Andre Hakkak, the co-founder and CEO of White Oak Global Advisors, is on track to achieve a net worth of about $400 million by 2025. This impressive figure reflects his significant ownership in a firm that manages over billions in assets, along with strategic investments in real estate, technology, and healthcare.

Hakkak has built his wealth through innovative financial solutions for middle-market businesses, successful venture capital efforts, and the rapid growth of his firm since its inception in 2007. His financial empire continues to thrive through astute portfolio management and diverse investment strategies, paving the way for further wealth growth.

Key Takeaways

- Andre Hakkak’s net worth is set to soar to $400 million by 2025, largely thanks to his leadership at White Oak Global Advisors. His wealth is primarily derived from overseeing assets exceeding $20 billion through this firm.

- Strategic investments in real estate and a diverse portfolio of private equity also play crucial roles in his financial growth. The market valuations of his ventures and key partnerships continually enhance his wealth, keeping him on track for this ambitious projection.

- As CEO of White Oak Global Advisors, Hakkak remains the cornerstone of his income, driving his financial success and reputation in the industry.

Introduction

Andre Hakkak is a key player in finance and the co-founder and CEO of White Oak Global Advisors. His notable reputation stems from his strategic leadership and innovative financial solutions.

Although private about his personal life, including details about his wife and residence, Hakkak’s professional achievements stand out in investment circles. As industry professionals reflect on his impact, they consider projections for his net worth in 2025.

Hakkak’s influence is evident through White Oak’s diverse portfolio and strong market presence. This look into Hakkak’s career, business ventures, and financial success reveals his significant role in global finance and his effect on modern investment strategies.

Who is Andre Hakkak?

Andre Hakkak is a distinguished financier and entrepreneur who graduated from UC Berkeley’s Haas School of Business with a degree in Finance and Marketing.

He began his career in investment banking at Robertson Stephens & Co. and went on to found several successful ventures, such as Suisse Global Investments and Alpine Global, where he held leadership roles.

As the Co-founder and CEO of White Oak Global Advisors, Hakkak currently heads a dynamic investment management firm that oversees over $400 million in assets.

The firm is dedicated to delivering innovative financing solutions to small and medium-sized businesses while prioritizing environmental and social responsibility.

Early Life and Education

On a chilly winter day in 1973, Tehran celebrated the birth of Andre Hakkak, who would grow to become a notable figure in finance.

In his early years, his family made a pivotal choice to move to the United States, laying the groundwork for his future achievements.

Hakkak aimed for academic excellence, attending the University of California, Berkeley. There, he earned a Bachelor of Science degree with a dual emphasis in Marketing and Finance.

He then advanced his studies at the esteemed University of Chicago, obtaining a Master’s degree in Finance.

These educational experiences enriched him with the solid skills and insights needed to excel in the finance industry.

Professional Journey

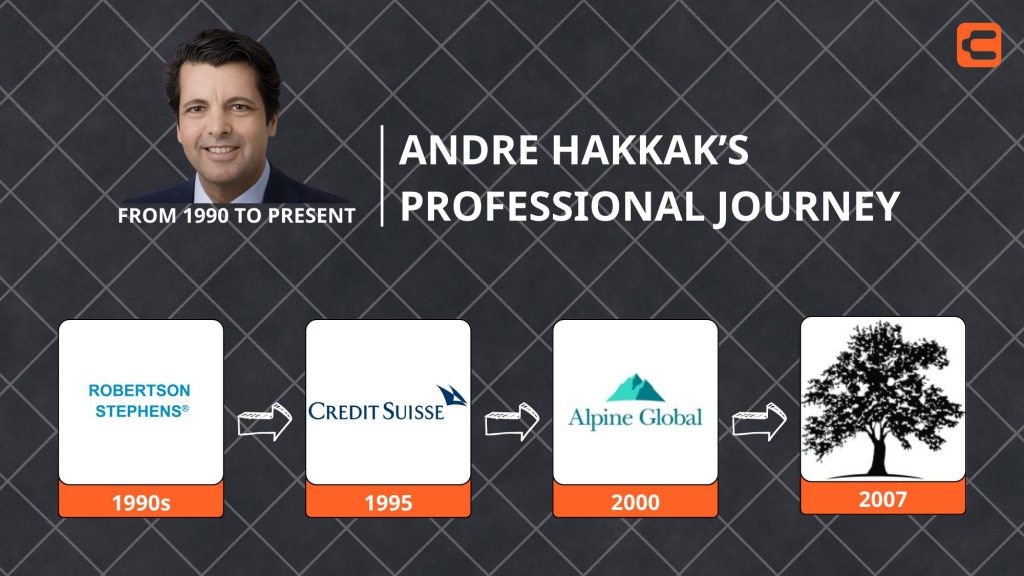

Andre Hakkak’s professional journey took off in the early 1990s when he joined Robertson Stephens & Co. as an investment banker. In 1995, he founded Suisse Global Investments, where he created tailored solutions for banking and insurance clients on a global scale.

| Year | Company | Role |

|---|---|---|

| 1990s | Robertson Stephens & Co. | Investment Banker |

| 1995 | Suisse Global Investments | Founder |

| 2000 | Alpine Global, Inc. | Chief Investment Officer |

| 2007 | White Oak Global Advisors | Co-Founder |

In 2000, Hakkak launched Alpine Global, Inc., specializing in real estate investments and alternative fixed-income strategies. His most notable success arrived in 2007 when he co-founded White Oak Global Advisors, a firm that now manages over $20 billion and caters to thousands of small and medium enterprises (SMEs) worldwide.

Read more: What Is Dan Bilzerian Net Worth In 2024: Inside The King of Instagram’s Wealth

Andre Hakkak Net Worth in 2025

As of 2025, Andre Hakkak’s net worth is substantial, resulting from his position as CEO and co-founder of White Oak Global Advisors, a prominent alternative asset management firm.

His wealth stems from his ownership share in the firm, solid investment gains, and diverse business pursuits in finance.

Analysts estimate his net worth to be hundreds of millions, though exact amounts are kept confidential due to his business interests.

Latest Estimates

New estimates forecast Andre Hakkak’s net worth at around $400 million by 2025, showcasing his success as CEO of White Oak Global Advisors and his strategic investments in finance.

This impressive wealth comes from his impactful leadership and solid track record in investment management, particularly his support for small and medium-sized businesses.

- Main wealth source: Leadership role at White Oak Global Advisors, where he spearheads investments and growth strategies.

- Previous experience: Executive tenure at Alpine Global, Inc., solidifying his standing in financial markets.

- Growth drivers: Steady results in providing alternative financing to businesses, coupled with wise investment choices across diverse sectors.

Hakkak’s estimated net worth reflects his skill in navigating intricate financial arenas while fostering sustainable growth.

How His Net Worth Is Calculated

Andre Hakkak’s estimated net worth of $400 million results from a blend of various financial channels and valuation techniques. Analysts evaluate his wealth by looking at his wide range of business interests, investment assets, and strategic alliances, all of which form the backbone of his financial success.

Quick Take

Key factors in the valuation process include the current market worth of his companies, returns on investments, and the growth of his managed assets.

His entrepreneurial projects, which span several sectors, are assessed based on market trends and potential for future expansion. The calculation also accounts for his equity in multiple firms, real estate investments, and other valuable properties.

Additionally, strategic partnerships enhance the overall evaluation, as these collaborations often create significant advantages through shared opportunities.

Read more: Patrick Bet-David Net Worth: A Young Generation’s Motivation for Success

Andre Hakkak’s Business Empire

Andre Hakkak stands out as the CEO and co-founder of White Oak Global Advisors, a premier alternative asset management firm that excels in direct lending and private credit solutions.

Under his leadership, the firm has amassed billions in assets, delivering crucial financial support to middle-market businesses across various sectors.

In addition to his work at White Oak, Hakkak has strategically broadened his business portfolio through targeted investments and advisory roles in diverse industries, maintaining a level of privacy regarding the specifics of these ventures.

White Oak Global Advisors

White Oak Global Advisors, founded in 2007 by innovative leaders Andre Hakkak and Bharat Bhise, has appeared as a formidable force in alternative investments and private credit markets. The firm specializes in delivering secured loans and financial solutions to small and medium-sized enterprises, fostering their growth in various sectors.

The company’s success is reflected in:

- Billions of dollars in assets under management (AUM), showcasing a strong market presence.

- Strategic investments in key industries like healthcare, technology, manufacturing, and real estate.

- A solid track record of fruitful deals and collaborations, reinforcing their reputation as a reliable investment firm.

White Oak’s creative investment strategies and deep market insights have greatly enhanced Andre Hakkak’s financial achievements while ensuring a diverse and robust portfolio.

Other Business Ventures

Hakkak leads White Oak Global Advisors and boasts a rich portfolio of business interests showcasing his entrepreneurial skills. Notably, he contributes as an opinion columnist for CEOWORLD magazine, offering insights into finance and investment strategies for a worldwide readership.

Through the Hakkak Family Foundation, he has made strides in philanthropy, concentrating on education and healthcare initiatives. This charitable organization highlights his commitment to social impact alongside his business endeavors.

While Hakkak prioritizes the success of White Oak Global Advisors in delivering financial solutions to small and medium enterprises (SMEs), his diverse business interests underline his passion for both economic growth and community advancement.

Read more: Dr Disrespect Net Worth: Controversy Tied to Scandal

Andre Hakkak’s Lifestyle

Andre Hakkak manages a collection of upscale properties strategically located in key financial hubs, particularly New York and London.

His charitable work emphasizes education and financial literacy, with considerable donations to universities and local organizations.

Since founding his foundation in 2015, Hakkak has launched multiple scholarship initiatives and financed research in financial technology and sustainable business methods.

Properties and Real Estate

Andre Hakkak’s real estate investments are a major part of his portfolio. His standout purchase is a $14.3 million mansion in Pinecrest, Miami.

This expansive 10,500-square-foot estate sits on 1.2 acres and boasts seven bedrooms, eleven bathrooms, and luxurious amenities, including a pool, gym, theatre, and guest house.

Before this acquisition, Hakkak and his wife showcased their real estate skill by selling their Coral Gables estate for $27.5 million. This sale nearly doubled their initial $13.6 million investment made in 2020.

Key elements of Hakkak’s real estate strategy include:

- Strategic choices in high-end Miami neighbourhoods

- Targeting premium properties with strong appreciation potential

- Timing investments to benefit from the rising South Florida market

Philanthropy and Contributions

Philanthropy shapes Andre Hakkak’s life, as he frequently attends charitable events with his wife, Marissa. The couple actively engages in various initiatives and community projects, showcasing their dedication to social responsibility and meaningful change.

At these events, Hakkak stresses the significance of using success to uplift others. He shares experiences from his entrepreneurial path to motivate collective efforts.

Together with Marissa, they participate in industry gatherings and panel talks, advocating for enhanced community involvement and giving. Their philanthropic approach goes beyond financial support; they immerse themselves in causes, leading initiatives to foster real change.

Read more: Grant Cardone Net Worth: The New York Times Bestselling Author

Andre Hakkak and Marissa Shipman

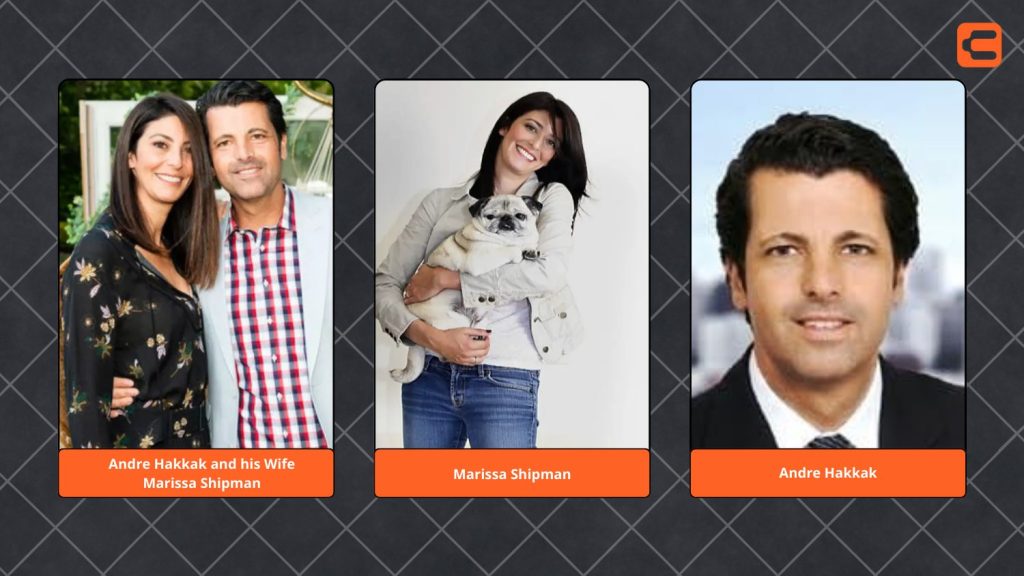

Andre Hakkak and Marissa Shipman forged a lasting partnership at a 2007 business networking event in New Orleans. Their entrepreneurial spirit created an instant bond.

After a year of dating, they got engaged in 2010 and married on June 12, 2011, in a beautiful ceremony in New Orleans. Their family grew with the birth of their daughter Ava in 2012 and son Ethan in 2019, all while they pursued their professional dreams.

Together, they celebrated key milestones, such as:

- Elevating Marissa’s theBalm cosmetics brand, which gained international acclaim in 2017.

- Organizing charitable events, like a women’s empowerment gala in 2022.

- Balancing their careers with family life while giving back to the community.

Lessons from Andre Hakkak’s Success

Andre Hakkak’s investment strategies showcase a smart blend of seeking profitable ventures while upholding integrity in finance.

He focuses on in-depth market analysis and comprehensive risk evaluation, fostering sustainable investment practices that reflect long-term financial and social consequences.

Hakkak’s decisive leadership and strategic choices illustrate that success in finance can harmonize with ethical conduct, paving the way for future professionals in the industry.

Investment Strategies

Tactical investment strategies have significantly contributed to Andre Hakkak’s financial achievements through four standout principles.

His portfolio emphasizes diversification across various sectors, focusing on long-term asset growth instead of quick gains. Hakkak’s strategic risk-taking, paired with a keen interest in cutting-edge technologies, forms a foundation for sustainable wealth building.

| Strategy | Description |

|---|---|

| Tactical Portfolio Management | Spreading investments across sectors minimizes risk while maximizing growth potential. |

| Innovation-Driven Growth | Targeting up-and-coming technologies and disruptive business models that transform traditional sectors. |

| Risk-Reward Optimization | Conducting thorough analyses to evaluate investment opportunities, ensuring balanced risk management coupled with substantial returns. |

These methods highlight Hakkak’s deep understanding of market movements and his adaptability to shifting economic landscapes.

Balancing Success and Responsibility

Andre Hakkak’s leadership style is marked by a unique balance between professional success and social responsibility. He prioritizes sustainable growth while positively impacting the communities involved with his business.

Leadership Principles and Social Responsibility

| Leadership Principles | Social Responsibility |

|---|---|

| Open Communication | Community Investment |

| Ethical Choices | Environmental Care |

| Active Stakeholder Engagement | Educational Programs |

| Performance Focus | Philanthropic Efforts |

Hakkak’s strategic approach showcases how businesses can thrive while making a meaningful societal contribution. By forming strategic partnerships and launching targeted initiatives, he aligns corporate goals with community needs. This approach has been highly effective in fostering long-term value while enhancing relationships with investors, employees, and community members.

Read more: Brian Armstrong Net Worth: Leader Of The New Era Of The Crypto Industry In The US

FAQs

What is Andre Hakkak’s Net Worth in 2025?

Andre Hakkak’s net worth is expected to reach impressive heights by 2025, sparking interest across the financial landscape. His wealth largely stems from his influential roles in the financial industry and a diverse array of business initiatives.

While exact figures are tightly held, several key areas boost his financial portfolio.

- Business Leadership: Hakkak’s primary source of income originates from his top positions in notable financial institutions and investment firms.

- Real Estate Investments: Strategic property acquisitions in various markets add significant value to his overall assets.

- Diverse Investments: His investment strategy includes a variety of private equity holdings and well-timed market plays.

Industry experts predict a steady growth in Hakkak’s wealth as he continues to thrive in financial markets and entrepreneurial pursuits through 2025, showcasing his adeptness in achieving financial success.

What are Andre Hakkak’s primary sources of income?

Andre Hakkak, a seasoned professional in the financial sector, generates his income primarily as the CEO of White Oak Global Advisors. This key role provides significant earnings through his salary, bonuses, and profit-sharing typical for executives in finance.

In addition to his main job at White Oak, Hakkak diversifies his income with a broad spectrum of investments across various industries and asset classes. These strategic investments add substantial revenue to his overall financial standing.

Furthermore, his entrepreneurial pursuits and thoughtful investments in different business ventures enhance his earnings, building a solid financial base that goes beyond his investment management responsibilities.

What is White Oak Global Advisors?

White Oak Global Advisors is a prominent private credit firm that excels in direct lending and private equity solutions. This firm has carved a niche within the financial services sector, delivering creative financing options to middle-market businesses aiming for growth capital and strategic investments.

Key features of White Oak Global Advisors include:

- Comprehensive lending solutions across diverse industries such as healthcare, manufacturing, and technology.

- Strategic private equity investments targeting sustainable growth and long-term value creation.

- Tailored financial structures built to address specific client requirements, offering flexibility in terms and deployment.

Is Andre Hakkak involved in philanthropy?

Andre Hakkak actively participates in philanthropy, a key element of his career. As the CEO of White Oak Global Advisors, he plays a substantial role in various charitable projects, although specific details about his contributions are kept under wraps.

| Charitable Focus Area | Known Involvement |

|---|---|

| Education | Funding for financial literacy programs |

| Community Development | Support for local business initiatives |

| Economic Empowerment | Mentoring small business owners |

| Social Impact | Backing sustainable growth initiatives |

Hakkak’s approach to giving reflects his professional mission. His emphasis on sustainable development and community advancement highlights his dedication to creating economic opportunities and enhancing financial education in underserved areas. By leveraging his expertise, Hakkak makes a meaningful impact through strategic philanthropic efforts.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |