Key Points:

- Bitcoin Spot ETF inflows totaled $440M, continuing a 9-day streak.

- Ethereum Spot ETF inflows hit $306M, with Fidelity and BlackRock leading.

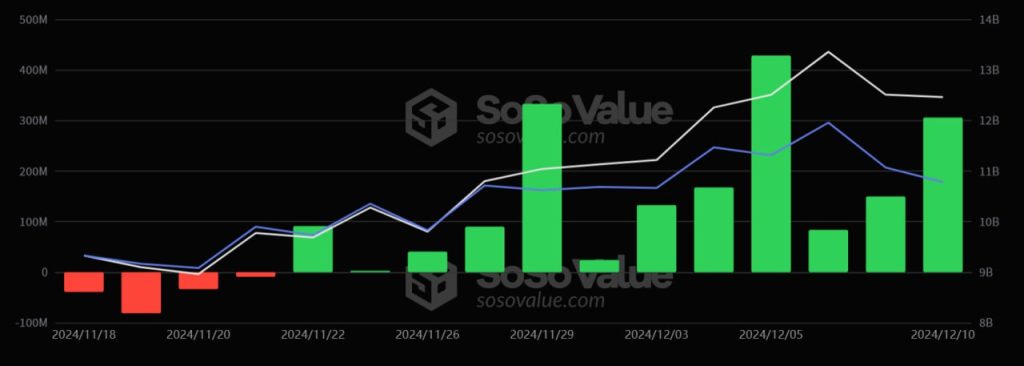

Bitcoin Spot ETF inflows reached $440M on December 10, marking 9 consecutive days of growth. Ethereum Spot ETFs also saw a 12-day streak with $306M inflows.

Bitcoin Spot ETF Inflows Maintain Record Streak

BTC spot ETFs saw a $440 million net inflow on December 10, the eleventh straight day of high strength. In this incredible run, BlackRock ETF IBIT led with $296 million daily inflows, followed by Fidelity ETF FBTC with $210 million. ETFs sponsored by Bitcoin are gaining investor trust with this stable performance, according to Sosovalue.

Bitcoin spot ETFs are becoming more popular as a safe investment. Along with spotlighting market titans like BlackRock and Fidelity, the streak encourages Bitcoin in institutional portfolios. As institutional interest in Bitcoin grows, so does enthusiasm for its long-term potential.

Read more: $479M Spot Bitcoin ETF Inflows Fuel Eight-Day Streak on Dec 9

Ethereum Spot ETFs Reach $306M in Daily Inflows

The net influx of $306 million on December 10 was wonderful for Ethereum spot ETFs. This is the 12th day of inflows, indicating robust Ethereum investment product interest. Inflows to Fidelity ETF FESH were $202 million daily, followed by BlackRock ETF ETHA with $81.6574 million.

As Ethereum spot ETFs rise, investors are betting on its asset class performance. High-performing businesses like Fidelity and BlackRock demonstrate Ethereum-based investment vehicles’ growing popularity among institutional investors seeking diversification.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |