Key Points:

- Metaplanet Bitcoin Investment expanded with a $26M purchase of 269.43 BTC, bringing its total holdings to 2,031 BTC as part of its 2025 10K BTC acquisition goal.

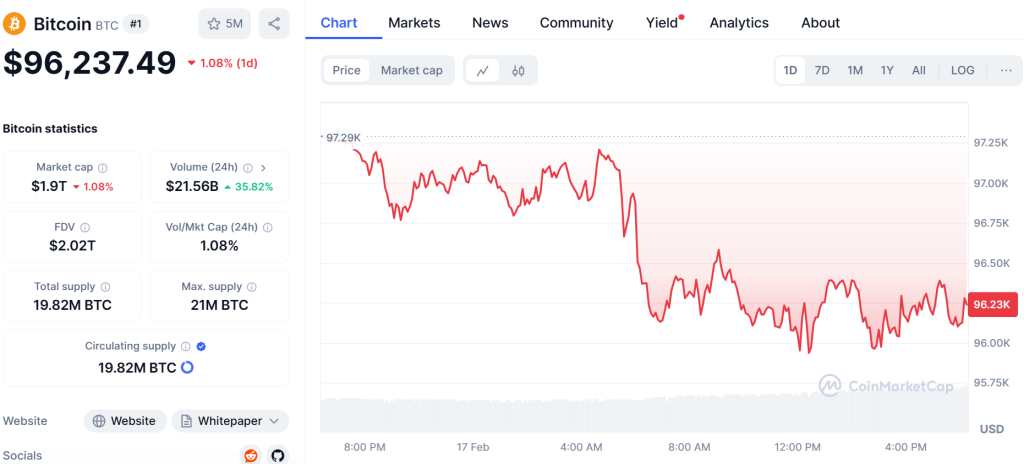

- The company’s average BTC purchase price is $80.7K, with current market prices showing a 16% gain, positioning Metaplanet as Asia’s second-largest corporate BTC holder.

Metaplanet Bitcoin Investment continues as the firm adds 269 BTC, pushing holdings past 2,000 BTC and reinforcing its treasury strategy in Japan’s corporate landscape.

Metaplanet Bitcoin Investment Strategy Gains Momentum

Metaplanet, often dubbed the “Asian MicroStrategy,” has resumed its Bitcoin accumulation strategy with its first purchase of 2025 – 269.43 BTC valued at $26M. This acquisition aligns with the company’s ambitious target of amassing 10,000 BTC by year-end.

With this latest buy, Metaplanet now holds 2,031 BTC, acquired at an average price of $80,700 per BTC. As Bitcoin trades around $96,200, the company’s investment is currently up 19%. However, this pales in comparison to MicroStrategy (now Strategy), which boasts 48% returns due to its long-term BTC accumulation at lower prices.

Read more: Metaplanet Bitcoin Investment Continues to Boost With $62 Million Raised

Metaplanet Climbs Global BTC Holder Rankings

Despite entering the Bitcoin market later than Strategy, Metaplanet’s aggressive approach has placed it among the top 20 corporate BTC holders globally, ranking 16th worldwide. In Asia, it now trails only Boyaa Interactive, a Chinese gaming giant holding 3,183 BTC.

Metaplanet’s Bitcoin investment approach reflects a broader trend in Japan’s corporate sector, where firms are increasingly adopting BTC as a strategic asset. With companies like Remixpoint also entering the market, Japan is emerging as a key player in the institutional Bitcoin landscape.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |