Key Points:

- Tether invests in StablR to enhance European stablecoin adoption and liquidity.

- StablR’s MiCA-compliant stablecoins, EURR and USDR, aim to drive crypto adoption in Europe.

Tether invests in StablR to drive stablecoin adoption in Europe by focusing on compliance with MiCA regulations and enhancing liquidity for institutional users.

Tether Invests in StablR to Support European Stablecoin Growth

Tether (USDT), the leading stablecoin issuer, has announced its investment in StablR, a European stablecoin provider. This move is part of Tether’s strategic push to drive the adoption of regulated digital assets across Europe, aligning with the upcoming implementation of the EU’s Markets in Crypto-Assets (MiCA) framework.

StablR recently secured an Electronic Money Institution (EMI) license from the Malta Financial Services Authority, enabling it to issue fully regulated stablecoins across the European Union. This regulatory compliance positions StablR as a key player in the growing stablecoin market in the region.

Tether’s investment highlights its commitment to fostering a compliant and transparent digital asset ecosystem, particularly as the demand for stablecoins like StablR’s EURR (euro-pegged) and USDR (dollar-pegged) continues to grow among institutions and merchants.

Read more: Ripple Stablecoin RLUSD Will Be Launched on December 17

Tether and StablR Collaborate Through the Hadron Platform

A critical aspect of Tether’s partnership with StablR is the integration with Hadron, Tether’s recently launched tokenization platform for real-world assets. Hadron simplifies the conversion of traditional assets such as stocks, bonds, fiat currencies, and commodities into digital tokens. It also incorporates advanced compliance tools, including KYC, AML, risk management, and transaction monitoring.

By leveraging Hadron, StablR aims to expand its stablecoin services across multiple blockchain networks, including Ethereum and Solana. This expansion enhances liquidity and accessibility, ensuring that institutional users and merchants can seamlessly transact across diverse blockchain ecosystems.

Tether CEO Paolo Ardoino emphasized that the collaboration showcases Tether’s belief in fully regulated stablecoins as the cornerstone of Europe’s digital asset ecosystem. This partnership marks a new milestone for Tether in driving innovation within the rapidly growing European stablecoin market.

European Stablecoin Market Thrives Under MiCA Framework

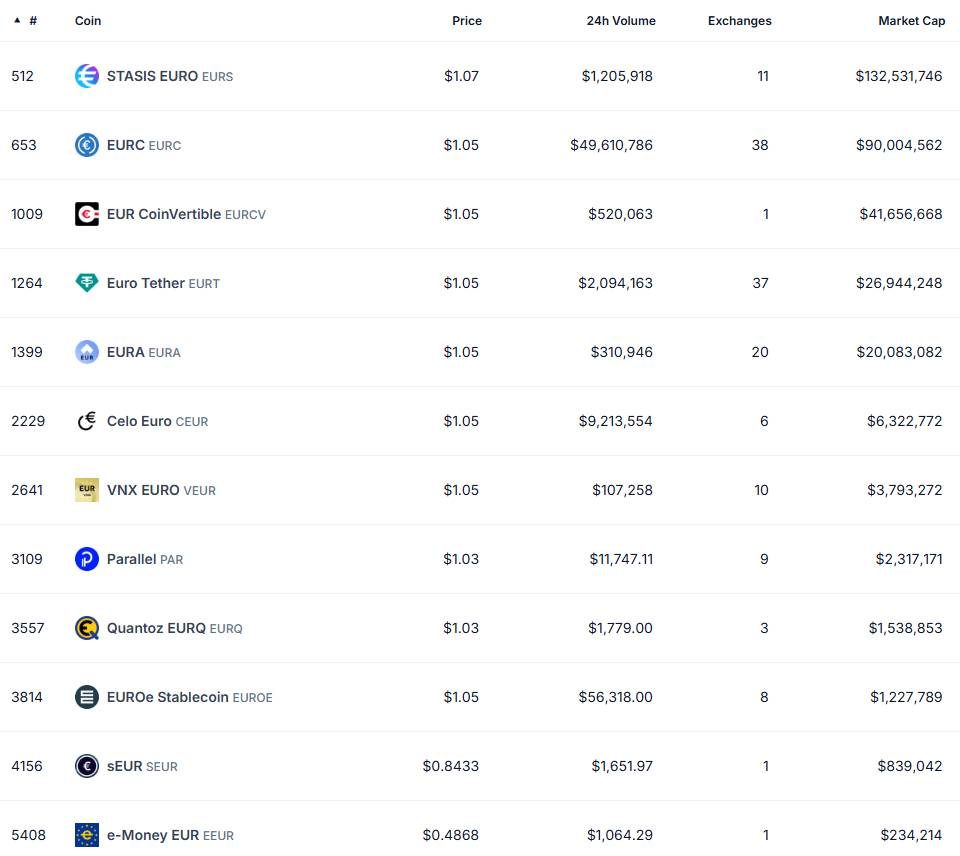

The European stablecoin market is experiencing significant momentum, with euro-pegged assets now approaching $400 million in market capitalization. The EU’s MiCA regulation, which comes into full effect on December 30, 2024, establishes stringent compliance standards for stablecoin issuers and exchanges operating in the region. This regulatory clarity has created a favorable environment for companies like StablR to thrive.

StablR’s EURR and USDR stablecoins are fully MiCA-compliant and backed by full reserves, addressing the market’s demand for secure, transparent, and redeemable digital assets. Issued as ERC-20 tokens on Ethereum and compatible with Solana, these stablecoins offer broad interoperability, making them highly accessible within major blockchain ecosystems.

As Tether invests in StablR, this collaboration solidifies the foundation for a regulated and innovative stablecoin ecosystem in Europe, setting the stage for continued growth and adoption.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |