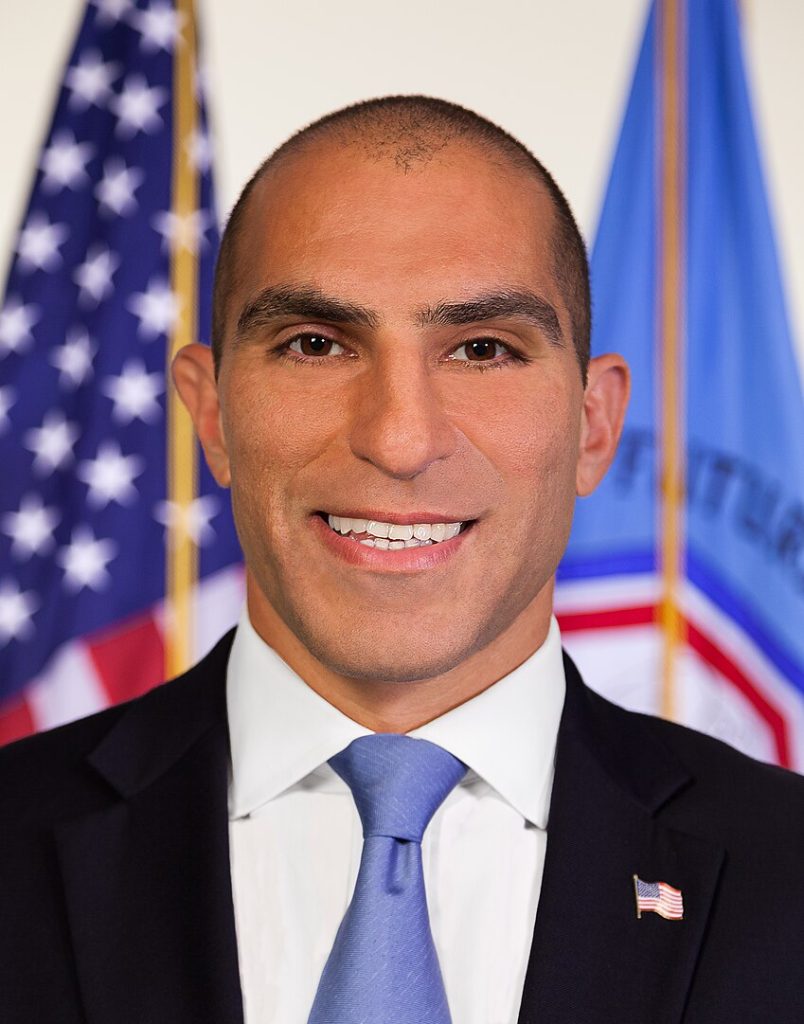

CFTC Chairman Rostin Behnam Resigns, Leaves $17.1B Legacy Behind

Key Points:

- CFTC Chairman Rostin Behnam announced his resignation effective January 20, coinciding with the inauguration of President-elect Donald Trump.

- His administration initiated a significant lawsuit against Binance, resulting in a $4.3 billion settlement related to crypto market enforcement.

Stepping down amid increasing regulatory scrutiny, CFTC Chairman Rostin Behnam announced his resignation effective January 20, coinciding with the inauguration of President-elect Donald Trump.

CFTC Chairman Rostin Behnam Steps Down Amid Regulatory Concerns

Over his four-year tenure, Behnam directed the Commodity Futures Trading Commission in finalizing federal guidelines for carbon offsets and enhancing oversight of cryptocurrency markets, including significant progress surrounding political betting markets.

Behnam expressed concern regarding the prevailing regulatory gaps within the digital asset space, highlighting that substantial portions of cryptocurrencies remain largely unregulated despite rising interest from traditional financial institutions and retail investors.

His leadership was instrumental in vital actions, such as the 2023 lawsuit against Binance, ultimately resulting in a $4.3 billion settlement. Additionally, under Behnam’s direction, the CFTC reported a total relief amount of $17.1 billion resulting from actions against prominent companies like FTX and Alameda Research.

Future of Crypto Regulation and Political Betting Markets

According to The Financial Times, Rostin Behnam, stepping down as CFTC Chairman, has articulated the agency’s potential role as a spot regulator for digital commodities, highlighting the importance of thorough rules rooted in law. His advocacy is crucial, especially as the market for political betting expands, inviting scrutiny regarding legality and societal impacts.

The CFTC’s recent actions against platforms like Kalshi underscore a growing need for definitive guidelines separating permissible from impermissible wagering types.

As technology fuels demand, regulators must guarantee clarity in regulations to safeguard market integrity, minimizing risks associated with digital assets and contentious betting markets. The recent CFTC actions against political prediction markets indicate an increasing scrutiny of this emerging sector.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |