Key Points:

- $1.6 million USDC was transferred to purchase LIBRA pre-launch.

- After selling, the LIBRA team generated a $6.65 million profit.

- LIBRA’s price plummeted 94% shortly after launch, indicating possible insider trading.

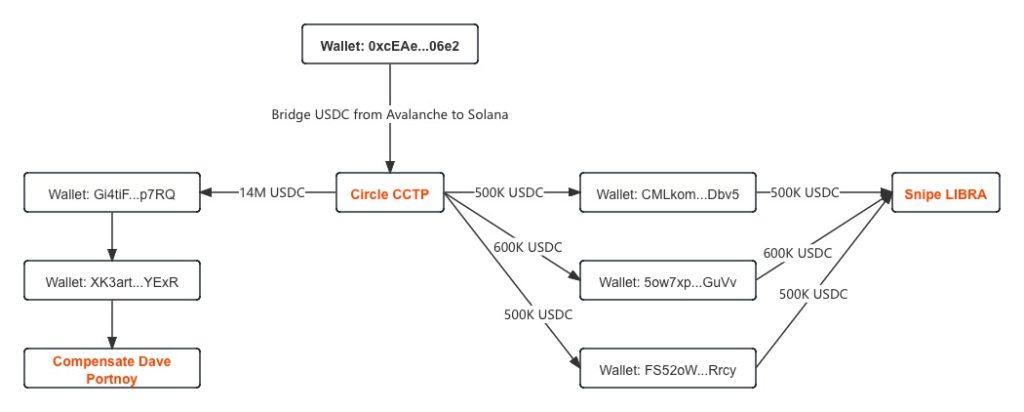

Blockchain analysis has revealed suspicious trading activities involving LIBRA cryptocurrency’s internal wallets. The investigation shows that wallet “0xcEAe…06e2” transferred $1.6 million USDC via Avalanche to acquire 3.77 million LIBRA tokens, which were then sold for $8.25 million USDC, generating a $6.65 million profit.

The coordinated transactions through three connected wallets, followed by a 94% price drop within four hours, suggest potential market manipulation. Further examination of wallet activity may uncover additional details.

LIBRA Team Suspected of Moving $8.25 Million Before LIBRA Price Crash

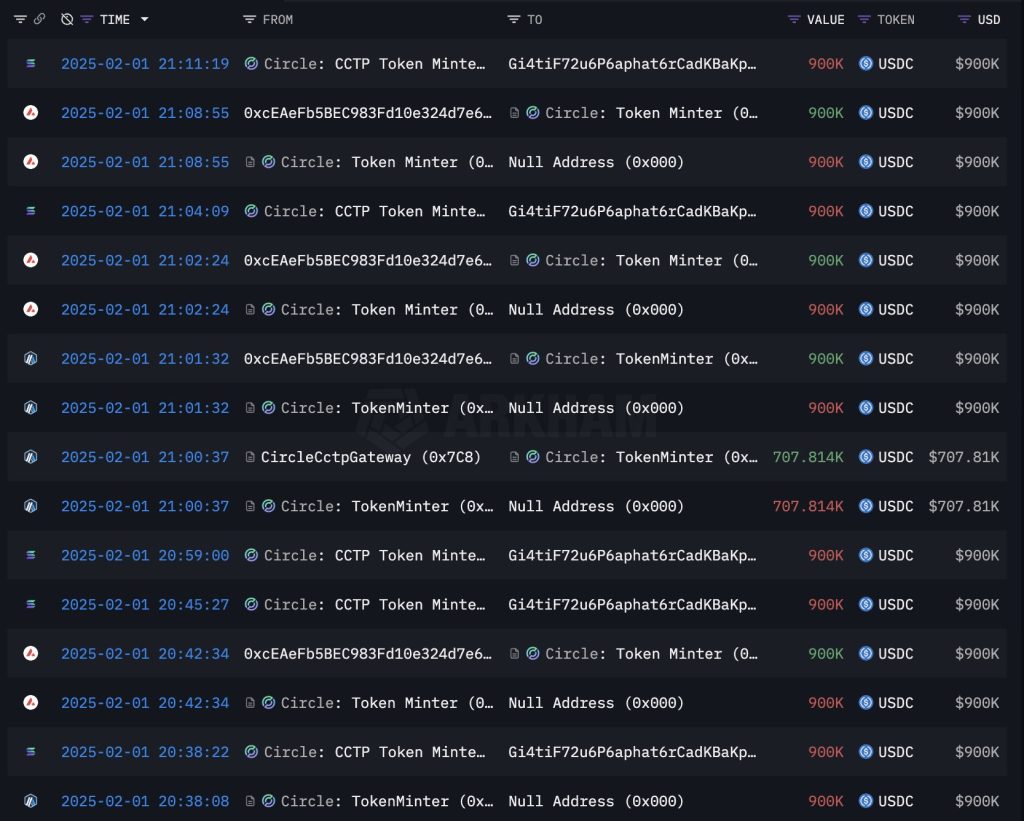

An investigation into LIBRA’s trading activities has revealed a pattern of suspicious coordinating fund transfers among three internal wallets. According to blockchain analysis Lookonchain, the wallet address “0xcEAe…06e2” transferred $1.6 million in USDC via the Avalanche network to three separate wallets on Solana shortly before the official launch of LIBRA.

Shortly thereafter, these tokens were sold for approximately $8.25 million USDC. Following this transaction, eight connected wallets reportedly withdrew a total of $57.6 million USD Coin and 249,671 Solana from the liquidity pool.

The inquiry further established a link between the aforementioned wallet and the provisioning of funds to Dave Portnoy, suggesting the possible involvement of team members in these financial manoeuvres.

These events took place mere hours before the official launch of LIBRA, culminating in a dramatic increase of 94% in price decline within a four-hour window. The sequence of transactions has raised questions regarding the possibility of market manipulation orchestrated by insiders during this critical launch period.

Fraud Claims Against Milei After $107M LIBRA Token Plunge

Following allegations of market manipulation surrounding the launch of the LIBRA token, Argentina’s political climate has intensified, prompting opposition lawmakers to call for the impeachment of President Javier Milei.

The financial repercussions of the LIBRA token launch have been significant, with initial reports indicating that investors incurred losses totalling over $107 million. The token’s value experienced a drastic decline, plummeting by 94% within just four hours of its debut on February 14, 2025.

Opposition leaders and civic organizations are calling for his impeachment. The controversy has triggered proceedings under Article 265 of Argentina’s Penal Code, which could result in 1 to 6 years in prison.

Constitutional experts suggest that a guilty verdict on fraud charges could lead to Milei’s removal. The Anti-Corruption Office is investigating potential evidence of his direct involvement in promoting cryptocurrency.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |