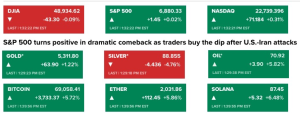

Key Points:

- Bitcoin Spot ETF Inflows totaled $557M on December 4, continuing a 5-day streak, with BlackRock IBIT recording $572M in single-day inflows.

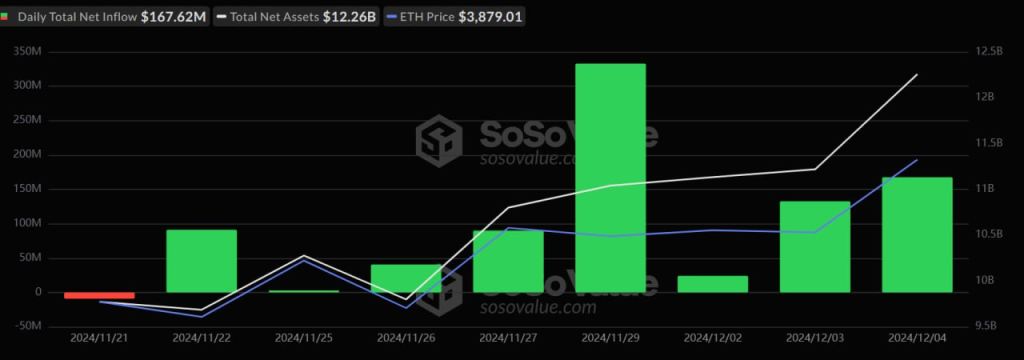

- Ethereum Spot ETF inflows hit $168M on December 4, maintaining an 8-day streak, led by $124M from BlackRock ETHA and $40M from Fidelity FETH.

Bitcoin Spot ETF Inflows reached $557M on December 4, marking 5 days of consecutive gains. BlackRock ETF IBIT saw a $572M inflow, highlighting investor interest.

Bitcoin Spot ETF Inflows Reach $557 Million

Bitcoin Spot ETFs recorded $557 million in net inflows on December 4, marking the fifth consecutive day of gains. BlackRock’s IBIT led the surge with an impressive $572 million in single-day inflows, demonstrating strong institutional demand for Bitcoin-based investment products. This streak underscores the growing confidence in Bitcoin ETFs as a reliable asset class.

These inflows signal renewed optimism in the Bitcoin market, especially among institutional investors. With sustained interest over multiple days, Bitcoin Spot ETFs are positioned to play a significant role in the broader adoption of cryptocurrency-based financial products, according to Sosovalue.

Read more: Bitcoin Spot ETF Inflows Reach $354M With $103B Net Value

Ethereum Spot ETFs Maintain Strong 8-Day Inflow Streak

Ethereum Spot ETFs attracted $168 million in net inflows on December 4, continuing their eight-day streak of positive gains. BlackRock’s ETHA contributed $124 million, while Fidelity’s FETH added $40.6 million in single-day inflows. These figures highlight Ethereum’s growing appeal as a staple in institutional portfolios.

This consistent inflow streak reflects Ethereum’s utility beyond investment, particularly in decentralized finance (DeFi) and smart contracts. As the cryptocurrency ecosystem matures, Ethereum-based ETFs demonstrate resilience and increasing interest from institutional and retail investors, cementing their role in the evolving crypto economy.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |