Key Points:

- Robinhood crypto services are about to be launched in Singapore by late 2025 through Bitstamp, the European exchange it acquired for $200 million.

- Bitstamp’s in-principle approval from Singapore’s Monetary Authority will enable Robinhood to operate under local regulations.

Robinhood Markets plans to introduce crypto services in Singapore in 2025 by leveraging its recent acquisition of European digital asset exchange Bitstamp.

Read more: Robinhood Bitcoin Oil And Gold Futures Trading Soon

Robinhood Crypto Service Ready for Expansion in Singapore Through Bitstamp Exchange

Johann Kerbrat, vice president and general manager of Robinhood Crypto, confirmed that the company intends to launch its crypto offerings in compliance with local regulations. The move is part of Robinhood’s broader expansion strategy in Asia, where Singapore will serve as its regional headquarters.

While an exact date has not been determined, the rollout is expected to follow the completion of the Bitstamp acquisition, which is anticipated in the first half of 2025, pending regulatory approval.

Bitstamp, a well-established European exchange, received in-principle approval from the Monetary Authority of Singapore (MAS) in March 2024. The approval allows it to offer digital payment token services under Singapore’s Payment Services Act.

The exchange also holds multiple licenses across European markets, including Italy, Spain, the Netherlands, and France, positioning it as a key asset for Robinhood’s international expansion.

The $200 million Bitstamp deal, announced in June 2024, provides Robinhood with a regulated platform to enter Singapore’s crypto sector. Kerbrat highlighted that Bitstamp’s existing Singaporean license was a crucial factor in the acquisition, as it facilitates Robinhood’s compliance with regulatory requirements.

Surging Crypto Revenue With 700% Fuels Robinhood’s Growth

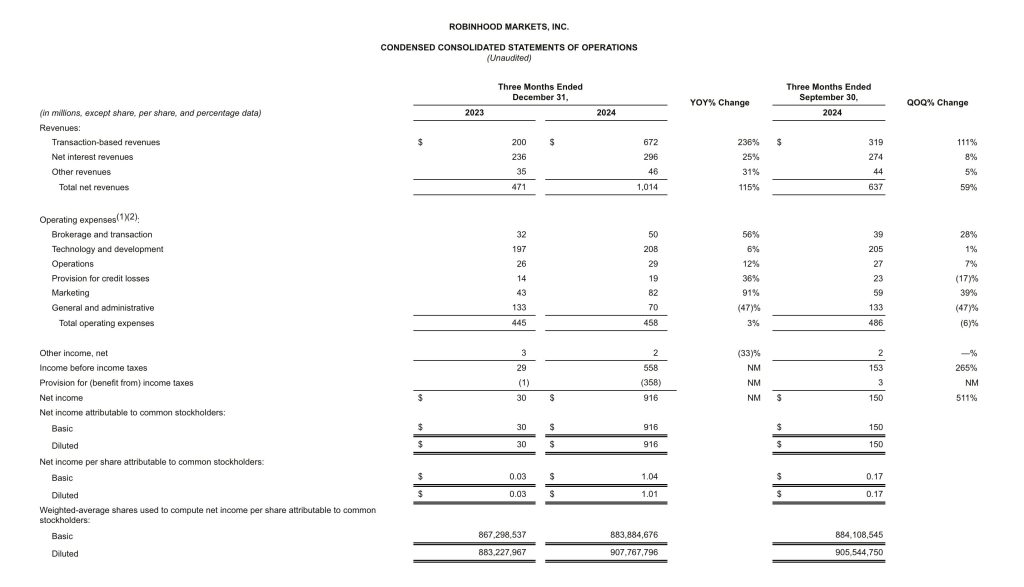

Robinhood crypto push comes amid a surge in digital asset trading. In the fourth quarter, the company reported a 700% increase in cryptocurrency trading revenue, reaching $358 million, compared to $45 million a year earlier. Total transaction-based revenue jumped over 200% to $672 million, contributing to a record-breaking net income of $916 million.

Beyond Singapore, Robinhood has been expanding its crypto services globally. It recently launched Ethereum staking in the European Union and added seven new tokens to its U.S. trading platform.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |