Key Points:

- Binance and SEC requested a 60-day pause in legal proceedings.

- The pause aims to conserve resources and explore settlement options.

- A joint status report will follow the pause to update the court.

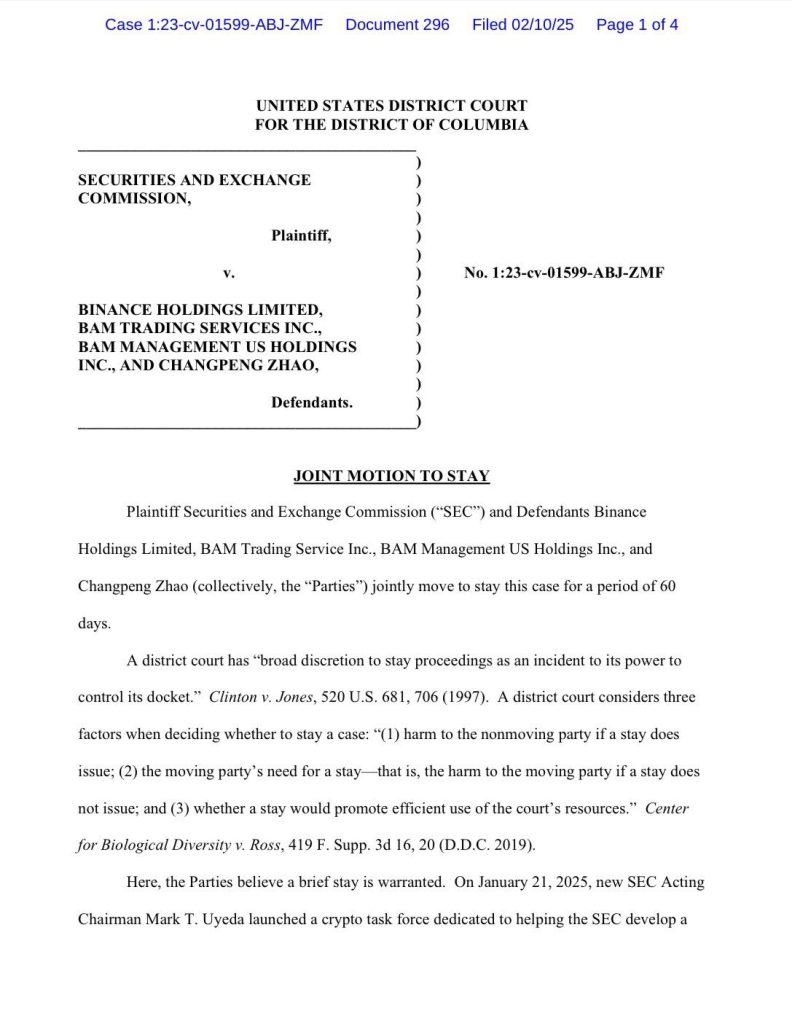

Binance and the U.S. Securities and Exchange Commission filed a joint motion on February 10, 2025, to pause their legal proceedings for 60 days.

The pause aims to conserve resources while both parties explore potential settlement options in the U.S. District Court for the District of Columbia. A joint status report will follow the pause period to provide updates on progress.

SEC Halts Proceedings, Cites Crypto Task Force’s Role

The legal battle between Binance and the U.S. Securities and Exchange Commission (SEC) has taken a notable turn, with both parties submitting a joint motion to pause proceedings for 60 days.

The outcome, occurring during Mark Uyeda’s tenure as acting SEC chair, signals a potential step towards resolution. The motion, filed on February 10, 2025, in the U.S. District Court for the District of Columbia, aims to conserve resources while exploring settlement options.

“The work of this task force could influence and facilitate the potential resolution of this case”.

Wrote in the document (page 2/4).

Additionally, the SEC has recently launched a crypto task force led by Hester Peirce, which could significantly influence the case’s outcome. Following the pause, a joint status report is expected to provide updates on progress.

Binance and SEC Case Pause May Reshape Battles

The recent legal pause related to Binance may yield broader implications for the cryptocurrency industry, potentially influencing other companies under SEC enforcement actions.

According to Fox Business reporter Eleanor Terrett, firms such as Ripple, Coinbase, and Kraken—especially those facing non-fraud allegations—could adopt similar strategies in their legal confrontations with the SEC.

Such an action may allow these companies to negotiate resolutions effectively while conserving their resources, following the model set by Binance.

The pause mechanism could emerge as a new template for resolving regulatory disputes within the cryptocurrency sector, potentially reshaping how companies address compliance issues and interactions with regulatory authorities.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |