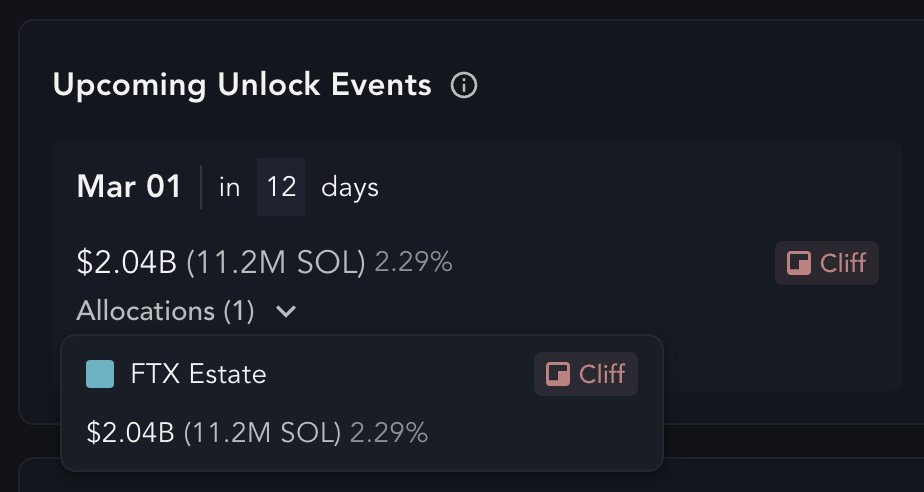

Key Points:

- 11.2 million SOL tokens will be unlocked for trading on March 1, 2025.

- These tokens are valued at approximately $2.06 billion at current prices.

- Previous auction participants reported impressive returns of 80% to 187%.

On March 1, FTX’s bankruptcy proceedings will reach a significant milestone with the release of 11.2 million SOL tokens, valued at approximately $2.06 billion. This distribution follows several successful auctions where institutional investors like Galaxy Digital and Pantera Capital acquired substantial SOL positions at favorable prices, achieving ROIs between 80% and 187%.

The releasing event represents an essential step in FTX’s creditor repayment strategy, with broader implications for market dynamics and stakeholder interests.

$2.06B in SOL to Be Released March 2025

While FTX remains in the throes of its bankruptcy proceedings, the exchange’s prior auctions of SOL tokens have yielded significant returns for institutional investors.

On February 17, 2025, it was reported that 11.2 million SOL, worth approximately $2.06 billion, will be unlocked on March 1, 2025, as part of the FTX bankruptcy auction. This comes after FTX’s earlier sales of 41 million SOL through three separate auctions.

In the major auction events, Galaxy Digital acquired 25.52 million SOL at a price point of $64 per token, which culminated in a 187% return on investment.

Concurrently, Pantera Capital, along with other investors, secured 13.67 million SOL at $95 per token, resulting in a 93% return.

Additionally, Figure Markets and other participants obtained 1.8 million SOL at a cost of $102 per token, thereby achieving an 80% return.

FTX Creditors to Receive 119% Plus Interest in Repayments

As FTX prepares to commence its creditor repayment process on February 18, 2025, the cryptocurrency exchange has established a detailed distribution framework that prioritizes Convenience Class claims up to $50,000.

Eligible creditors can anticipate receiving 119% of their recorded claims from November 2022, in addition to 9% annual interest. Distributions will be processed through recognized platforms such as Kraken and BitGo, with an expected turnaround time of 1 to 3 business days.

FTX has earmarked approximately $13 billion for these payouts; however, it will withhold 50% of the total amount to address disputed claims. Prior to receiving any distributions, creditors must fulfil KYC verification requirements and submit the necessary tax documentation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |