Key Points:

- BlackRock Bitcoin ETF outflows surged to $332.6M, marking the highest daily outflow since launch.

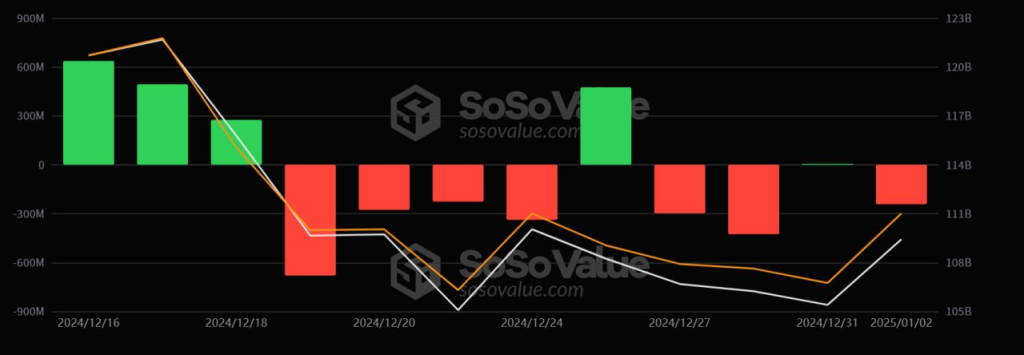

- Total U.S. spot Bitcoin ETF outflows reached $242.3M on Jan 2.

BlackRock Bitcoin ETF outflows hit a record $332.6M on Jan 2, reflecting portfolio rebalancing amid market shifts, while total ETF net outflows reached $242.3M.

BlackRock Bitcoin ETF Sees Record Daily Outflows

BlackRock‘s iShares Bitcoin ETF recorded a net outflow of $332.6 million on Jan. 2, the largest single-day outflow since its launch. This topped the previous record on Christmas Eve when outflows reached $188.7 million. Analysts point to this massive activity as institutional portfolio rebalancing amid broader market fluctuations and Bitcoin’s recent price movements.

After all that, BlackRock’s ETF still leads the market in cumulative net inflows with $36.9 billion and manages nearly $53.5 billion in net assets. This trend suggests the long-term allure of the ETF, while the short-term shifts show wider investor sentiment and strategic portfolio adjustments., according to Sosovalue.

Read more: Bitcoin Spot ETF Inflows Surge With $5.3181M On December 31

Ethereum ETFs Experience Significant Outflows

Ethereum ETFs saw heavy outflows on Jan. 2, with $77.5 million being pulled out of the U.S. market alone. Most of these outflows were from Bitwise’s ETHW, from which $56.1 million was withdrawn from the fund. Another heavy mover was Grayscale’s ETHE, which saw $21.4 million leave the ETF on the same day.

The increased outflows in Ethereum-focused funds coincide with a rise in trading volume, which leaped to $397.2 million, up from $313.1 million on Dec 31. That potentially suggests that investors are moving into a more active stance, possibly as a function of end-of-year market dynamics and rebalancing triggered by Ether’s market performance.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |