Key Points:

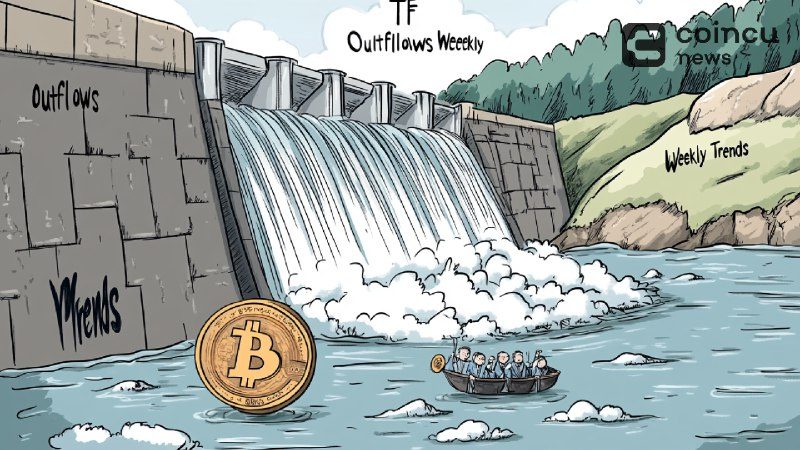

- Bitcoin Spot ETF Outflows hit $388M from Dec 23 to Dec 27.

- Fidelity FBTC achieved $183M inflows, contrasting Ethereum’s $349M inflows.

Bitcoin Spot ETF Outflows reached $388M last week, Dec 23-27, with Fidelity ETF FBTC seeing $183M inflows; Ethereum ETFs saw a $349M net inflow in the same period.

Weekly Bitcoin Spot ETF Outflows Insights

Between December 23 and December 27 last week, Bitcoin spot ETFs witnessed notable outflows totaling $388 million. Despite this slump, Fidelity’s FacebookTC stood out with a noteworthy weekly flow of $183 million. Given that inflows and outflows reflect investor mood throughout the Christmas season, this exposes uneven performance across Bitcoin ETFs.

Right now, Bitcoin spot ETFs have a net asset value of $106.683 billion overall. These latest withdrawals indicate investors could be reassisting their holdings given market volatility, deviating from past weeks of inflows. Some ETFs, like Fidelity FBTC, show resiliency by drawing money throughout this time though, according to Sosovalue.

Read more: BTC Spot ETF Outflows Continue With $227M Lost Over Three Days

Ethereum ETFs Outshine Bitcoin ETFs in Weekly Flows

While Bitcoin ETFs saw withdrawals, Ethereum spot ETFs moved favorably with a net inflow of $349 million from December 23 to December 27. BlackRock’s ETHA leads this upward trend with a weekly inflow of $182 million; closely followed by Fidelity’s FESH with $160 million in inflows.

These inflows show rising investor curiosity in assets based on Ethereum. Now showing multiple straight weeks of positive net flows, Ethereum spot ETFs remain vibrant. Even as Bitcoin ETFs battle with outflows, this shows Ethereum’s growing supremacy in drawing institutional and individual investors.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |