcoin’s price fluctuated between $15,000 and $30,000, with some institutional interest but significant market volatility.

- July–December: Bitcoin began recovering, with news of increasing adoption by traditional financial firms.

- December: The price rose to $35,500 as investors speculated on the next bull run.

2024 – Price: $102,000

Key Events:

- YTD: Bitcoin price surged to $102,000 as institutional adoption accelerates.

- Bitcoin ETF Approval: The Bitcoin ETF (Exchange-Traded Fund) was approved, bringing more institutional investors into the market.

- Halving: Bitcoin’s halving started in April 2024, reducing the block reward from 6.25 BTC to 3.125 BTC.

- Trump wins the 2024 election: During his campaign, Trump championed cryptocurrencies, vowing to transform the United States into the “crypto capital of the world” and to build a national reserve of Bitcoin.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |