Key Points:

- Cathie Wood predicts Bitcoin will exceed gold’s market value as it matures into a significant financial asset.

- Cathie Wood predicts the new SEC Chair will unlock digital asset growth by easing restrictive policies.

Cathie Wood predicts Bitcoin surpassing gold’s $15T market as the new SEC Chair backs digital assets and Powell describes Bitcoin as digital gold.

Cathie Wood Predicts Bitcoin’s Rise Over Gold

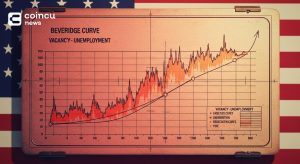

ARK Invest CEO Cathie Wood envisions Bitcoin evolving beyond its current $2 trillion market, challenging gold’s $15 trillion valuation. Fed Chairman Powell reinforced this view by calling Bitcoin a “digital version of gold,” emphasizing its potential to disrupt traditional financial systems. Wood sees Bitcoin’s early-stage development as a stepping stone to greater adoption.

The incoming SEC Chair Paul Atkins is expected to favor a more open regulatory approach, freeing Bitcoin and other digital assets from previous restrictions. This change could catalyze Bitcoin’s growth, aligning with Wood’s belief in its superior financial utility compared to traditional gold, according to Cathie Wood.

Read more: Cathie Wood’s Ark Invest Continues Offloading Coinbase Shares By Investment Strategy

New SEC Chair to Unlock Bitcoin’s Potential

Cathie Wood Predicts the incoming SEC Chair Paul Atkins will ease restrictive regulations, fostering innovation in digital assets. Atkins’ support could provide Bitcoin with the regulatory clarity needed to thrive, a sharp contrast to Gary Gensler’s stringent policies. This shift is crucial for protecting digital property rights, according to Wood.

Fed Chair Powell’s statement comparing Bitcoin to gold highlights its growing acceptance as a secure store of value. Bitcoin’s unique attributes, such as decentralization and lower transaction costs, position it as more versatile than gold, underscoring Wood’s forecast for its dominance in global financial markets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |