Key Points:

- Bitcoin in US Reserves Debate raises concerns about harming public interests and the dollar’s global reserve currency status.

- Bill Dudley argues Bitcoin in the US Reserves Debate risks favoring specific groups over majority interests.

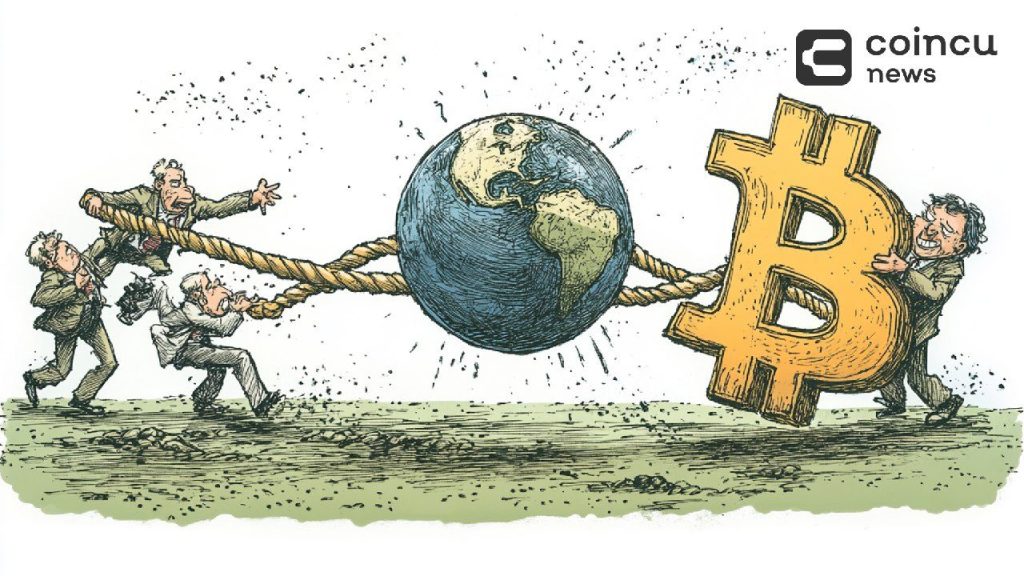

Bill Dudley warns that Bitcoin in US Reserves Debate could harm public interests, weaken the dollar’s status as a global currency, and favor specific interest groups.

Bitcoin in US Reserves Debate Sparks Concerns for Dollar’s Role

Former New York Fed chairman Bill Dudley opposed Bitcoin in US national reserves. He warned that doing so may undermine the dollar’s standing as the international reserve currency, diverting focus from public issues to established groups.

The stability of conventional financial institutions and digital money innovation may conflict. While Bitcoin is a dispersed financial instrument, putting it in national reserves raises questions about monetary policy and economic sovereignty, according to Bloomberg.

Read more: Vancouver Bitcoin Proposal With New Financial Potential to Be Considered on December 11

New SEC Chair to Unlock Bitcoin’s Potential

Bitcoin in US reserves might imperil most specialized interest groups, Bill Dudley noted. This adjustment may not protect Americans’ financial interests, he said. Additionally, it might cast doubt on the dollar’s status as the world’s reserve currency.

These challenges demonstrate Bitcoin’s difficulty in national acceptance. Financial innovation and international economic stability must be balanced by policymakers. Too soon merging uncertain digital assets into national goals is dangerous, according to Dudley.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

![Best Presale Coins To Buy Now: ZKP, Bitcoin Hyper, Remittix, NexChain, & DeepSnitch [Expert Analysis]](https://coincu.com/wp-content/uploads/2026/01/image-51-300x169.jpeg)